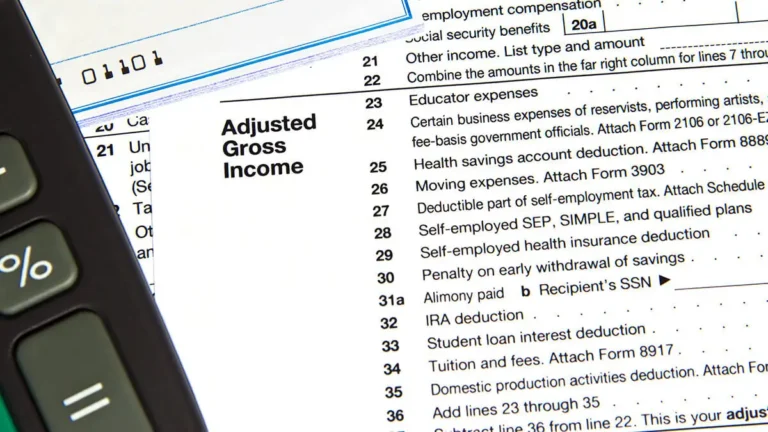

As a small business owner, you have likely heard of the terms gross or net income. But, are you familiar with adjusted gross income? Learn what is adjusted gross income, how to calculate it, and uses for adjusted gross income below.

Read More What Is Adjusted Gross Income? How to Calculate AGI [With an Example]

Michele Bossart

Patriot Software’s Accounting Customers Can Get Paid Faster

Canton, OH Patriot Software, a leading accounting and payroll software provider for American businesses, proudly announces the launch of its newest feature for accounting customers: ACH payments on invoices for customers who integrate with Stripe. With Stripe, customers can access 2-day timing for ACH settlement, compared to 4-5 business days for standard ACH settlement. Stripe’s […]

Read More Patriot Software’s Accounting Customers Can Get Paid Faster

Patriot Software Launches 1099 Contractor Portal Feature

Canton, Ohio Patriot Software, a provider of online accounting and payroll software for American businesses, announced the launch of the 1099 contractor portal to streamline information between clients and their independent contractors.

Read More Patriot Software Launches 1099 Contractor Portal Feature

Understand the Difference Between Exempt vs. Nonexempt Employees

Employees want the wages they deserve. Employers want to avoid penalties and fines. Want the best of both worlds? Understand the difference between exempt vs. nonexempt employees.

Read More Understand the Difference Between Exempt vs. Nonexempt Employees

What Is an Exempt Employee?

Are all of your employees eligible to receive overtime pay? Some employees are exempt from overtime pay and minimum wage laws. Exempt employee qualifications are determined by the Fair Labor Standards Act (FLSA). To run payroll correctly, you need to be familiar with exempt employees. What is an exempt employee?

Read More What Is an Exempt Employee?

Form 1099-NEC vs. W-2 Differences: Which Should You Use?

After the end of every year, you need to report your workers’ wages. You must send a form to the worker and governments. But, which IRS form do you send? The form you use—Form 1099 vs. W-2—depends on if the worker was a contractor or an employee.

Read More Form 1099-NEC vs. W-2 Differences: Which Should You Use?

How to Fill Out Form I-9 When You Hire a New Employee

Each time you hire a new employee, you are responsible for verifying they are eligible to work in the United States. To do this, use Form I-9, Employment Eligibility Verification, when onboarding new hires. All U.S. employers are required to use the I-9. Failing to do so can result in penalties. Learn how to fill […]

Read More How to Fill Out Form I-9 When You Hire a New Employee

What Is the Fair Labor Standards Act (FLSA)?

When you become an employer, you can’t always play by your own rules. There are certain federal, as well as state and local, standards you must follow. The FLSA is one set of federal regulations you need to know about and comply with. What is the FLSA?

Read More What Is the Fair Labor Standards Act (FLSA)?

Patriot Software Teams Up With Stripe to Streamline Online Payments

Canton, Ohio Patriot Software, a leading online accounting software provider, and Stripe, a financial infrastructure platform for businesses, have joined in a partnership to offer a new era of enhanced and frictionless payment experiences for customers. Under this partnership, Patriot Software accounting customers can now effortlessly accept credit card payments on customer invoices, significantly enhancing […]

Read More Patriot Software Teams Up With Stripe to Streamline Online Payments

Patriot Software Given Editor’s Choice Award from CardRates

Canton, OH Patriot Software, a leading provider of cloud-based accounting software and payroll software for American businesses, has been given the Editor’s Choice™ Award for payroll and accounting solutions distinction from CardRates, a respected online resource for financial news and reviews.

Read More Patriot Software Given Editor’s Choice Award from CardRates