“What’s your occupation?” Everybody gets this question—at the doctor’s office, when opening a new bank account, etc. People are curious. They want to know what it is exactly you do for a living. And if you’re an employer, the government wants to know what your employees do, too. To find out, federal and state agencies use SOC codes.

So, what are SOC codes? How can you use them in your business? Do you have to?

What are SOC codes?

SOC, or Standard Occupational Classification, codes classify workers into occupational categories. Standard Occupational Classification is a standard system that makes it easier for federal agencies to collect, calculate, and disseminate occupational data. SOC codes are generally six digits.

There are 867 occupations in the SOC system. To streamline the classification, these 867 occupations are nested under more general groups:

- Major groups (23)

- Minor groups (98)

- Broad occupations (459)

- Detailed occupations (867)

Several states require employers to assign SOC codes to each employee and report the codes to the state. But, occupational-related data isn’t just for government use.

Businesses can also use SOC codes to set employee salaries. The Bureau of Labor Statistics provides national and state wage information (e.g., median hourly wage, annual mean wage, etc.) for each occupation with an SOC code.

Don’t confuse SOC codes with NAICS codes or workers’ compensation codes. Here’s a brief breakdown of the other codes you may deal with in business:

- NAICS (North American Industry Classification System): Identify business industries using a standard federal classification system

- Workers’ comp codes: Identify types of work so insurance companies can estimate job risk and workers’ comp insurance costs

SOC codes list

The BLS has a complete SOC codes list that details major groups, minor groups, broad occupations, and detailed occupations.

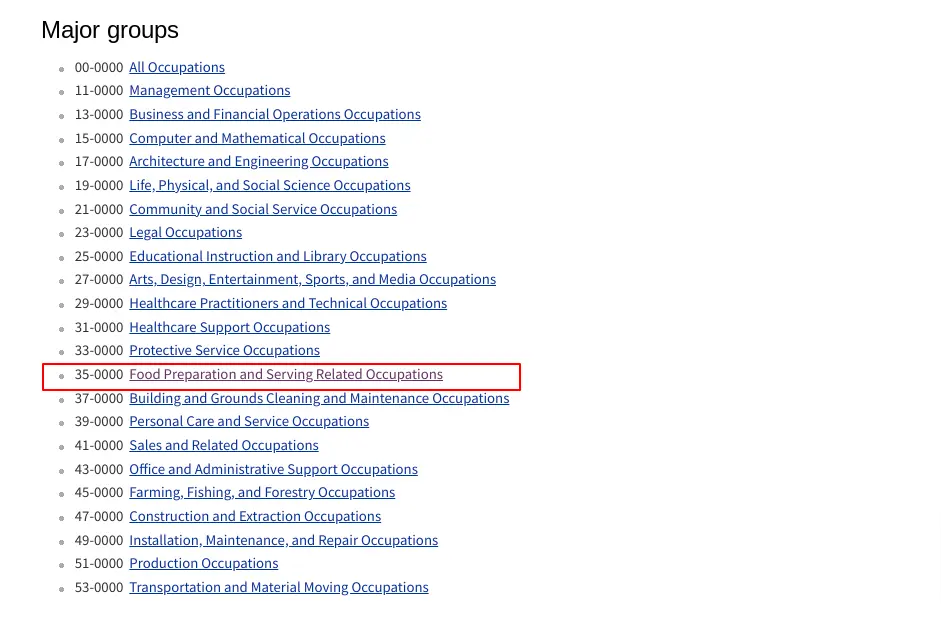

We aren’t going to list all 867 SOC codes here (sorry, readers!). But you can check out the 23 major groups:

- All Occupations

- Management Occupations

- Business and Financial Operations Occupations

- Computer and Mathematical Occupations

- Architecture and Engineering Occupations

- Life, Physical, and Social Science Occupations

- Community and Social Service Occupations

- Legal Occupations

- Educational Instruction and Library Occupations

- Arts, Design, Entertainment, Sports, and Media Occupations

- Healthcare Practitioners and Technical Occupations

- Healthcare Support Occupations

- Protective Service Occupations

- Food Preparation and Serving Related Occupations

- Building and Grounds Cleaning and Maintenance Occupations

- Personal Care and Service Occupations

- Sales and Related Occupations

- Office and Administrative Support Occupations

- Farming, Fishing, and Forestry Occupations

- Construction and Extraction Occupations

- Installation, Maintenance, and Repair Occupations

- Production Occupations

- Transportation and Material Moving Occupations

You can view a complete SOC codes list on the BLS website.

Example

Looking at the list of 867 occupations and trying to decide where your employees fit can be overwhelming. So, here’s a step-by-step example of how you would find and assign SOC codes to workers.

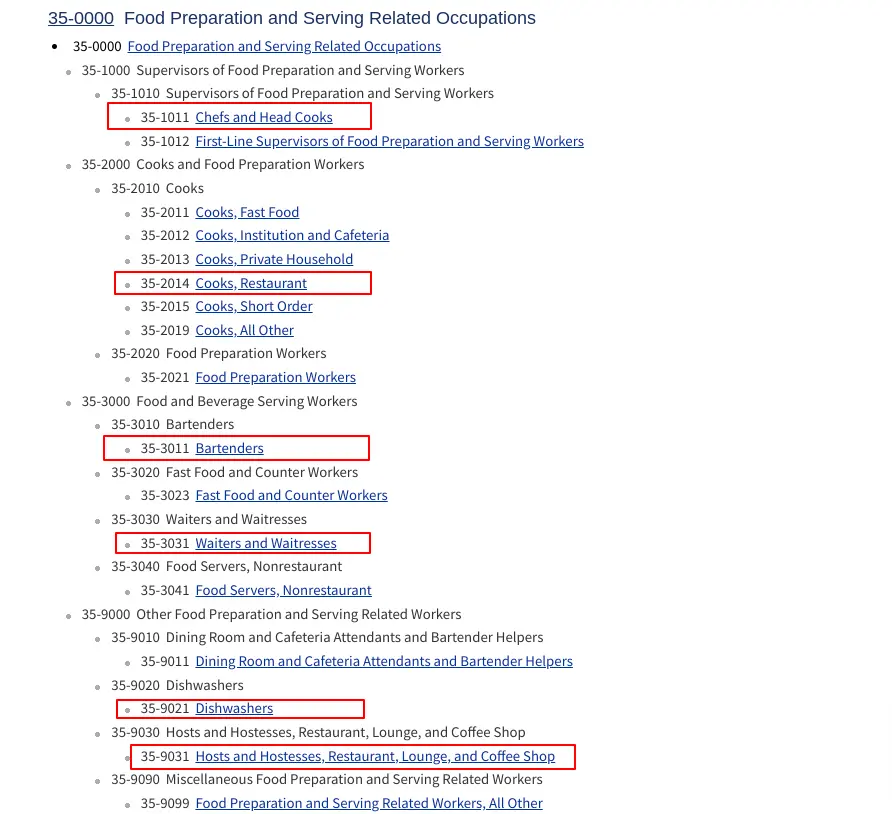

Say you run a restaurant. You have eight waiters and waitresses, four cooks, one head cook, three dishwashers, two bartenders, and two hostesses.

Let’s use the BLS Occupational Employment and Wage Statistics page to find each employee’s SOC code.

First, look at the BLS’ major groups and filter down from there. For this example, the major group is 35-0000, “Food Preparation and Serving Related Occupations.”

Next, look at the minor and broad groups to find each employee’s detailed occupation code. The detailed occupation codes you need for your employees are outlined in red below.

Here are the SOC codes that most closely align with your team:

- Waiters and waitresses: 35-3031

- Cooks: 35-2014

- Head cook: 35-1011

- Dishwashers: 35-9021

- Bartenders: 35-3011

- Hostesses: 35-9031

States that require SOC code reporting

Several states require that employers include SOC codes in quarterly employment reports (i.e., SUTA tax returns). Does yours?

The following states require all employers to report SOC codes for employees with earnings subject to SUTA tax during the quarter:

- Alaska

- Indiana

- Louisiana

- South Carolina

- Washington

- West Virginia

If an employee works more than one job, do not assign multiple SOC codes. Choose the code that fits the majority of their work. Check with your state for more information.

Make SOC code lookup and reporting easy with Patriot’s payroll software. We offer an on-page search tool in our software. And when it comes time to report employee SOC codes to the state, you can easily find the data with our robust payroll reports. Or, let us do the reporting for you when you sign up for Patriot’s Full Service Payroll. Get your free trial today!

This is not intended as legal advice; for more information, please click here.