All employers are responsible for reporting employee wage and tax information to the IRS. Many employers use Form 941 to report this information each quarter. But some eligible small business owners use Form 944 to report wages and taxes annually instead. Are you one of them? If so, you need to learn how to fill out Form 944.

What is Form 944?

Form 944, Employer’s Annual Federal Tax Return, reports federal income and FICA (Social Security and Medicare) tax on employee wages.

Employers who use Form 944 only file and pay withheld taxes once a year. The 944 form is a replacement for the quarterly Form 941. But, only qualifying small employers can use Form 944.

You may qualify to use Form 944 instead of Form 941 if your annual liability for federal income, Social Security, and Medicare taxes is $1,000 or less annually. Only use Form 944 if the IRS sends you a written notice.

How to fill out Form 944 for 2023

Did the IRS notify you that you can fill out the 944 form? Take a look at the following steps to learn how to fill out IRS Form 944 to report wages paid in 2023.

1. Gather Form 944 information

Unless you use payroll software, you’ll need to fill out Form 944 by hand. To do that, gather some basic information about your business, employee wages, and payroll taxes.

Before learning the ins and outs of how to fill out a 944 form, get the following information ready:

- Information about your business (e.g., name, address, and Employer Identification Number)

- Total wages you paid employees during the year

- Tips employees reported to you

- Federal income tax you withheld from employee wages

- Employer and employee shares of Social Security and Medicare taxes

- Additional Medicare tax withheld from employee wages

- Certain credits and adjustments

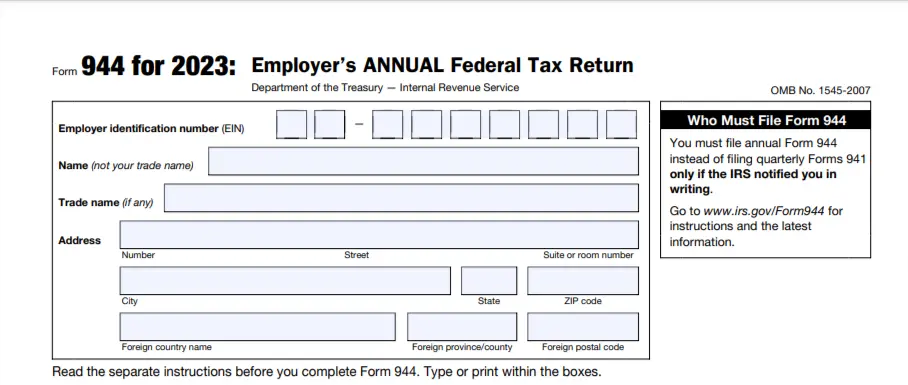

2. Fill out business information

The top portion of Form 944 is reserved for business information, including your:

- Employer Identification Number (EIN)

- Name

- Trade name, if applicable

- Business address

3. Fill in the sections of Form 944

There are five parts of Form 944. If you’d like to follow along, you can find the latest version of the 944 on the IRS website.

Keep in mind that there is also a payment voucher form (Form 944-V, Payment Voucher) at the end of Form 944. But, you only need to handle Form 944-V if you pay with a check or money order.

Here’s how to fill out a 944 form by part, complete with screenshots.

Part 1: Questions for the year

Part 1 of Form 944 has 12 lines. Some lines have multiple parts (e.g., 4a, 4b, etc.). Part 1 begins on Page 1 of the 944 and continues onto Page 2. When you get to Page 2, you must add your name and EIN to the top of the page.

Here’s a detailed look at each line and the information you need to provide.

Line 1

Enter the total wages, tips, and other compensation you paid employees during the year, including sick pay. This includes the amounts you also include in box 1 on your employees’ Forms W-2.

Do not include qualified sick or family leave wages here.

Line 2

On line 2, enter the amount of federal income tax you withheld from wages, tips, and other compensation.

Include federal income tax you withheld from:

- Qualified sick leave wages paid in 2023 (for leave taken after March 31, 2020 and before October 1, 2021)

- Qualified family leave wages paid in 2023 (for leave taken after March 31, 2020 and before October 1, 2021)

- Tips

- Taxable fringe benefits

- Supplemental unemployment compensation benefits

Do not include income tax withheld by a third-party sick payer, if applicable, or qualified health plan expenses.

Line 3

Check the box on line 3 if no wages, tips, and other compensation are subject to Social Security or Medicare tax. Then, you can skip lines 4a-4e and go to line 5.

Leave this box blank if wages, tips, and other compensation are subject to Social Security or Medicare tax. Then, fill out lines 4a-4e.

Lines 4a-4e

Line 4 reports taxable Social Security and Medicare wages and tips. Fill out lines 4a-4e if wages, tips, and other compensation you paid employees are subject to Social Security or Medicare tax.

Keep in mind that wages above the Social Security wage base are not subject to the Social Security tax, so don’t include them. The 2023 Social Security wage base is $160,200. Medicare does not have a wage base. Instead, there’s an additional Medicare tax rate of 0.9% you must withhold when an employee earns $200,000 or more.

4a

Enter taxable Social Security wages on line 4a under column 1. Multiply this amount by 0.124 (aka 12.4%, the total tax rate shared between employers and employees). Then, enter the total in column 2.

4a(i)

Enter qualified sick leave wages on line 4a(i) that you paid in 2023 for leave taken after March 31, 2020 and before April 1, 2021. Then, multiply by 0.062 (aka 6.2%, the employee portion of Social Security tax). Lastly, enter the total in column 2. These wages are not subject to the employer portion of Social Security tax.

4a(ii)

Enter qualified family leave wages on line 4a(ii) that you paid in 2023 for leave taken after March 31, 2020 and before April 1, 2021. Then, multiply by 0.062. Again, enter the total in column 2. These wages are not subject to the employer portion of Social Security tax.

4b

Enter taxable Social Security tips on line 4b under column 1. Multiply this amount by 0.124. Then, enter the total in column 2.

4c

Now, you can move on to Medicare. Enter your employees’ total taxable Medicare wages and tips on line 4c under column 1. Multiply this amount by 0.029 (aka 2.9%, the total tax rate shared between employers and employees). Enter the total in column 2.

4d

If any of your employee wages and tips were subject to additional Medicare tax withholding, enter the amount on line 4d under column 1. Multiply the amount by 0.009 (aka 0.09%) and enter the total in column 2.

4e

And last but not least, add all of your column 2 totals up from lines 4a-4d. Enter the total amount in line 4e. This is the total Social Security and Medicare taxes.

Line 5

Enter your total taxes before adjustments on line 5. To do this, add together lines 2 (federal income tax withheld) and 4e (total Social Security and Medicare taxes).

Line 6

More than likely, you’ll need to do some adjustments to account for:

- Fractions of cents (due to rounding relating to Social Security and Medicare taxes withheld)

- Sick pay (third-party sick payer)

- Tips and group-term life insurance

Adjustments for fractions of cents can be either positive or negative. Enter a negative amount for tips and group-term life insurance adjustments.

Line 7

Add together the amounts on lines 5 and 6. Enter the amount on line 7.

Lines 8a-8g

Lines 8a-8g deal with nonrefundable credits.

8a

Line 8a is for a payroll tax credit for increasing research activities. Enter the amount of credit from Form 8974, line 12 if this credit applies to you. And, attach Form 8974, Qualified Small Business Payroll Tax Credit for Increasing Research Activities.

Leave 8a blank if this credit does not apply to your business.

8b

Did you pay qualified sick leave or family leave wages in 2023 for leave taken after March 31, 2020 and before April 1, 2021? If so, enter the nonrefundable portion of credit for qualified sick and family leave wages on line 8b.

You can find the nonrefundable portion of the credit for qualified sick and family leave wages from Worksheet 1, step 2, line 2j.

8c

Line 8c is currently “Reserved for future use.” Leave this blank.

8d

Did you pay qualified sick leave or family leave wages in 2023 for leave taken after March 31, 2021 and before October 1, 2021? If so, enter the nonrefundable portion of credit for qualified sick and family leave wages on line 8d.

You can find the nonrefundable portion of the credit for qualified sick and family leave wages from Worksheet 2, step 2, line 2p.

8e

Line 8e is currently “Reserved for future use.” Leave this blank.

8f

Line 8f is currently “Reserved for future use.” Leave this blank.

8g

Add together lines 8a, 8b, and 8d, and enter the total here.

Line 9

Enter your total taxes after adjustments and nonrefundable credits. You can find this amount by subtracting line 8g from line 7. You cannot enter an amount less than zero.

If line 9 is less than $2,500, you can pay the amount with Form 944 using Form 944-V or depositing the amount.

If line 9 is $2,500 or more, deposit your tax liabilities with an electronic funds transfer (EFT). But, you can pay taxes with Form 944 if you deposited taxes accumulated in the first three quarters of the year and your fourth quarter liability is less than $2,500.

Lines 10a-10j

Not all lines are currently in use. There are several lines you must leave blank because they say “Reserved for future use:”

- 10b

- 10c

- 10e

- 10g

- 10i

- 10j

10a

Line 10a reports your total deposits for the year. This includes overpayments applied from a previous year and overpayments applied from Form 944-X, 944-X (SP), or 941-X (PR).

10d

Did you pay qualified sick leave wages, qualified family leave wages, or both in 2023 for leave taken after March 31, 2020 and before April 1, 2021? If so, enter the amount here.

This is the refundable portion of credit for qualified sick and family leave wages for this period. You can find this information from Worksheet 1, step 2, line 2k.

10f

Did you pay qualified sick leave wages, qualified family leave wages, or both in 2023 for leave taken after March 31, 2021 and before October 1, 2021? If so, enter the amount here.

This is the refundable portion of credit for qualified sick and family leave wages for this period. You can find this information from Worksheet 2, step 2, line 2q.

10h

Record the total deposits and refundable credits by adding together lines 10a, 10d, and 10f.

Line 11

If you underpaid (aka line 9 is greater than line 10h), enter your balance due. Your balance due is the difference between lines 9 and 10h.

If you did not underpay, leave this line blank and move on to line 12.

Line 12

If you overpaid (aka line 10h is greater than line 9), enter the amount here. Your overpayment is the difference between lines 10h and 9.

If you did not overpay, leave this line blank and go back to line 11.

Also, decide if you want the IRS to:

- Apply your overpayment to your next return

- Send a refund

Check the appropriate box.

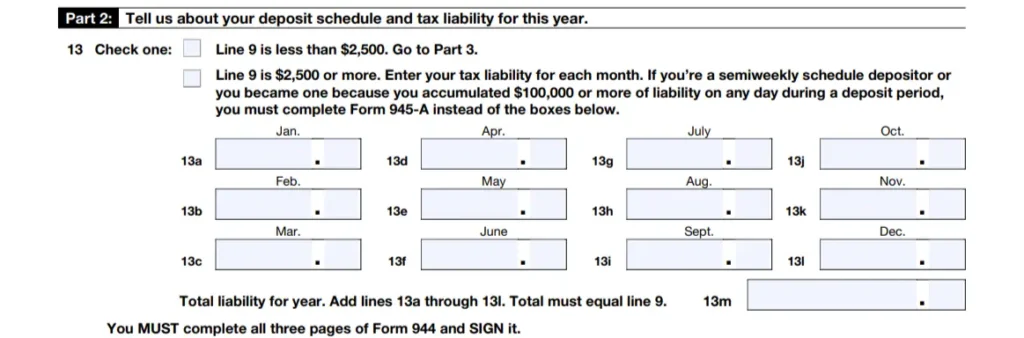

Part 2: Deposit schedule and tax liability for the year

Compared to Part 1, Part 2 is relatively short. In fact, there’s only one line—line 13. Here, you need to enter information about your deposit schedule and tax liability.

Line 13

There are two boxes to choose from on line 13. The box you check depends on the amount you enter on line 9.

If line 9 is less than $2,500, mark an “X” next to the first box. Then, you can move on to Part 3.

If line 9 is $2,500 or more, mark an “X” next to the second box and do one of the following, depending on your deposit schedule:

- Monthly tax depositor: Fill out lines 13a-13l. In lines 13a-13l, enter your monthly tax liabilities. Add up lines 13a-13l and enter the total in line 13m. Line 13m must equal line 9.

- Semiweekly tax depositor: Complete Form 945-A and file it with your 944.

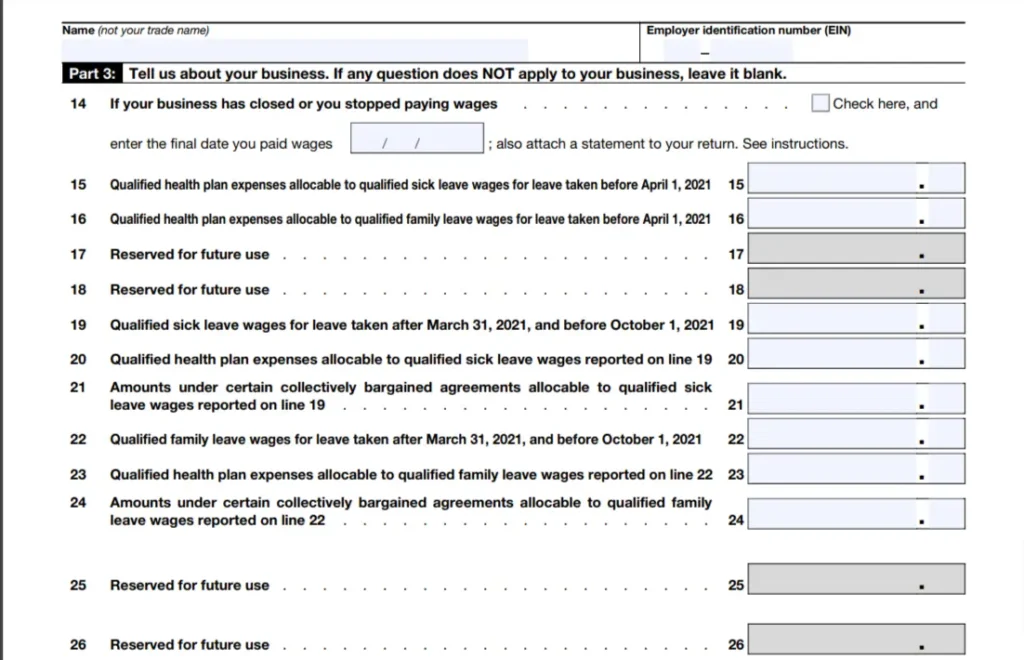

Part 3: About your business

Part 3 starts on page 3 of Form 944. So, remember to add your name and EIN at the top of the page.

Lines 14-26 make up Part 3 and ask questions about your business. There are several lines on the most current Form 944 that say “Reserved for future use.” Leave these blank. If any other questions don’t apply to your business, leave them blank, too.

Line 14

Line 14 asks if your business has closed or if you stopped paying wages. If this line applies to you, check the box (aka enter an X) and enter the final date you paid wages. You’ll also need to attach a statement when you file Form 944.

If this line does not apply to you, leave it blank.

Line 15

On the current 944, enter any qualified health plan expenses allocable to qualified sick leave wages for leave taken after March 31, 2020 and before April 1, 2021.

The amount you enter on line 15 is also what you enter on Worksheet 1, step 2, line 2b.

Line 16

The current 944 asks you to enter any qualified health plan expenses allocable to qualified family leave wages for leave taken after March 31, 2020 and before April 1, 2021.

The amount you enter on line 16 is also what you enter on Worksheet 1, step 2, line 2f.

Line 17

The 944 for 2022 does not use line 17. It is “Reserved for future use.”

Line 18

The 944 for 2022 does not use line 18. It is “Reserved for future use.”

Line 19

Did you pay qualified sick leave wages to employees in 2023 for leave taken after March 31, 2021 and before October 1, 2021? If so, enter the amount here.

The amount you enter on line 19 is also what you enter on Worksheet 2, step 2, line 2a.

Line 20

Enter any qualified health plan expenses allocable to the qualified sick leave wages you report on line 19.

The amount you enter on line 20 is also what you enter on Worksheet 2, step 2, line 2b.

Line 21

Line 21 asks you to enter amounts under certain collectively bargained agreements that are allocable to qualified sick leave wages you report on line 19.

The amount you enter on line 21 is also what you enter on Worksheet 2, step 2, line 2c.

Line 22

Did you pay qualified family leave wages to employees in 2023 for leave taken after March 31, 2021 and before October 1, 2021? If so, enter the amount here.

The amount you enter on line 22 is also what you enter on Worksheet 2, step 2, line 2g.

Line 23

Enter any qualified health plan expenses allocable to the qualified family leave wages you report on line 22.

The amount you enter on line 20 is also what you enter on Worksheet 2, step 2, line 2h.

Line 24

Enter amounts under certain collectively bargained agreements that are allocable to qualified family leave wages you report on line 22.

The amount you enter on line 24 is also what you enter on Worksheet 2, Step 2, line 2i.

Line 25

The 944 for 2023 does not use line 25. It is “Reserved for future use.”

Line 26

The 944 for 2023 does not use line 26. It is “Reserved for future use.”

Part 4: Third-party designee

Do you want an employee, paid tax preparer, or another person to talk about your Form 944 with the IRS? If so, Part 4 of Form 944 is the place to list your third-party designee and their phone number.

Adding a third-party designee gives them the ability to give missing 944 information to the IRS, call the IRS to find out about processing Form 944, and respond to IRS notices about math errors.

Check “Yes” to add a third-party designee or “No” if you don’t want anyone else to discuss the return with the IRS.

Part 5: Signature

And finally, we’ve come to the last part of learning how to fill out Form 944—the signature. Keep in mind that only certain people can sign Form 944.

The following people can sign Form 944 for each business structure:

- Sole proprietorship: Owner

- Corporation: President, vice president, or another principal officer

- Partnership: Responsible and duly authorized partner, member, or another officer

- Disregarded entity: Owner or a principal officer

- Trust or estate: Fiduciary

Authorized signers must sign in the box next to “Sign your name here,” print their name and title, add a date, and include a phone number.

If you hire a paid preparer to fill out Form 944, they must fill out the “Paid Preparer Use Only” section and include information like their name, address, and EIN.

4. Submit Form 944 by the 2024 deadline

Form 944 is due by January 31 each year. However, the IRS may give you until February 12, 2024 if you made on-time tax deposits.

The IRS encourages businesses to file Form 944 electronically. But, you can choose to mail a paper return instead. Where you send Form 944 depends on your state and whether you’re making a deposit with your form. You can view mailing addresses on the IRS website.

Check out the IRS Form 944 Instructions for more information on completing and filing the employer return.

How to fill out 944 form accurately: Tips

The IRS provides several tips to help employers make accurate entries on Form 944:

- Use 12-point Courier font if typing

- Do not enter dollar signs and decimal points

- Enter dollars to the left of preprinted decimal points and cents to the right of them

- Don’t round entries to whole dollars

- Leave boxes blank if they have a value of zero (except line 9)

- Enter negative amounts with a minus sign

- Add your name and EIN on each page

- If filing paper forms, staple sheets in the upper left corner

- Complete all three pages of Form 944

How Patriot Software handles Form 944

Patriot Software offers both Basic and Full Service Payroll to streamline payroll.

Patriot’s Basic Payroll software customers will be able to fill out form 944 with information found in payroll reports in the software.

Full Service Payroll customers will have Form 944 that Patriot will file with the IRS on the customer’s behalf. Full Service Payroll customers can view Form 944 in their company tax packets.

This article has been updated from its original publication date of March 15, 2023.

This is not intended as legal advice; for more information, please click here.