Entering Colorado SUTA Rates

Background

Colorado has changed its unemployment rate structure for 2024—your annual rate notice will include three rates, all of which need to be entered separately in Patriot. You can also find these rates in MYUI Employer+ on the state’s website. For questions about how to find your rate read the information below or contact Colorado Department of Labor and Employment Unemployment taxes: 1-800-480-8299.

What rates do I enter for Colorado SUTA?

Find your rates on your state-mailed rate notice:

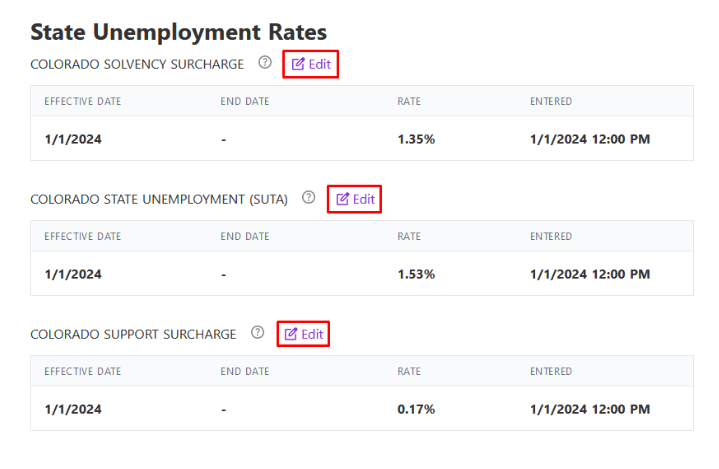

Enter these rates in the software as a decimal.

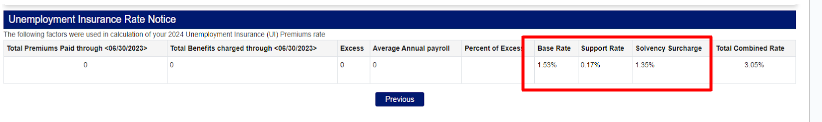

- Your SUTA rate is the “Base Rate” (Item 6) on the rate notice.

- Your Colorado Support Surcharge rate is “Support Rate” (Item 7) on the rate notice.

- Your Colorado “Solvency Surcharge” rate is (Item 8) on the rate notice.

The total combined rate (Item 9) is for your information only.

Find your rates in your online account at Colorado’s MYUI Employer+

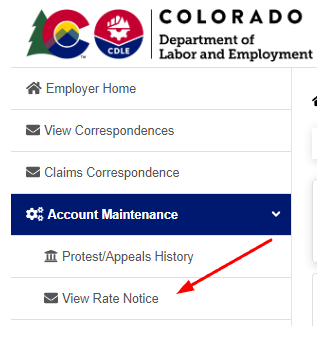

Log in to MYUI Employer+ on the Colorado Department of Labor website for employers.

- Click Account Maintenance > View Rate Notice

- Enter the year you want to view and click Search.

- You will see a screen with three Colorado suta tax rates and the combined rate at the end. You will enter the three rates separately in Patriot. The combined rate is for your information only.

- Enter these rates in the software.

For more help with Colorado SUTA, check out, “Colorado SUTA TPA Instructions“.

Also see, “Colorado Paid Family and Medical Leave Insurance (FAMLI)“.

Your feedback will not receive a reply. If you have a specific issue, please reach out to our support team here.