Are you an Illinois employer? Do you provide paid time off (PTO) to your employees? Providing paid time off is no longer a choice—it’s a state mandate. In March 2023, Illinois Governor JB Pritzker signed SB208 into law, requiring Illinois paid leave.

Known as The Paid Leave for All Workers Act, the law makes Illinois the first Midwest state to mandate PTO. Here’s what you need to know.

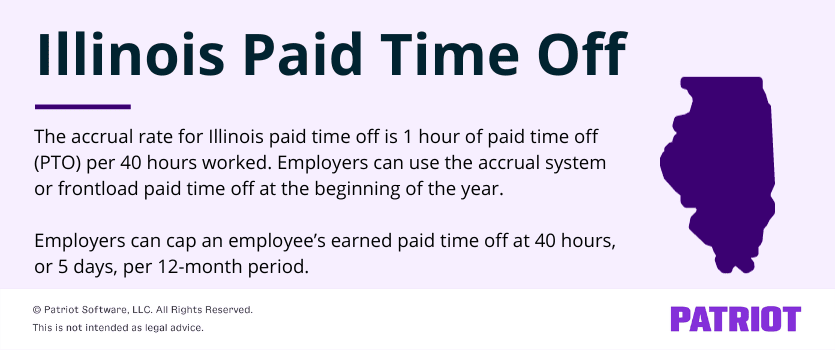

| Illinois Paid Time Off Summary |

|---|

| All Illinois employers must offer employees 40 hours of paid time off per 12-month period. Employers can front-load this paid leave at the beginning of the year, or employees can immediately begin accruing leave at a rate of one hour per 40 hours worked. |

Illinois paid leave: What to know

A handful of states that require employers to offer paid sick leave to employees. But Illinois is only the third state, behind Maine and Nevada, to require that employers give employees paid time off for any reason.

Under The Paid Leave for All Workers Act, employers must pay employees their full wages while on leave. Tipped employees are entitled to their locality’s minimum wage.

Providing employees with paid leave has several benefits—for both employers and employees. According to Illinois Governor JB Pritzker:

Employers benefit from allowing employees to tend to the urgent personal matters of their lives. Workers’ productivity increases, and they often gain greater passion for their job when they can manage the stresses they face outside work.”

Understand the key parts of the law, including the accrual rate and carryover requirements, to stay compliant.

What’s the accrual rate?

The Illinois paid leave accrual rate is one hour per 40 hours worked. A full-time employee who works 40 hours per week would accrue one hour per week.

Employers can cap an employee’s earned paid time off at 40 hours per 12-month period, or five days.

You do not have to use the accrual method. You can choose to frontload hours for employees instead. If you frontload hours, provide each employee with 40 hours of paid time off at the beginning of the year.

Do the Illinois PTO laws apply to all employers?

The Illinois paid time off laws apply to all employees working for an Illinois employer.

However, The Paid Leave for All Workers Act does exclude:

- Independent contractors

- Exempt employees covered by a collective bargaining agreement in construction and parcel delivery industries

Employers subject to the City of Chicago and Cook County paid sick leave ordinances must follow local laws instead of state law.

Employers who already have a policy that provides at least 40 hours of paid time off in a 12-month period do not need to make changes.

When can employees accrue and take leave?

Employees accrue paid time off immediately when they begin employment.

Employees can take earned time off 90 days following the start of their employment.

What are the qualifying reasons for paid time off?

Employees can take paid time off for any reason, which may include:

- Sick leave

- Vacation

- Childcare

- Mental health reasons

- Medical appointments

Employees do not need to provide documentation backing up why they took their earned time off.

However, employers can establish a paid time off policy that sets rules for leave (e.g., advance notice requirements for vacation). You must communicate your policy to employees ahead of time. The Illinois Department of Labor will provide more information on this in the future.

Can employees carry over unused leave?

Carryover rules depend on whether you frontload time or use the accrual method.

Employers who frontload hours at the beginning of the year can require that employees use it or lose it before the next 12-month period.

If you use an accrual system, you must let employees carry over up to 40 hours to the next 12-month period.

Do you have to include Illinois paid time balance on pay stubs?

Some states require that employers display paid leave information on employee pay stubs. For example, California requires employers to show the number of sick leave days available to the employee on a pay stub or accompanying document.

Illinois requires that employers provide each employee with an itemized statement of deductions for each pay period (i.e., a pay stub). However, employers do not need to put employees’ paid leave balances on pay stubs.

Employers must maintain records and provide paid leave balance information to employees who request it.

What do employers need to do?

Employers must comply with the Illinois PTO laws. To do so, you must:

- Adopt a paid time off policy: If you already have a paid time off policy that meets The Paid Leave for All Workers Act’s requirements, you do not need to modify your policy. Otherwise, create a PTO policy that complies with the state mandate.

- Notify employees: Make sure employees know about the paid time off law and their rights. Add your PTO policy to your employee handbook and hang all required labor law posters.

- Track Illinois paid leave: Track each employee’s earned and used paid time off, along with the current balance. Illinois requires that employers track paid time off for any reason.

You can use payroll software to set up accrual rules, track paid leave balances, and pay employees for time off.

Illinois paid time off: Quick facts

If you’re an Illinois employer, you should know the following key facts about The Paid Leave for All Workers Act:

- All Illinois employers must provide paid leave

- Employers must provide one hour of paid leave for every 40 hours worked

- Employers can cap paid leave at 40 hours per 12-month period

- Employees can use paid time off for any reason

- You can use payroll software to track and manage employees’ earned and used time off

For more information on Illinois paid time off, check out the FAQ page on Illinois’ website.

This article has been updated from its original publication date of October 23, 2023.

This is not intended as legal advice; for more information, please click here.