Although you may have a minority-owned business, you must meet specific criteria for formal recognition as a minority business enterprise (MBE). And if you meet the criteria, there are business benefits to receiving an MBE certificate.

So, what is an MBE, and what is the MBE certificate?

Minority-owned businesses and the MBE certificate

MBE signifies that an individual who is a minority is the primary owner of the business. To apply for and receive a minority-owned business certificate, the business must be legally defined as minority-owned. So what does that mean exactly?

Legal definition of minority-owned enterprise

To qualify and register as a minority-owned business, the company must meet the following requirements:

- Be at least 51% minority-owned and operated by a U.S. citizen from one of the recognized U.S. minority groups

- Have daily operations and management carried out by the minority ownership members

- Be a for-profit business that is physically located in the U.S. or trust territories

What groups are considered minority groups in the U.S.? There are seven federally recognized minority groupings:

- Hispanic/Latino Americans

- Black/African Americans

- Asian Americans

- Arab/Middle Eastern Americans

- Native Americans

- Alaska Natives

- Native Hawaiians/Pacific Islanders

MBE certificate

So, what is the MBE certificate? The minority business enterprise certificate recognizes that a business is truly minority-owned. Basically, your business certificate confirms the legitimacy of claims regarding minority ownership.

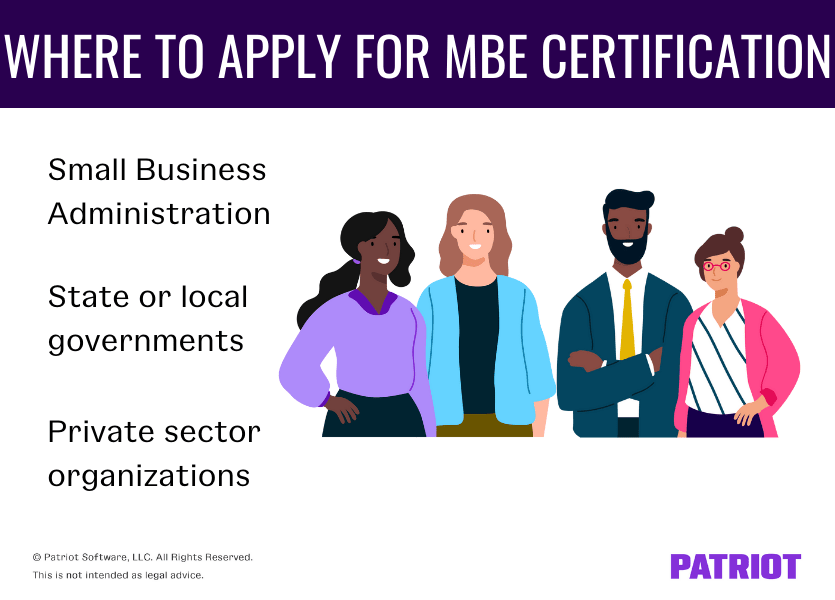

Businesses can seek a minority business certificate through one of the following channels:

- Small Business Administration (SBA) for federal recognition

- State or local governments

- Private sector certification

There is some overlap between each type of certification, but each agency has its own process and criteria. Therefore, you may need to get a new certification from a different agency if you want to receive the benefits of that agency. Contact the agency for additional information.

Benefits of a minority-owned business certificate

Again, there are some similarities between each sector’s MBE certification. But, the advantages differ by certification. So, what does an MBE entitle you to?

SBA MBE certification

The Small Business Administration is a federal agency that provides public sector assistance to small businesses. MBE certification through the SBA allows businesses access to the 8(a) Business Development Program to help “socially and economically disadvantaged” businesses.

The Small Business Administration defines “socially disadvantaged” as businesses owned by individuals in SBA qualifying minority groups. “Economically disadvantaged” businesses are those who meet financial qualifications.

The 8(a) program limits competition for certain contracts to the participating businesses, which allows them to better compete in the federal marketplace.

Businesses must register with the federal System for Award Management (SAM) website to certify the business as minority-owned. After SAM approves the business, upload the certification to the SBA certification website.

Registration and certification through the SBA allow you to be eligible for the 8(a) Business Development Program.

To qualify for the 8(a) Business Development Program, you must:

- Be an SBA small business

- Have not previously participated in the 8(a) program

- Be at least 51% owned and controlled by U.S. citizens who are socially and economically disadvantaged

- Have a personal net worth of $750K or less, adjusted gross income of $350K or less, and $6 million or less in assets

- Demonstrate good character and potential to perform on contracts

Businesses seeking to participate in the 8(a) program may have previously participated in other SBA programs. The 8(a) program lasts a maximum of nine years and includes annual reviews.

Contact the SBA for more information.

State and local MBE certification

An advantage of state and local MBE certificates is that the agencies provide technical and financial assistance to MBEs so the businesses can more successfully compete for contracts. And, the state agencies can better advocate for minority-owned businesses. But, one of the biggest advantages to state and local MBE certification is that receiving a certificate allows MBEs access to targeted government contracting.

Each state has its own agency for the advancement of opportunities for minority-owned businesses. The Department of Commerce created the Minority Business Development Agency (MBDA), which has a list of state resources.

Private sector MBE certification

The National Minority Supplier Development Council (NMSDC) is an organization that certifies minority-owned businesses. The NMSDC lists recognized MBE businesses in both regional and national Minority Supplier Databases. And, the list includes both corporate members and private-sector companies that MBEs can potentially receive contracts from and connect with.

Other benefits of minority business certification through the NMSDC include:

- Management training programs

- Special loan programs

- Business opportunity fairs

Certification requirements include:

- Being at least 51% owned by at least one individual who is part of a federally recognized minority group*

- Having U.S. citizenship

- Being a for-profit business that is physically located in the U.S. or its trust territories

- Having management and daily operations overseen and exercised by the minority ownership member(s)

*The NMSDC requires documentation stating that the individual(s) representing the 51% minority ownership have at least 25% heritage in the identified minority group.

If your business qualifies as a minority-owned business based on the criteria, gather the necessary documentation to complete and submit the application. Use the NMSDC website to verify the documentation your business needs to provide. Documentation may vary based on the business structure.

The NMSDC also charges a fee for certification. The fee varies based on your business location and size.

You must register on the site of the regional council where you are applying before you can apply. After you submit the application and the applicable fee, the NMSDC reviews the documentation. The process can take up to 90 days to complete. Regional affiliates notify businesses if they are approved. If your business is denied, you may submit an appeal.

Tax incentives and MBE certification

The federal government does not specifically offer tax breaks to minority business enterprises. But, there are federal tax incentives for working with other MBEs and operating in low-income areas.

For example, businesses that operate in low-income areas may receive the New-Markets Tax Credit against federal income taxes. But, the business must invest in designated community development entities.

States may also provide tax incentives to minority-owned businesses. Check with your state for more information.

This is not intended as legal advice; for more information, please click here.