Payroll Software Features That Make Payroll as Easy as Possible

Patriot’s Payroll software features are developed with small business owners in mind. We understand that you need an easy and reliable way to run payroll for your employees. Choose between our two payroll software options—Basic Payroll and Full Service Payroll—to get the software features you need. With either option, rest assured you’ll have powerful, yet easy-to-use software, U.S.-based support, and the ability to access your account anytime, anywhere. No mobile app needed!

Easy-to-use Features

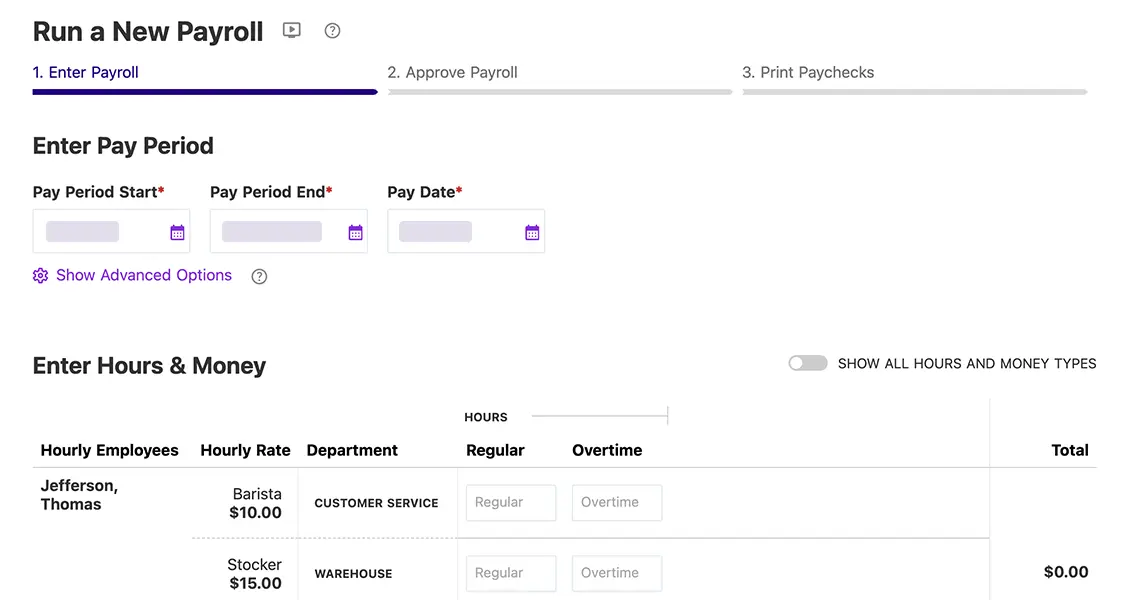

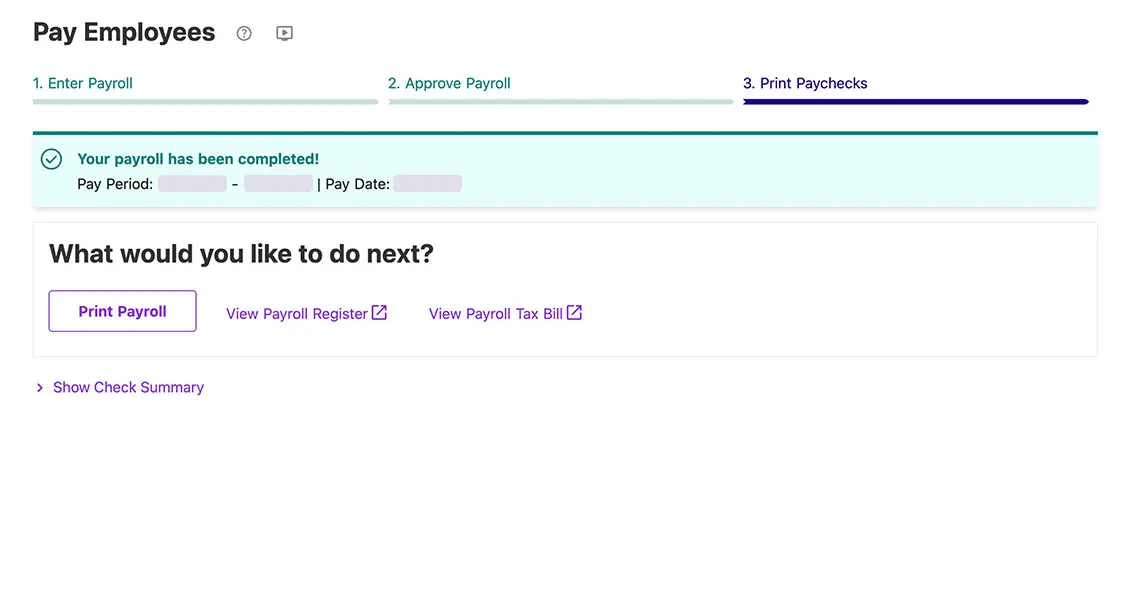

Easy 3-Step Process

Quickly run payroll and get back to your business using our simple, three-step process.

Free Payroll Setup

We know that starting payroll or switching providers can be time-consuming, so we offer free payroll setup assistance. We can help enter your employee data and your year-to-date payroll information. Or, just use our payroll startup wizard and do it yourself.

Unlimited Payrolls

Pay your employees as often as you want without being charged for extra payroll runs!

On-the-fly Pay Rate Changes

Change employee hourly pay rates during payroll without needing to cancel the payroll or leave the page. How's that for time-saving workflows?

Watch Video (0:47 seconds)Free Employee Portal

Give your employees secure access to their pay stubs, pay history, time-off balances, and electronic W-2s.

Watch Video (0:17 seconds)Pay Overtime, Sick-time, and More

Regular wages aren’t the only things you need to track. Easily add bonuses, commissions, tips, vacation and holiday pay, and more!

Unlimited Users with Permissions

Add as many users as you need. Want to control access to sensitive payroll data and limit who can run payroll too? Of course, you do! Assign permissions to your users to view only reports or run payroll and see sensitive information. You’ve got control.

Watch Video (0:20 seconds)Accurate Payroll and Tax Calculations

Kick outdated tax tables to the curb. You can always count on us for accurate calculations and up-to-date information.

Time-off Accruals

Have a PTO policy you want to automate? You can easily set up and customize time-off accrual rules. Time-off hours will be added to employee balances based on the rules you set.

Watch Video (0:16 seconds)Free Direct Deposit

Forgot to run payroll until the last minute? No worries. Patriot offers a free 4-day and 2-day (for qualifying customers) direct deposit service so you can pay your employees with no extra fuss. Have an employee who wants to be paid by check instead? No problem! Handwrite or print checks right from the software.

Tracking Reported Tips

Do your employees earn tips? No problem. Accurately track and withhold taxes for reported tips.

Multiple Pay Rates

Add up to five pay rates for each hourly employee. You can differentiate pay rates for employees by adding a description to each rate.

Watch Video (0:17 seconds)Customizable Hours, Money Types, Deductions

Use our standard hours and money types or add your own, plus add your own employee deductions and company-paid contributions.

Watch Video (0:18 seconds)Free Workers' Comp Integration

We offer free pay-as-you-go workers' comp integration with our partner, Next Insurance. Once this is set up, Next Insurance uses your payroll information to calculate the premium amounts, make the necessary payments to your insurance carrier, and submit all the paperwork. You'll never have to worry about a huge workers' compensation premium payment at the end of the year again!

HR Center

Hold on to your HR hat because we’ve simplified compliance with our HR Center! This value-added feature gives you federal, state, and local compliance updates and actionable steps tailored to your business and locality. Get timely and important legal updates, and assess your company's strengths and potential risks with the HR assessment.

Free 401(k) Integration

Patriot offers free 401(k) integration through our partner Vestwell. We’ve negotiated exclusive discount pricing for our customers, so you and your employees win!

Multiple Locations

If your business has more than one physical location, assign the employee’s primary work location (including working from home). The proper payroll taxes will be calculated based on where the employee works.

Watch Video (0:19 seconds)Accounting Software Integration

Payroll information is imported seamlessly to Patriot’s Accounting software. We also integrate with QuickBooks Desktop and QuickBooks Online.

Watch Video (0:18 seconds)Repeating, Additional Money Types

Do any of your employees need a repeating money type such as car allowance, cell phone allowance, housing allowance, etc? No problem! Create as many different repeating money types as you’d like.

Watch Video (0:14 seconds)Pay Contractors in Payroll

Do any of your employees need a repeating money type such as car allowance, cell phone allowance, housing allowance, etc? No problem! Create as many different repeating money types as you’d like.

Watch Video (0:24 seconds)Free Contractor Portal

Empower your 1099 contractors with their own portal! Let them take control of their contact details and effortlessly view payments and direct deposit info.

Departments

When it comes to your business, it's good to know where your payroll budget is being spent. With departments, you will be able to use reports to find payroll costs for each of your teams.

Watch Video (0:20 seconds)Time and Attendance Software Integration

Employee hours are easily imported into payroll when you integrate with Patriot’s Time and Attendance software.

Net to Gross Payroll Tool

Our Net to Gross Payroll tool is an easy way to record gift cards given outside of the software or bonuses that you'd like to gross up. Just add in the desired take-home pay, and we'll do the heavy lifting by calculating the taxes from there.

S-Corp Health Insurance Tool

Need to track and account for company paid health insurance for > 2% shareholders? No problem. Use our S-Corp Health Insurance tool to add the company-paid premiums to shareholders' W-2s. Just a few clicks and the W-2 will be updated and labeled correctly keeping you compliant.

Umbrella Login for Multiple Businesses

Serial entrepreneurs, here’s one for you: use your existing login when adding a new company in Patriot, and everything will be neatly managed under a single, convenient login.

Full Service Features

We’ll File Year-end Payroll Tax Filings (No Additional Fees)

Patriot will submit your 940, 941, W-2, and W-3 data to the proper tax agencies each quarter or at year-end, for no additional fee.

We’ll File and Deposit Federal Payroll Taxes

Patriot will begin collecting, depositing, and filing your federal payroll taxes based on the start date you select.

We’ll File and Deposit State Payroll Taxes

Just keep a few company-specific settings updated, and we'll take care of your state payroll tax deposits and filings for you. (Each additional state filing is $12 per month, per state.)

We’ll File and Deposit Local Payroll Taxes

Have local payroll taxes? Patriot will deposit and file all of your local and city taxes, too!

Tax Filing Reliability Guaranteed

You can count on Patriot to deposit and file your taxes accurately and on time, based on your account settings. We’ll take care of any penalties and interest in the unlikely event of a glitch on our end.

We’ll File Year-end 1096-MISC for Contractors to the IRS (and Qualifying States)

Patriot will submit your 1096s for your independent contractors to the proper tax agencies at year-end, for no additional fee.

Getting Started

Free USA-based Support

Payroll can be tricky, but we simplify it by offering free, USA-based support via phone, email, or chat. Contact us 9 a.m. - 7 p.m. ET, Monday - Friday. Our support is the best! (And we aren't biased at all).

Mobile Friendly

Our software is 100% mobile friendly. You can run your accounting or payroll directly from your smartphone or tablet. There is no need to download an app onto your mobile device and waste precious storage space.

Watch Video (0:14 seconds)No Long-term Contracts

Say goodbye to contracts and hello to our monthly pricing system. Cancel anytime, without penalty.

Dependable and Accurate

We’re routinely tested and audited for accuracy. And, we use the same technology as banks to keep your data secure.

100% Online

Securely access your software from any device with an internet connection. No downloading needed.

Easy-to-use Software

Patriot’s payroll software features are developed with small business owners in mind. You can get the hang of our software in minutes.