How to Correct a 1099 Type

If you made a vendor/contractor payment with an incorrect “1099 Type,” don’t panic. You can select the correct 1099 type in your Patriot account. Simply go to:

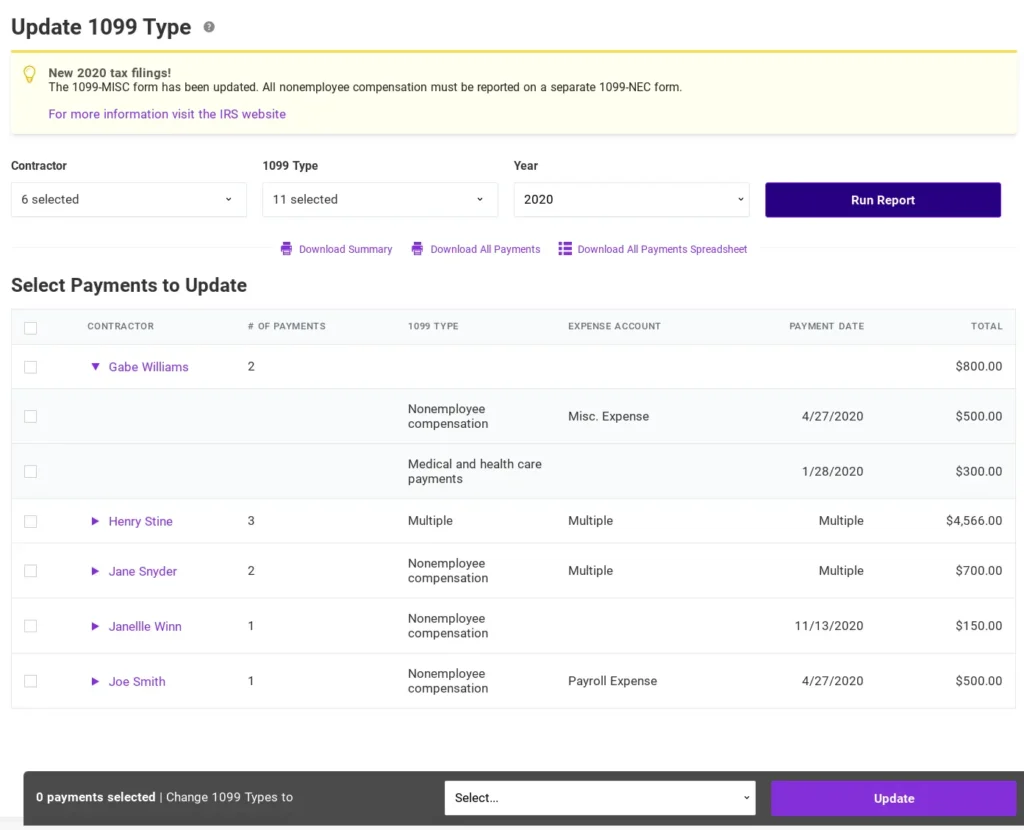

Reports > 1099 Contractor Reports > Update 1099 Type

Please note that 1099 payments to vendors made by credit cards are not included on your 1099 per the IRS. Please read, “Recording a Vendor Payment made by Credit Card,” for more info.

To update your contractor’s 1099 type:

- Find the contractor you need to make the correction for. You can see the current 1099 type assigned to them under “1099 Type.” If they have more than one 1099 type, it will say “Multiple.”

- To update the 1099 type for all of the contractor’s payments, select the box next to the contractor’s name.

- If the contractor has more than one payment, and you need to update the 1099 type for only one of their payments, click their name to view all the 1099 types assigned to them. Then, check the box in the row with the 1099 type you want to change.

- In the bar at the bottom of the page, click the drop-down that says “Select” (next to the button that says “Update”) and choose the 1099 type you need to change it to.

- Click “Update.”

If you have already filed your 1099s be sure to file a corrected 1099 to the IRS and state, if applicable. For more information, please read our help article, “How to Issue a Corrected 1099 (MISC and NEC).”

Your feedback will not receive a reply. If you have a specific issue, please reach out to our support team here.