When you hire new employees, you are responsible for collecting new hire paperwork. You must gather information, such as an employee’s name, address, and Social Security number (SSN). But, what happens when an employee doesn’t have an SSN? Can you hire someone without a Social Security number? Get the answers to all of your burning SSN-related questions below.

What’s an SSN?

Before we dive into whether you can hire an employee without an SSN, let’s briefly recap what an SSN is.

A Social Security number is a nine-digit number issued by the Social Security Administration (SSA) to all U.S. citizens. Your SSN identifies you as an individual. No two Social Security numbers are the same. A Social Security number is a nine-digit number formatted like this: XXX-XX-XXXX.

As mentioned, you must gather specific documents when you hire an employee. Two forms you must collect from new hires are Forms W-4 and I-9.

Form W-4, Employee’s Withholding Certificate, is a new hire form your employees must complete. Use Form W-4 to determine how much to withhold in federal income taxes from employee wages. Employees must fill out personal information on Form W-4, such as their name, address, marital status, and SSN.

Form I-9, Employment Eligibility Verification, is a form used to confirm your employee is legally allowed to work in the U.S. On an I-9 form, employees must fill out their name, address, and SSN. And, employees must provide you with personal identification (e.g., passport, SSN card, driver’s license, etc.) for you to review along with their completed form.

Depending on your state and business, you might also need to gather additional new hire documents, such as a state W-4 form, from employees. An employee must list their SSN on a state W-4 form.

Employers use SSNs to report employees’ annual wages to the IRS and SSA. Employers also report employee wages to local and state tax agencies.

SSN vs. ITIN

You might have heard of an Individual Taxpayer Identification Number (ITIN). ITINs are only available for resident and nonresident aliens who are not eligible to work in the U.S.

Do not accept an ITIN in place of an SSN. An ITIN is formatted like an SSN (e.g., XXX-XX-XXXX). And like an SSN, an ITIN is also nine digits long. However, an ITIN always begins with the number “9.”

When looking through new hire paperwork, check to see if the employee filled in an SSN or ITIN.

Can you hire an employee with no SSN?

With all the documentation you need, you’re probably wondering, What happens if my new hire does not have an SSN?

Can I hire an employee without an SSN? The short answer: no. However, if a candidate does not have an SSN, there is a workaround to get an SSN. This solution is simple: have the candidate apply for (and hopefully get) an SSN.

If a candidate you want to hire does not have an SSN, don’t panic. Instead, learn about what steps you and your candidate must take if they do not have an SSN. First things first, direct your candidate to Form SS-5 to apply for an SSN.

Form SS-5

Your potential hire must apply for an SSN using Form SS-5.

Form SS-5, Application for Social Security Card, allows candidates or employees without an SSN to apply for one. Both resident and nonresident alien candidates must use Form SS-5 to apply for an SSN.

You or your candidate can access a copy of Form SS-5 from the SSA’s website.

Employees can apply for a Social Security card for free. They must fill out Form SS-5 and provide original documents proving their identity, immigration status, and age.

Along with applying for an SSN, candidates or employees can also use Form SS-5 to:

- Apply for a replacement Social Security card

- Change or correct their SSN record

Individuals typically receive their SSN card within two weeks after the SSA processes their application.

If a worker has applied for an SSN but has not received it yet, gather the following information from them:

- Full name

- Current address

- Date of birth

- Place of birth

- Mother’s full name (including maiden name)

- Father’s full name

- Gender

- Date they applied for an SSN

The SSA does not require employees to have an SSN before they start working. However, the IRS requires you to have an employee’s SSN to report their wages.

A candidate can begin working for you before they provide you with their SSN. But, they must provide you with an SSN within a reasonable amount of time.

Employees can get a letter from the SSA for employers stating that they applied for an SSN.

Per the IRS, an employee can’t work for you if they are denied an SSN after applying.

Contact the SSA for more questions about hiring an employee without an SSN.

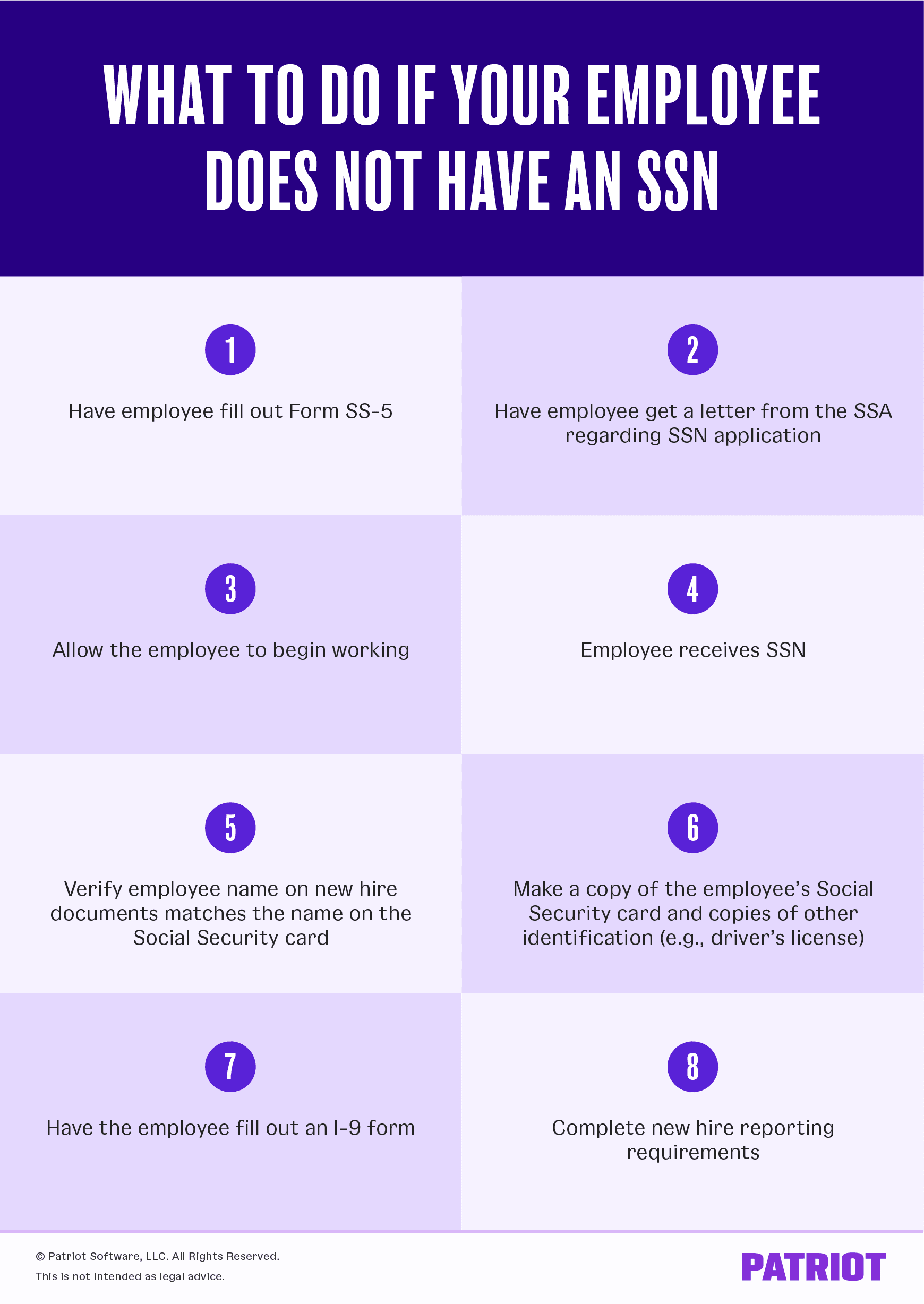

What to do if your employee does not have an SSN

Again, have your employee apply for a Social Security card immediately by filling out Form SS-5. Follow the steps below to ensure you are meeting IRS requirements when hiring an employee.

Steps to follow when hiring an employee without an SSN:

- Have employee fill out Form SS-5

- Have employee get a letter from the SSA regarding SSN application

- Allow the employee to begin working

- Employee receives SSN

- After the employee receives their SSN, verify that the employee name on the new hire documents matches the name on the employee’s Social Security card

- Make a copy of the employee’s Social Security card along with copies of other identification (e.g., driver’s license)

- Have the employee fill out an I-9 form

- Complete new hire reporting requirements

After your employee begins working, be sure to add them to payroll and withhold payroll taxes from their wages.

If an employee does not receive an SSN or gets turned down for one, they cannot legally work for you.

Do not accept an ITIN in place of an SSN. An ITIN cannot be used for employee identification or work. ITINs are only available to resident and nonresident aliens who are not eligible to work in the U.S.

Wage reports and no employee SSN

What do you do if you need to file Form W-2 for an employee with no SSN?

If your employee applied for a card and has not received it yet, write “Applied For” in Box A on Form W-2.

If you’re electronically filing Form W-2 for an employee without an SSN, enter 0’s in the Social Security number field.

If your worker receives their SSN after you file a wage report, file Form W-2c, Corrected Wage and Tax Statements, to report corrections.

Need an easy way to pay your employees? Patriot’s payroll software lets you streamline your payroll responsibilities so you can get back to your business. Our friendly and free support is only a call, email, or chat away. What are you waiting for? Get started with your self-guided demo today!

This article has been updated from its original publication date of July 1, 2019.

This is not intended as legal advice; for more information, please click here.