If you have hourly employees, you likely have them track their hours. But, what happens if they only work a fraction of an hour? How do you know how much to pay them?

If you want to pay hourly employees for partial hours worked, you need to learn how to convert minutes for payroll.

Read on to learn all about converting minutes for payroll, including payroll conversion steps to follow and methods for tracking converted minutes.

How to convert minutes for payroll

There’s a right way and a wrong way to convert minutes for payroll. If you’re not converting minutes, you might be overpaying and underpaying employees.

So, are you converting payroll minutes incorrectly? Here’s what you should not be doing:

- Say your employee worked 10 hours and 13 minutes. You multiply 10.13 by their hourly rate to get their gross wage. This is the incorrect way to convert minutes for payroll.

Instead, you need to follow certain steps for converting the payroll minutes to a decimal. Keep reading to find out the correct way to convert minutes for payroll.

Steps for converting minutes for payroll

If you’re calculating employee pay, you need to know how to convert payroll hours. If you don’t convert minutes, it can cause a lot of payroll problems down the road.

Before you begin converting payroll minutes, determine whether to use actual hours worked or to round hours to the nearest quarter.

Use the three steps below to convert minutes for payroll.

1. Calculate total hours and minutes

To calculate working hours and minutes, decide whether to:

- Use actual hours worked

- Round hours worked

Actual hours worked

To calculate actual hours worked, you need the total hours and minutes for each employee for the pay period.

To do this, you need to gather timesheets or time and attendance records for each employee.

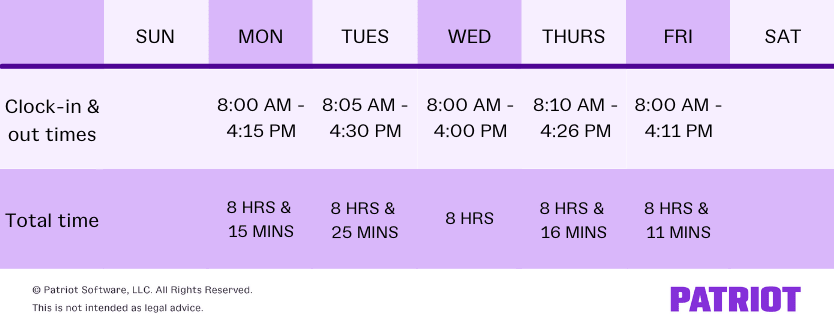

Let’s take a look at an example timesheet for a weekly employee. This employee does not take lunch breaks. Therefore, they do not need to clock in and out for lunches.

To calculate total hours worked, add up the total hours. Add the total minutes together separately from the hours.

Total hours = 8 + 8 + 8 + 8 + 8 (or 8 X 5)

Your employee’s total hours is 40.

Now, add together the total minutes.

Total minutes = 15 + 25 + 16 + 11

The employee’s total minutes equals 67. Convert 60 minutes of the total 67 minutes to equal one hour (67 minutes – 60 minutes = 1 hour and 7 minutes).

Next, add the converted minutes to your total hours. Your employee worked 41 hours and 7 minutes this week.

Rounding hours for payroll

Federal law gives employers the option to calculate wages using rounded hours for payroll. If you opt to use the rounding method, you must know how to round correctly to remain compliant.

Under the law, you’re allowed to round the employee’s time to the nearest quarter of an hour. A quarter of an hour is 15 minutes (e.g., 12:15 p.m.). If your employee clocks in at any time before or after a quarter, you might need to round up or down.

You can only round up to the next quarter if the time is eight to 14 minutes past the previous quarter.

If your employee’s time is from one to seven minutes past the previous quarter, round down.

Rounding hours example

Let’s take a look at rounding hours in action. Say your employee clocks in at 8:03 a.m. and clocks out at 4:12 p.m. This employee does not take a lunch. Their actual time worked is 8 hours and 9 minutes. However, their rounded hours will vary.

The time of 8:03 a.m. must be rounded down to 8:00 a.m. because it’s no more than seven minutes past the quarter. On the other hand, the time of 4:12 p.m. must be rounded up to 4:15 p.m. because it’s more than 7 minutes past the quarter.

Although the actual time worked is 8 hours and 8 minutes, the rounded hours would be 8 hours and 15 minutes.

| Round down | Less than 7 minutes past the quarter (1 – 7) |

| Round up | More than 7 minutes past the quarter (8+) |

2. Convert payroll minutes to decimals

Converting minutes to decimals for payroll is simple. All you need to do is divide your minutes by 60.

For example, say your employee worked 20 hours and 15 minutes during the week. Divide your total minutes by 60 to get your decimal.

15 / 60 = 0.25

For this pay period, your employee worked 20.25 hours.

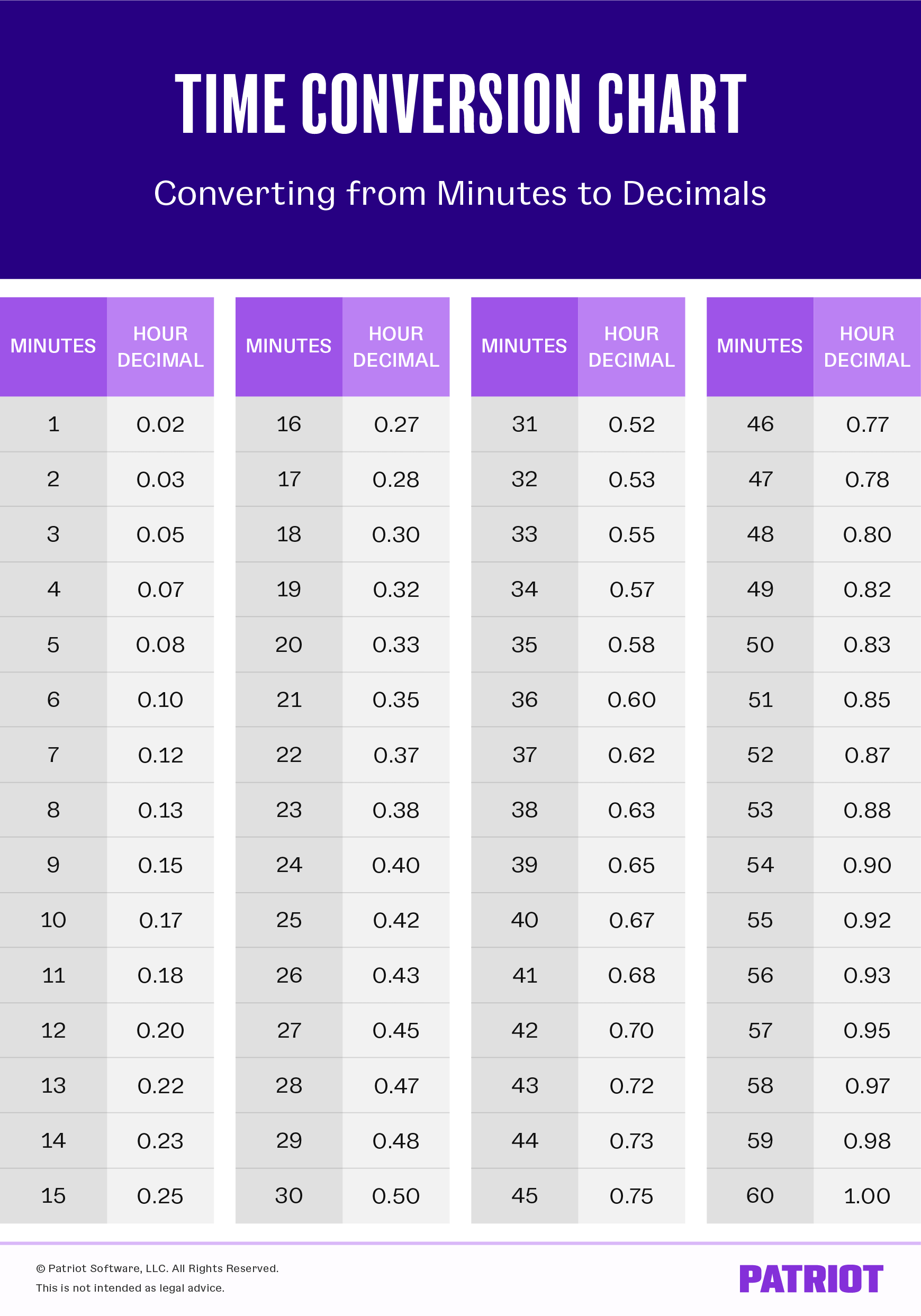

If you want a quicker way to convert minutes to decimals, use a payroll time conversion chart. Check out our handy chart below to help you quickly convert your employee’s minutes:

3. Multiply calculated time and wage rate

After you convert your employee’s time, you can calculate how much you need to pay your employee. To find your employee’s gross pay, multiply their wage rate by their time in decimal time.

Let’s use the same example from above. Your employee worked 20.25 hours. They earn $10.00 per hour. Multiply your employee’s hourly rate by their total hours to get their total pay.

$10.00 X 20.25 hours = $202.50

Your employee’s total wages before payroll taxes and deductions is $202.50.

Options for tracking converted payroll minutes

If you need a way to convert minutes for payroll, you have a few options. You can use a spreadsheet, utilize payroll software, or convert minutes by hand.

1. Spreadsheet

Payroll spreadsheets can let you manage employees’ minutes, track hours, and calculate conversions.

If you don’t want to do calculations by hand or invest in payroll software, using a payroll spreadsheet is your next best bet.

Update your payroll spreadsheet each pay period. Make sure you double-check your work to ensure there are no errors.

2. Payroll software

A great way to track employee hours and convert payroll minutes to decimals is by using payroll software.

Software calculates and converts for you so you don’t have to worry about doing it yourself. Plus, most payroll software can integrate with time and attendance software to automatically import employee hours.

3. By hand

If you like doing things old school and are comfortable doing your own calculations, consider converting payroll minutes by hand.

If you plan to convert payroll minutes yourself, be sure to use the three steps above and take advantage of the payroll conversion chart.

This article has been updated from its original publication date of October 9, 2019.

This is not intended as legal advice; for more information, please click here.