How to Use the Pay Report in the Mobile App

The My Patriot mobile app allows you to view your recent and past pay reports. This report is a summary of your pay and is provided for your convenience. If you need a pay stub for loans or other employment verifications, you can find an official pay stub in the My Patriot employee portal.

From the mobile app home page, tap the Pay Report icon from the bottom navigation.

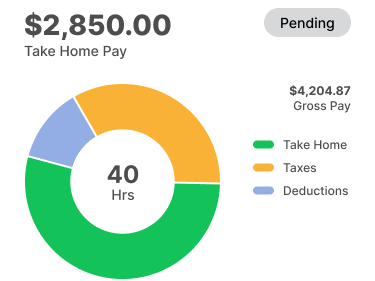

Pay dates will be displayed in descending order with the most recent pay date at the top of the report. If a payroll has been processed but is not the pay date yet, a pending status will be displayed in the right-hand corner.

Tap anywhere in each section of the report for the pay date to see further details of your pay.

Understanding the Pay Report

A visual graphic will display the net pay (take-home pay), employee taxes, and employee deductions (health insurance, child support, etc.). Your gross pay will be listed on the side of the graph.

Below the graph, you will find a handy link to your official pay stub in the employee portal.

Your pay is broken down with more details below the graph. Tap to expand each section of the report to see the details.

Hours and Earnings – This shows a summary of hours and gross pay as well as taxes and deductions. Taxes and deductions are subtracted from the gross pay to give you your net pay.

Taxes – This shows employee taxes deducted from your gross pay. This report does not include any employer portion of Social Security, Medicare, or other employer liabilities.

Deductions – This shows any money deducted from your gross pay. These deductions are separate from employee taxes. Some examples of employee deductions are IRA, 401(k), health insurance premiums, and child support.

Contributions – This shows money that the employer has contributed as a benefit to you but not deducted from your gross pay. Examples of contributions are contributions to employee retirement accounts from the employer, employer-paid health insurance, or other benefits that do not increase your net pay.

Your feedback will not receive a reply. If you have a specific issue, please reach out to our support team here.