As a business owner and employer, you need to know about the Department of Labor (DOL), labor laws, and more. That’s a lot of information to remember. Plus, you might have questions. Specifically, you might be asking, What does the Department of Labor do? And, you may be wondering how the DOL’s laws impact you and your business.

What does the DOL do?

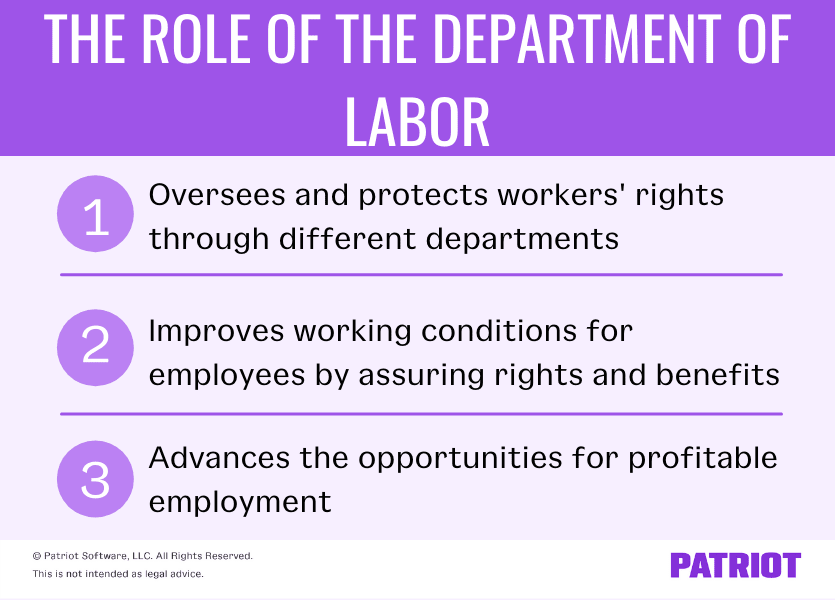

First things first, what does the Department of Labor do, exactly? According to the Department of Labor, their mission is:

“To foster, promote, and develop the welfare of the wage earners, job seekers, and retirees of the United States; improve working conditions; advance opportunities for profitable employment; and assure work-related benefits and rights.”

Basically, the DOL oversees workers’ rights and ensures that employers follow all labor laws defined by the federal government. States have their own DOL, too. Check with your state to learn more about its labor bureau.

Agencies and programs under the DOL

Because the mission of the U.S. Department of Labor is to broadly protect workers’ rights and their welfare, the DOL has several subdivisions. The agencies and subdivisions oversee different parts of labor laws. Here are just a few of the agencies and programs of the DOL:

- Bureau of Labor Statistics (BLS)

- Occupational Safety and Health Administration (OSHA)

- Office of Disability Employment Policy (ODEP)

- Office of Workers’ Compensation Programs (OWCP)

- Wage and Hour Division (WHD)

You should be somewhat familiar with all of the agencies and programs under the DOL, but there are a few you need to know inside and out. For a full list of DOL agencies and programs, consult the DOL website.

Take a look at some of the agencies you need to know as an employer and business owner.

1. Bureau of Labor Statistics

Why is the Bureau of Labor Statistics so important to business owners and employers? Well, the BLS provides statistics and data that can benefit you as an employer. This includes information on:

- Inflation and prices

- Pay and benefits

- Unemployment

- Employment

- Spending and time use

- Workplace injuries

- Occupational requirements

- Productivity

- Geographic information

For example, say you’re writing a job description and wondering if you should include a job description salary range. Before adding the salary information, you can use the BLS website to determine if your wages are competitive.

Or, say you want to make sure you’re getting the best deal on a product you purchase from a vendor. You can use the BLS website to search for data on producer prices to determine if you are over- or under-paying for specific products.

Check the BLS website for more information.

2. Occupational Safety and Health Administration

The Occupational Safety and Health Administration is one of the most well-known agencies of the DOL. OSHA is responsible for monitoring—you guessed it—the health and safety of employees while working.

OSHA provides the following to protect workers’ health and safety:

- Training

- Outreach

- Education

- Assistance

Congress created the OSHA program as part of the Occupational Safety and Health Act of 1970. Since then, the program focuses on enforcing the laws to ensure compliance. Familiarize yourself with the OSHA employer responsibilities and worker rights and protections. Create a workplace incident report to document health and safety incidents in the workplace. Consult the OSHA website for more information.

3. Office of Disability Employment Policy

If you’re an employer, you’re probably familiar with the Americans with Disabilities Act (ADA). The ADA is a law that inspires the work of the Office of Disability Employment Policy.

ODEP is responsible for providing technical assistance on the “reasonable accommodations” portions of the ADA. As an employer, you must provide reasonable accommodations to qualified applicants and employees with disabilities. What does that mean? It means that you must change or adjust one or more of the following to allow a worker to apply, perform job functions, or have equal access to benefits:

- The job itself

- Work environment

- The way work is usually performed

The agency works with employers to provide guidance, training, and resources to ensure compliance with disability employment laws and regulations. Check the ODEP website for more information.

Want to impress your friends at a dinner party?

Get the latest payroll news delivered straight to your inbox.

4. Office of Workers’ Compensation Programs

Laws require most employers to have a workers’ compensation policy. In fact, some states have workers’ compensation insurance offered through the state or as an employment tax. The OWCP’s mission is to:

“…protect the interests of workers who are injured or become ill on the job, their families and their employers by making timely, appropriate, and accurate decisions on claims, providing prompt payment of benefits and helping injured workers return to gainful work as early as is feasible.”

Basically, the OWCP provides medical compensation programs to provide:

- Wage replacement benefits

- Medical treatment

- Vocational rehabilitation

- Other benefits to certain workers or their dependents who experience a work-related injury or disease

Why should employers know about what OWCP offers? Because you may need to direct employees to the program if a worker files a workers’ compensation claim. For more information, check out the OWCP website.

5. Wage and Hour Division

The Wage and Hour Division of the DOL is one of the most important agencies to know as an employer. This agency is responsible for the compliance of:

- Federal minimum wage laws

- Overtime pay

- Recordkeeping

- Child labor laws

And, the department enforces other labor laws, including the:

- Migrant and Seasonal Agricultural Worker Protection Act

- Employee Polygraph Protection Act

- Family and Medical Leave Act

- Consumer Credit Protection Act (the wage garnishment portion, specifically)

- Fair Labor Standards Act

As an employer, the WHD enforces compliance and gives penalties or fines to individuals who do not follow the law. Use the WHD website to check the most current wage and hour laws to remain compliant.

The DOL and small businesses

The DOL has an entire division specifically for small businesses. The Office of Small and Disadvantaged Business Utilization (OSDBU) is the agency that carries out the DOL’s responsibility to small businesses. The agency has specialists and a resource center just for small businesses.

These resources include compliance materials, wage and hour information, employee benefits guidelines, employment law documents, and occupational safety support. Most of these resources are free to business owners.

For more information, check out the OSDBU website.

This article has been updated from its original publication date of August 6, 2012.

This is not intended as legal advice; for more information, please click here.