Basic Payroll: Filing Your W-3

In this article:

Option 1: Request Patriot file your W-2s

Option 2: File the SSA Wage File Electronically Yourself

Option 3: File a Paper W-2 and W-3 by Mail Yourself

After you distribute W-2 forms to your employees, if you are a Basic Payroll customer or have not completed your tax filing setup, you must file end-of-the-year filings to the SSA.

Patriot creates a W-3 Transmittal of Wages with the Social Security Administration (SSA) that satisfies this requirement. Employees and contractors are responsible for filing their own personal income tax return.

If you are a Full Service Payroll customer who has completed the tax filing setup, we will electronically file these for you. After we have filed, you can find your SSA confirmation under Reports > Payroll Tax Reports > Tax Filings.

If you are a Basic Payroll customer, here are your options for filing your W-2s.

Option 1: Request Patriot file your W-2s

If you are a Basic Payroll customer, or have not completed the full service setup you can request we file your W-2s/W-3 only (no other taxes) with the Social Security Administration electronically on your behalf. There is a $50 charge per filing for this service.

(E-filing with the SSA will fulfill the Copy A, W2, and W3 requirements with the IRS only. End-of-the-year tax filings to state or local government agencies will still need to be completed by you.)

After the you have created your employee W-2’s there will be an option to let Patriot handle your SSA Filing. Here’s how:

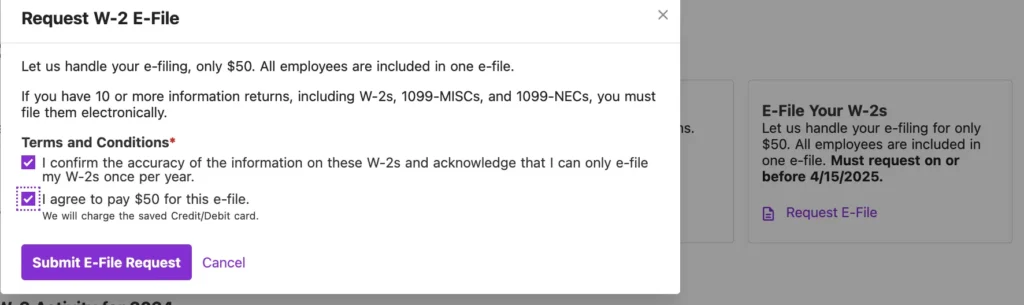

- Click the link “Request E-file.”

- Click the boxes to confirm accuracy and agree to the charge.

- Click “Submit E-file Request.”

- You can come back to this page to get the WFID (wage file identifier) number which will serve as your confirmation.

Option 2: File the SSA Wage File Electronically Yourself

For Basic Payroll and Full Service payroll customers who have not completed their payroll tax set up.

The IRS requires that employers must file electronically if they have 10 or more informational returns to file, which includes 1099s and W-2s. This means if you have paid at least 10 employees and/or contractors, you will need to file your W-2s electronically. You can download an electronic file (called a Wage File) from Patriot Software and upload the file to the SSA.

Before filing electronically, the SSA requires you to have a BSO (Business Online Account) account set up. You’ll need to create a login on the SSA website using LOGIN.gov if you don’t already have one, and then apply for a Business Service Online account.

- Reports > Payroll Year-End Forms > Year End – Create SSA W-2 File Please note this W-3 wage file satisfies both the W3 and the W2 copy A requirements.

- Select the Year.

- Enter your Business Services Online user ID. This is an 8-character ID you are assigned after your BSO application has been submitted. This user ID will be included in the file data.

- Click the “Create” button to download and save the .txt file to your computer.

- Upload this file to the Social Security Administration. For detailed upload steps, see Basic Payroll Customers: Steps to Upload your SSA File.

Option 3: File a Paper W-2 and W-3 by Mail Yourself

You can file your SSA end-of-year tax filings by mail if you do not have more than 10 information returns (1099 and W-2s), but you will need to purchase and mail both Form W-3 with Copy A of Form(s) W-2 outside of the software.

- Use the Company W-3 Summary report to fill out the paper Form W-3, available to both Basic payroll and Full Service payroll customers. For more information, check out the help article, “Company W-3 Summary Report.”

- Use the employee W-2 forms to fill out Copy A.

Form W-2 and the W-3 Summary Report are not approved for SSA filing purposes but rather an employer copy for your records and convenience.

[RELATED ARTICLE: What is a W-3?]

[DEFINITION: W-3 Form]

Your feedback will not receive a reply. If you have a specific issue, please reach out to our support team here.