When payday rolls around, employees receive their wages for hours worked. They may also receive a digital or paper pay stub, which breaks down their earnings and payroll deductions. As an employer, you must know how to generate pay stubs.

Pay stubs are essential documents for both employers and employees. Employers keep pay stubs as a record of employee pay. Employees may use pay stubs as proof of income when applying for houses, apartments, cars, etc.

Find out when employers have to create pay stubs, how to generate pay stubs in seconds, and more.

Skip Ahead

- What is a pay stub?

- What information do I need to generate a pay stub?

- Do employers need to provide pay stubs?

- How do employees use pay stubs?

- How to generate pay stubs

- How to create a pay stub with payroll software

What is a pay stub?

A pay stub is a document that breaks down an employee’s gross pay, tax and deduction information, and net pay during a pay period. Employees can keep pay stubs as records of their earnings throughout the year.

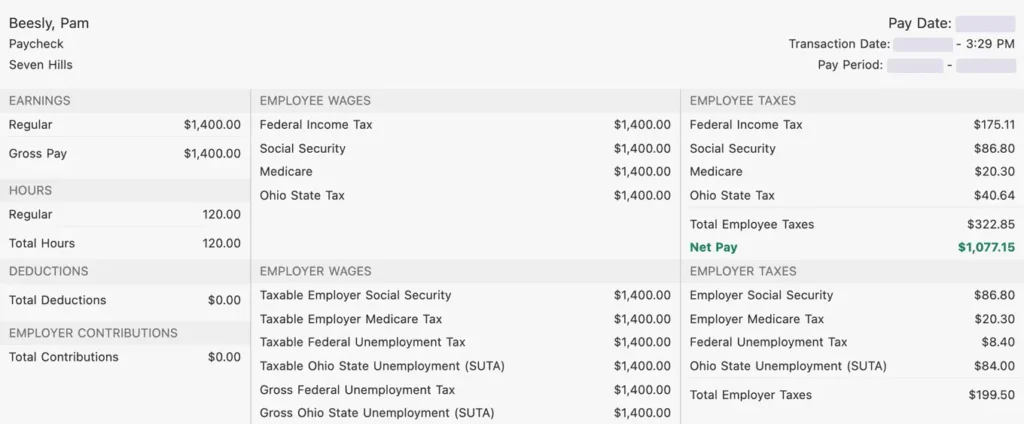

Here is an example pay stub:

What information do I need to generate a pay stub?

There are several pieces of information you need to create an accurate pay stub, including each employee’s:

- General information: Pay stubs include the employee name, pay date, and the start and end dates in the pay period

- Gross wages: The employee’s earnings before taxes and deductions

- Taxes: The federal, state, and local taxes your employee’s wages are subject to (employer and employee taxes)

- Deductions: What you withhold from employee pay for health insurance premiums, 401(k) contributions, etc.

- Employer contributions: What you contributed, such as health insurance premiums and a 401(k) company match

- Net pay: The employee’s take-home pay (aka the total amount of the paycheck or direct deposit)

You must run payroll to get your employees’ gross pay, taxes and deductions, and net pay.

The employee pay stub should also included detailed information about pay, such as overtime pay, bonus pay, pay advances, paid time off (PTO), etc.

Do employers need to provide pay stubs?

Employers do not need to provide pay stubs under federal law. However, many states require that employers give employees pay stubs.

Are pay stubs required by federal law?

No. The federal Fair Labor Standards Act (FLSA) does not require an employer to provide pay stubs.

However, the FLSA does require that employers keep accurate records of hours worked and wages paid to employees.

Are pay stubs required by state law?

Yes—depending on your state.

Most states require that employers give employees pay stubs. Most states also have rules about the information on the pay stub, such as earned and used state-mandated paid sick leave.

Keep in mind that some states don’t allow electronic stubs or require that employees first consent to receive electronic stubs.

Are there penalties for employers who fail to provide compliant pay stubs to their employees? Yes. Failing to follow your state’s employee pay stub requirements can lead to hefty penalties and even lawsuits. Consult your state for more information.

How do employees use pay stubs?

Employees use pay stubs as a record of their earnings, taxes and deductions, and take-home pay. Employees can reference their pay stubs if they have questions or concerns about their paychecks.

Pay stubs are also important tools for employees who are applying for a home loan, apartment lease, or a new car. Employees may need two to three pay stubs as proof of income during employment verification.

How to generate pay stubs

Creating pay stubs can be a tedious process, or it can take a matter of seconds depending on what system you use.

You can generate pay stubs:

- By hand

- With online pay stub generators

- With payroll software (*Winner!)

Creating pay stubs by hand is the most time-consuming option. You can use a tool (e.g., a Word document) to format the pay stub. You also need to enter the information, which can leave room for errors.

An online pay stub generator is generally a faster process than creating pay stubs by hand. First, find a reputable and reliable tool. Next, you’ll need to enter information about your business and each employee. You must also enter each employee’s pay, tax, and deduction information. Entering employee information into a pay stub generator can be tedious and leave room for data entry errors.

You can use payroll software to run payroll and automatically generate pay stubs. You can print pay stubs immediately to distribute or give employees the ability to view and print their pay stubs online through a secure employee portal. Of course, pay stubs include sensitive and confidential employee information. Reputable payroll systems, like Patriot Software, take data security seriously, ensuring your pay stub and payroll information are secure.

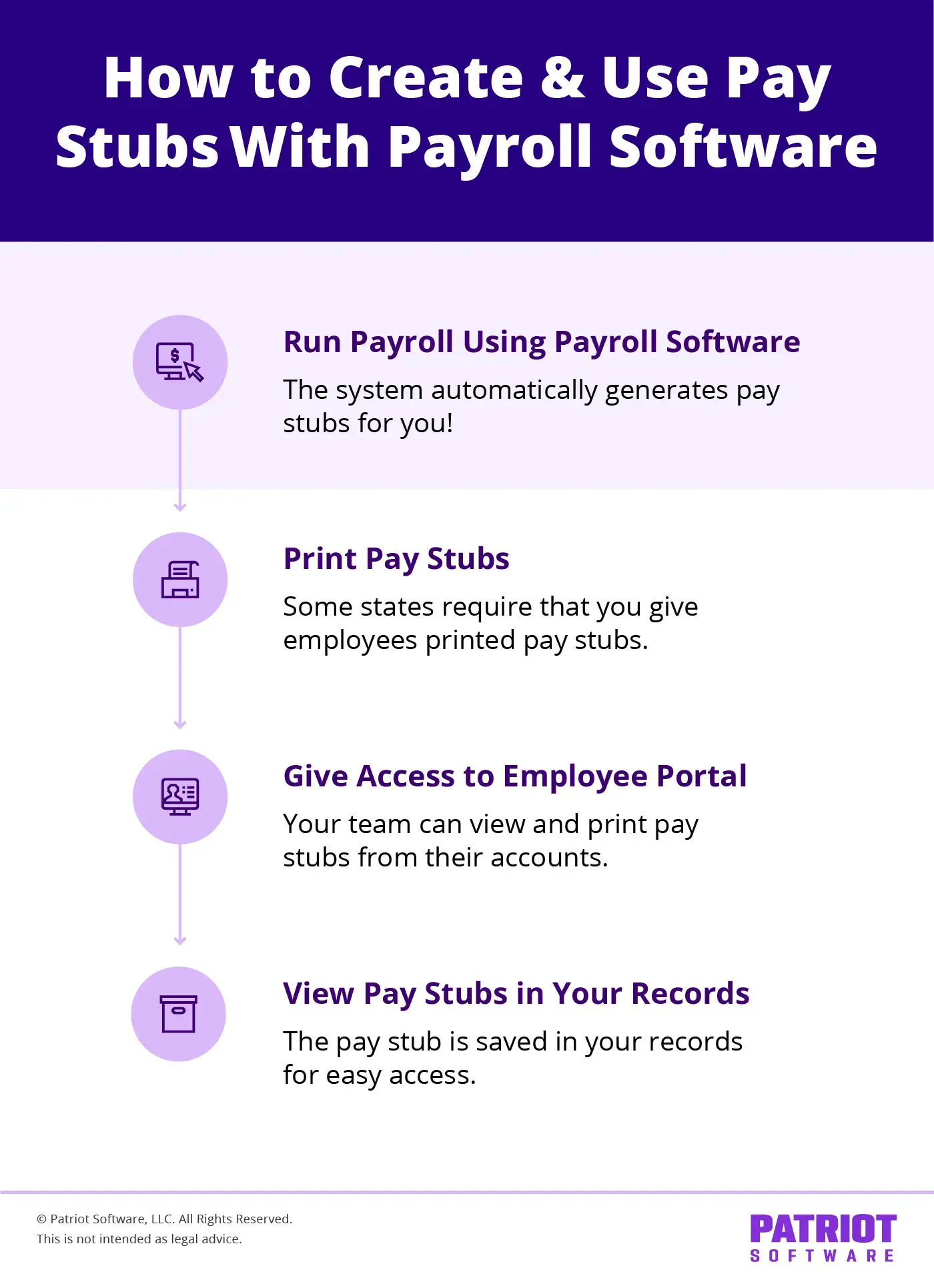

How to create a pay stub with payroll software

You can create a pay stub with payroll software each time you run payroll for employees.

You and employees (who have access to an employee portal) can also view and print past pay stubs in the software.

Here are some steps on how to make pay stubs for employees with payroll software.

1. Run payroll

First, run payroll for your employees.

The payroll software calculates the employee’s total gross pay, subtracts taxes and other deductions (e.g., health insurance), and calculates the employee’s net pay.

When you run payroll, the system automatically generates pay stubs for each employee.

2. Print pay stubs

After you run payroll, you should have the ability to easily print pay stubs.

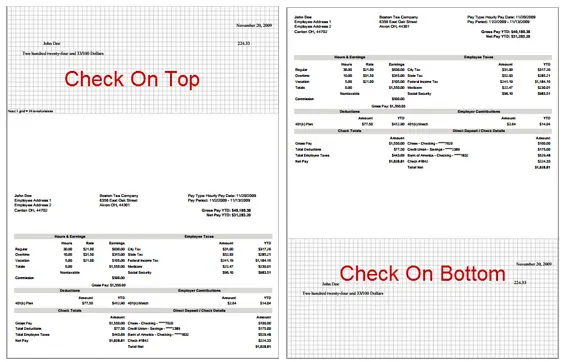

If you pay employees by paycheck, the pay stub comes attached. Follow your system’s instructions on paycheck formatting.

Here is an example of how the check and pay stub may print:

3. Give employees access to an employee portal

Some payroll systems offer a free employee portal. An employee self-service portal lets employees view important information, including their digital pay stubs.

If your employees have access to their employee portal, they can view their paycheck details as soon as you run payroll.

Employees can also conveniently print their pay stubs from their portal. Let’s say an employee is hurrying to gather their pay stubs over the weekend so they can buy their dream home. They can simply log in to their employee portal, print the pay stubs, and submit them to the lender.

4. View pay stubs in your records

Another perk of using payroll software to generate pay stubs is that the documents are saved in your software and accessible down the road.

Payroll software has easy-to-read payroll reports you can use to access payroll details. For example, you can view individual paycheck details in Patriot Software’s Individual Paycheck History report. You can also view all the payroll you have run for all employees with Patriot’s Payroll Register report.

Is there software that can help with generating pay stubs?

Yes! You can use online pay stub generators or payroll software instead of creating pay stubs from scratch.

An online pay stub generator and pay stub template can create professional-looking stubs. However, you must manually enter all of your employees’ personal, wage, and tax-related information, which can lead to mistakes. Year-to-date employee information, which some states require, is not available in an online pay stub generator.

Payroll software is a fast and secure way to generate pay stubs. Simply run payroll, and the system automatically creates the pay stub for you to print immediately. You may also be able to give employees access to an employee portal where they can view pay stubs online and print copies. And, you can easily access year-to-date information in your software account.

What is the app that makes pay stubs?

Several apps can create professional pay stubs for employees. Again, you can choose between pay stub generators, pay stub templates, and payroll software to generate pay stubs.

Research different systems on the market to decide what is best for your business. Many business owners use payroll software to streamline not just the pay stub creation process but the entire payroll process.

When researching how to create a pay stub, look for:

- Features

- User reviews

- Security

- Ease of use

Payroll software may also include a free employee portal that lets employees easily access their pay stubs.

Can pay stubs be digital?

The majority of employees receive their wages electronically via direct deposit. Many employers also give employees access to digital pay stubs.

Although check stubs can be digital, some states do not allow electronic stubs only or require that employers first get their employees’ consent.

What are the steps involved in printing pay stubs from a computer?

Printing professional pay stubs from a computer is typically an easy process.

After you generate the check stub, there should be an option to view or print the stub in the system you’re using.

Employees with access to an employee portal can log in, go to their pay stubs, and print.

Generate pay stubs with Patriot’s payroll software

Patriot’s online payroll streamlines the entire process of running payroll so you can:

- Run payroll in three easy steps

- Automatically generate pay stubs based on employee payroll

- Pay employees with paychecks or free direct deposit

- Easily print paychecks and check stubs

- Automatically posts digital pay stub in employee portal

Learn more about Patriot’s top-rated payroll software when you sign up for a no-obligation demo or free trial today!

This article has been updated from its original publication date of March 15, 2024.

This is not intended as legal advice; for more information, please click here.