Do you accept credit card payments in your small business? If you do, that’s great news for the 80% of consumers who prefer playing with plastic. But, it comes with additional business responsibilities, such as recording credit card sales in your books.

Although you may be familiar with recording cash or check sales, credit card sales come with merchant fees. These credit card merchant fees require you to take additional steps when creating journal entries.

Read on to learn the ins and outs of accounting for credit card merchant fees and sales.

How the credit card sales process works

Credit card sales are when customers pay for a product or service with a credit card. Payments to your business come from the customer’s credit card company, not the customer directly.

Because of this, there are two things you need to keep in mind about credit card sales:

- You might not receive payment from the customer’s credit card company until a later date

- You are responsible for handling credit card merchant fees that come with accepting this type of payment

If you want to begin accepting credit card payments, you need a point of sale (POS) system with a credit card reader. Again, accepting credit card payments comes at a cost—in addition to the cost of the reader or monthly flat fees.

In some cases, you might be able to pass along swipe fees to customers. But, some state laws prohibit businesses from passing along these fees. Not to mention, some customers might be turned off from having to pay the fees.

Because of laws and disgruntled customers, you must be prepared to cover credit card merchant fees.

Want to impress your friends at a dinner party?

Get the latest accounting news delivered straight to your inbox.

Subscribe to Email ListA little bit about credit card processing fees

Credit card merchant fees vary depending on what merchant account provider you choose.

Generally, fees are a percentage of a credit card sale. But, fees might also be a flat rate per transaction or a combination of a percentage and flat rate.

Average fees for MasterCard, Visa, Discover, and American Express tend to range from 1.43% – 3.5%.

How to record credit card sales in your books

When you pay or receive credit card processing fees, do not record them as part of your sales revenue. Instead, credit card accounting principles require that you list them as expenses.

First, let’s go over the accounts involved in a journal entry for credit card purchases:

- Cash

- Credit Card Expense

- Sales Revenue

- Accounts Receivable (if applicable)

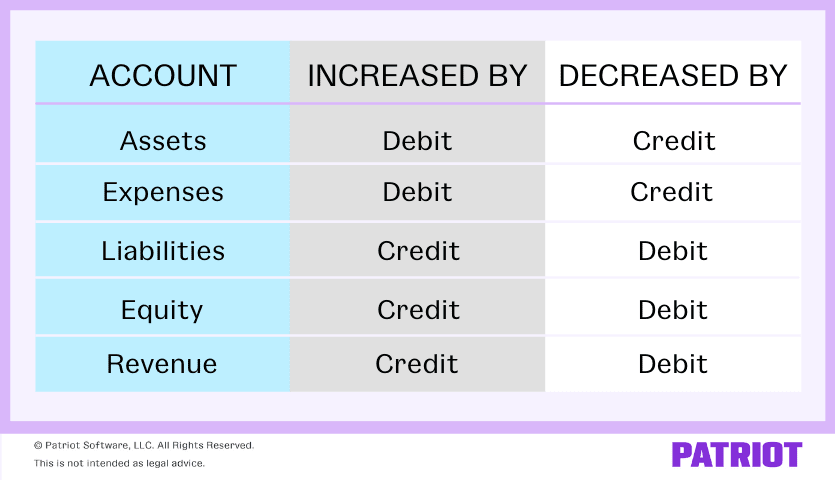

Next, you need to know which accounts to debit and credit. Use the chart below to see which types of accounts are increased and decreased by debits and credits.

Your Cash and Accounts Receivable accounts are assets, which means they’re increased by debits and decreased by credits. Credit Card Expense accounts are expense accounts, so they are also increased by debits and decreased by credits.

Because the Sales Revenue account is a revenue account, it is increased by credits and decreased by debits.

How you record a journal entry for credit card sales depends on whether you receive immediate payment from the card issuer.

Regardless of whether you receive immediate or delayed payment, use the Cash, Credit Card Expense, and Sales Revenue accounts. However, only use the Accounts Receivable account for delayed payments.

Journal entry for credit card purchases: Immediate payment

In most cases, you receive funds from a credit card purchase immediately. When you do, you must make a compound journal entry (i.e., there’s more than one debit, credit, or both).

So, how much should you debit and credit each account? To find out, subtract the credit card merchant fees from the total sale amount. This represents how much money your business actually made from the sale.

In your journal entry, you must:

- Debit your Cash account in the amount of your Sale – Fees

- Debit your Credit Card Expense account the amount of your fees

- Credit your Sales account the total amount of the sale

Remember that the sum of your debits to the Cash and Credit Card Expense accounts must equal the amount you credit your Sales account.

When you receive immediate payment, your journal entry for credit card purchases should look like this:

| Date | Account | Notes | Debit | Credit |

| X/XX/XXXX | Cash | Credit card sales | X | |

| Credit Card Expense | X | |||

| Sales | X |

Example

Let’s say you make a $500 sale to a customer paying with a credit card. The credit card fee is 2.5%.

First, determine the amount of the credit card fee by multiplying 2.5% by the total sales:

$500 X 0.025 = $12.50

Your credit card processing fees are $12.50. Debit your Credit Card Expense account $12.50.

Now, subtract $12.50 from your total sales of $500 to determine how much cash your business brought in:

$500 – $12.50 = $487.50

Debit your Cash account $487.50. And, credit your Sales account $500.

| Date | Account | Notes | Debit | Credit |

| X/XX/XXXX | Cash | Credit card sales | 487.50 | |

| Credit Card Expense | 12.50 | |||

| Sales | 500.00 |

Journal entry for credit card purchases: Delayed payment

If you do not immediately receive payment, accrual accounting still requires you to record payment when the transaction takes place.

You’ll need a placeholder account—Accounts Receivable—until you actually receive the funds from the customer’s card issuer.

Make two separate journal entries for credit card purchases with delayed payment.

The first journal entry is not a compound journal entry. This means you will only debit one account and credit one account. In the first journal entry, you must:

- Debit your Accounts Receivable account

- Credit your Accounts Receivable account

Remember that your debits and credits must equal one another. Your first journal entry looks like this:

| Date | Account | Notes | Debit | Credit |

| X/XX/XXXX | Accounts Receivable | Credit card sales: Delayed payment | X | |

| Sales | X |

Your second journal entry is compound and looks similar to the immediate payment entry. In the second journal entry, you must:

- Debit your Cash account in the amount of your Sale – Fees

- Debit your Credit Card Expense account the amount of your fees

- Credit your Accounts Receivable account the total amount of the sale

Basically, this journal entry is a reversal of your first journal entry to empty your Accounts Receivable account of the previously recorded amount and add to your Cash account.

The second journal entry looks like this:

| Date | Account | Notes | Debit | Credit |

| X/XX/XXXX | Cash | Credit card sales | X | |

| Credit Card Expense | X | |||

| Accounts Receivable | X |

Example

Again, let’s say you make a $500 sale to a customer paying with a credit card. The credit card fee is 2.5%. For the first journal entry, don’t worry about the credit card fee.

Your first journal entry must debit your Accounts Receivable $500 and credit your Sales account $500.

| Date | Account | Notes | Debit | Credit |

| X/XX/XXXX | Accounts Receivable | Credit card sales: Delayed payment | 500 | |

| Sales | 500 |

Your card issuer sends you the amount of the sale minus the credit card fee, which again is $12.50 ($500 X 2.5%).

Debit your Cash account $487.50 ($500 – $12.50), debit your Credit Card Expense $12.50, and credit your Accounts Receivable account $500.

The second journal entry should look like this:

| Date | Account | Notes | Debit | Credit |

| X/XX/XXXX | Cash | Credit card sales | 487.50 | |

| Credit Card Expense | 12.50 | |||

| Accounts Receivable | 500.00 |

Want an easier way to record credit card sales? Patriot’s online accounting software streamlines the way you manage your books. Start your free trial now!

This article is updated from its original publication date of November 7, 2019.

This is not intended as legal advice; for more information, please click here.