Accounting Software for Small Business

Easy and affordable accounting software with Patriot Accounting™

See a Demo Create Account

Online Accounting Software

That empowers business owners and accountants

Free USA-based Support

- Thousands of 5-star reviews

- Short wait times

- Call, email, or chat

- No robots–just a friendly team of humans!

This is why we’re known as ☆America’s Accounting™.

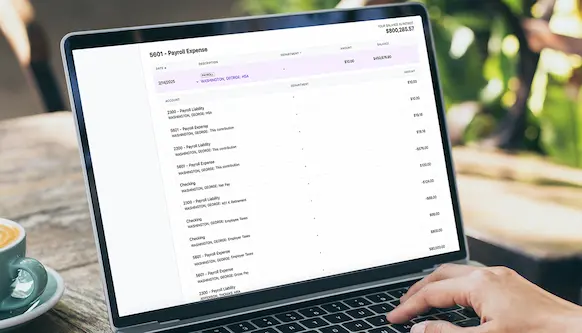

Seamless Integration With Patriot Payroll®

Get your accounting and payroll all in one place.

- Run payroll in 3 easy steps

- Record journal entries from payroll automatically

- Enjoy our famous USA-based support with both!

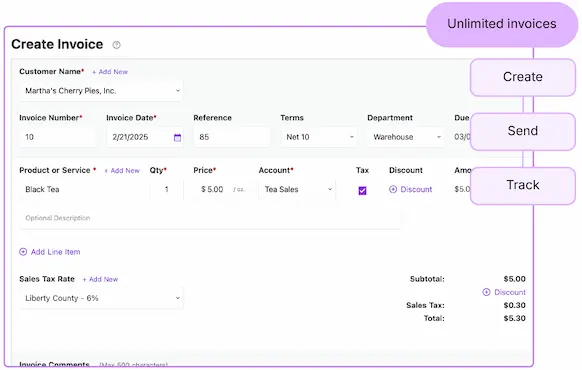

Create, Send, & Track Invoices

Get paid, hassle free, with unlimited invoices to all of your customers.

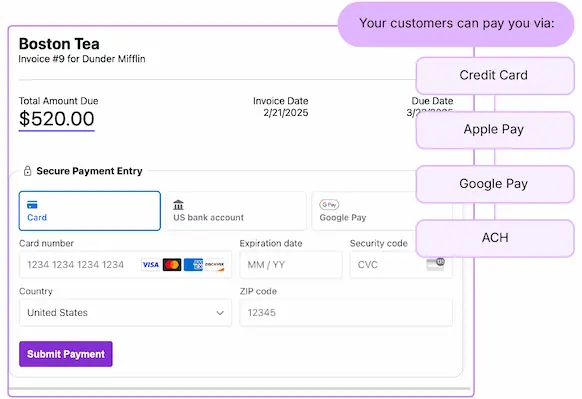

Accept Credit Cards

With our Stripe integration, you can accept:

- Credit card payments

- Apple Pay and Google Pay

- ACH payments

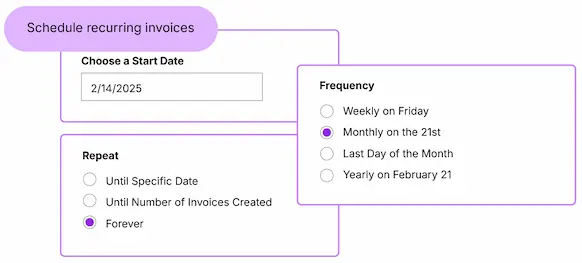

Accounting Premium Feature Send Recurring Invoices

Automatically create and email invoices to customers.

- Set your start date

- Choose your frequency

- Set an end date

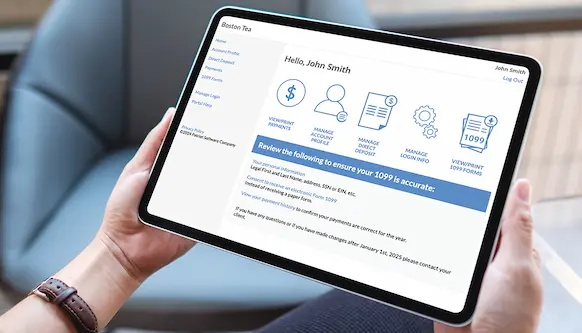

Give 1099 Contractors Secure Portal Access

You can give 1099 contractors free portal access.

- Personal and banking information management

- Payments and payment history

- Electronic Forms 1099

Unlimited Users at No Additional Cost

Invite your team, accountant, or others to access your account.

- Give multiple users access to your accounting software

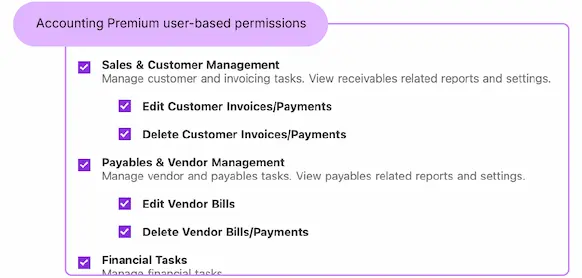

- Set user-based permissions with Accounting Premium

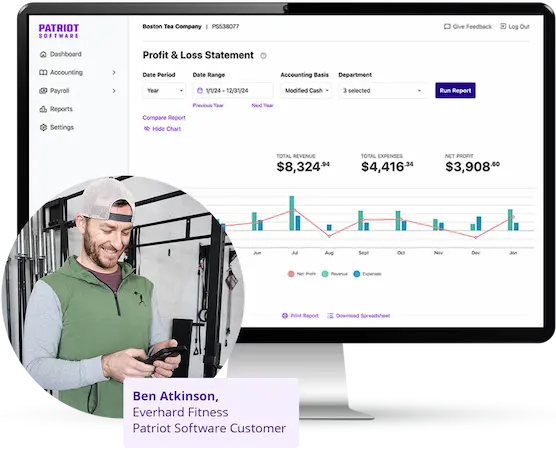

View & Download Financial Reports

Download key accounting reports as a PDF or spreadsheet.

Save Time With Patriot Accounting™

Manage your books with our accounting for small business.

- Track and categorize expenses and income

- Automatically import bank transactions

- Easily reconcile accounts

Easily Get Started With Our Affordable Accounting Software

Switching from another software, or starting from scratch? Either way, onboarding with Patriot is painless.

- Use standard settings or customize your settings

- Import data, like your chart of accounts

- Get help when you need it

Two Accounting Software Options

Accounting Basic

All the features you’ll need to track business expenses, money, and invoices.

Most Popular Choice

Accounting Premium

Everything in Accounting Basic, plus recurring invoices, receipt & document management, estimates, and more.

Accounting Basic & Accounting Premium Features

Enjoy the following easy-to-use features with both of our affordable accounting software options.

Patented Dual-Ledger Accounting

You and your accountant can switch between cash and accrual accounting—without messy conversions.

Patriot Smart Suggestion

Our online accounting for small businesses uses breakthrough AI technology.

Free Contractor Portal

Give secure self-service access to contractors so they can update info, view payments, and download 1099s.

Unlimited Customers & Invoices

Create, send, and track unlimited invoices to as many customers as you need.

Unlimited Vendors & Payments

Select a vendor or contractor, enter payment details, approve, and print paychecks.

Automatic Bank Imports

Connect your bank account or credit card so all activity flows into our online accounting software.

Accept Credit Cards

Your customers can pay you via credit cards, Google Pay, Apple Pay, or ACH payments with our Stripe integration.

Income & Expense Tracking

Keep your Chart of Accounts organized with asset, liability, equity, income, and expense account management.

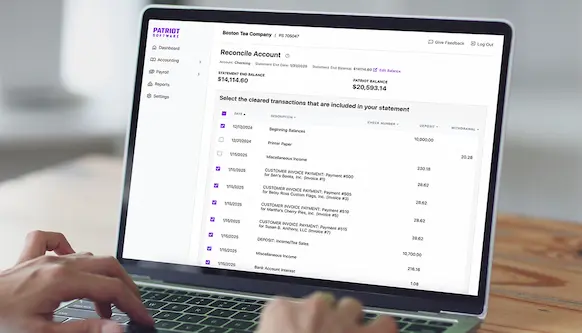

Account Reconciliation

Reconcile monthly bank statements with the transactions in Patriot’s easy accounting software.

Accounting Premium Only Features

Enjoy all the above top-rated features, plus advanced tools to take your accounting to the next level.

Create & Send Estimates

Send estimates to your customers, and seamlessly convert to invoices with the click of a button.

Invoice Payment Reminders

Set up automatic payment reminders for customers with past due invoices.

Recurring Invoices

Automatically send out the same invoice to your customer on a set frequency of time.

User-based Permissions

Choose what accounting tasks you want to give added users, like your accountant, permission to manage.

Manage Receipts and Documents

Securely upload and attach receipts and other files to your transactions.

Add Subaccounts

Add and nest subaccounts to get greater transaction details.

Accounting Integrations and Add-ons

Streamline even more tasks with our payroll software integration and Bookkeeping Service add-on.

- Run payroll in 3 easy steps

- Free direct deposit

- Seamless accounting integration

- We’ll close your books each month

- We’ll host a monthly review meeting

- We’ll reconcile your accounts

Online Accounting Software FAQs

Asked ... and answered

Yes! You can easily import account trial balances, vendors, customers, chart of accounts, and up to two years of bank transactions via Plaid integration (or as many bank transactions as you want manually using bank statements).

We made this accounting solution simple by design. You do not need any special training to track income and expenses, generate customer invoices, or print reports for your accountant. There are plenty of help articles and videos to learn how to use the software that you can access here.

Yes. We have free integration with Stripe, a third-party processor to provide you and your customers with a seamless payment experience. You can sign up with Stripe through our software. *Stripe has a standard fee schedule. Learn more here.

Yes, our Accounting Basic Software and Accounting Premium Software are both standalone products. While we’d love for you to try our award-winning payroll products, they are not required to use our accounting software.

Yes! You can set up multiple logins to give to your accountant and/or others as needed at no additional cost! With Accounting Premium, you can set permissions with each user you add.

Accounting FAQs

Yes! You can easily import account trial balances, vendors, customers, chart of accounts, and up to two years of bank transactions via Plaid integration (or as many bank transactions as you want manually using bank statements).

We made this accounting solution simple by design. You do not need any special training to track income and expenses, generate customer invoices, or print reports for your accountant. There are plenty of help articles and videos to learn how to use the software that you can access here.

Yes. We have free integration with Stripe, a third-party processor to provide you and your customers with a seamless payment experience. You can sign up with Stripe through our software. *Stripe has a standard fee schedule. Learn more here.

Yes, our Accounting Basic Software and Accounting Premium Software are both standalone products. While we’d love for you to try our award-winning payroll products, they are not required to use our accounting software.

Yes! You can set up multiple logins to give to your accountant and/or others as needed at no additional cost! With Accounting Premium, you can set permissions with each user you add.

Patriot’s Accounting Basic and Accounting Premium both integrate seamlessly with Patriot Basic Payroll and Patriot Full Service Payroll.

We use a third party to securely and seamlessly integrate your bank transactions, Plaid. You can connect your bank accounts and/or credit cards so that all your activity automatically flows into the software. Plaid supports most major banks and credit unions. However, you will need online banking access with your bank. If automatic imports aren’t for you, you can opt to manually record journal entries or import a file. Learn more here.

You can add (and invoice) an unlimited number of customers in the software.

Yes! With Accounting Premium, you can send recurring invoices to your customers on your desired schedule at no additional charge.

There is no limit to the number of bank transactions you can manually import from your bank account. Keep in mind that automatic bank transactions can pull up to 2 years of bank transactions.

Patriot Software has a unique patented cash-to-accrual basis toggle that will display your financial reports in cash or accrual basis with the simple click of a button. This means you can use the easy-to-understand cash basis for everyday entries, but can give your accountant the needed information in accrual-basis reporting.

This toggle doesn’t “convert” the cash-basis entries to cash- or accrual-basis accounting. It makes entries in each format and stores the data so it is ready for accurate reporting.