In 2023, the median pay for accountants and auditors was $79,880 annually. But the highest 10% of accountants earn over $137,280. And if you’re like most hard-working accounting professionals, you may wonder how to make more money as an accountant.

To make more money, you need to amp up your income. And as we all know, that’s easier said than done. So, read on for five actionable tips on how to increase your income—and make more money as an accountant.

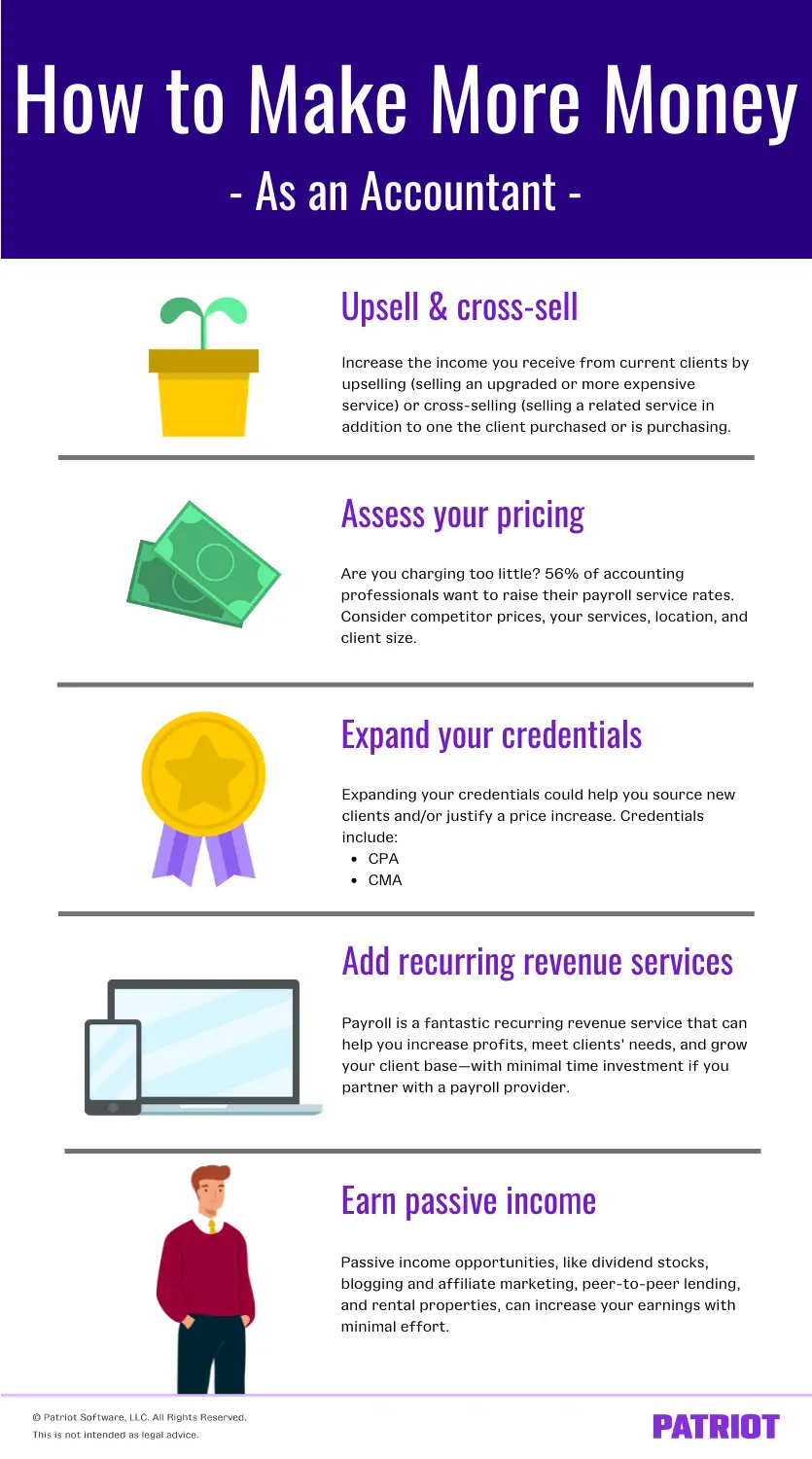

5 Tips on how to make more money as an accountant

Who doesn’t want to learn the secret of how to make the most money as an accountant? It’s the million-dollar question, after all. But, there are several factors outside of your control that limit your earning potential, like location and years of experience.

That’s why it’s important to work on the things you can control, like:

- Upselling and cross-selling to existing clients

- Assessing your pricing

- Expanding your credentials

- Adding recurring revenue services

- Earning passive income for accountants

1. Upsell and cross-sell to existing clients

Sourcing new clients is a great way to increase your firm’s revenue. But, you can’t forget about your existing client base’s potential.

You can increase the income you receive from current clients by upselling and cross-selling. Here’s a quick review of the difference between upselling and cross-selling:

- Upsell: Selling an upgraded or more expensive service to a client (e.g., selling full-service payroll services to clients interested in payroll services).

- Cross-sell: Selling a related service to a customer in addition to the one the customer already purchased or is purchasing (e.g., selling bookkeeping services to a client purchasing tax planning and consulting services).

According to one survey, 72% of salespeople who upsell and 74% who cross-sell say it drives up to 30% of their revenue. If you don’t already, upsell and cross-sell services to clients to increase your revenue.

2. Assess your pricing

Think you’re charging too little for your services? One survey found that 56% of accounting professionals want to raise their payroll service rates.

If you want to increase your revenue, you may need to assess your pricing. Of course, you don’t want to raise your prices just to be greedy—you could wind up losing clients. But, a price raise may keep you competitive and help you stay on top of rising costs.

When assessing your pricing, consider your competitors’ pricing, your services, your firm location, and your clients’ sizes.

3. Expand your credentials

How can accountants make more money? You can expand your credentials. Expanding your credentials could help you source new clients and/or justify a price increase.

Credentials that could help you make more money as an accountant include:

- Certified public accountant (CPA)

- Certified management accountant (CMA)

- Master’s degree (e.g., Master of Science in Accounting)

- Certified fraud examiner (CFE)

- Certified financial analyst (CFA)

Expanding your credentials takes time. But, doing so can help you increase credibility, stand out from the competition, and ultimately make more money.

4. Add recurring revenue services

Want to know how to make six figures as an accountant? Of course you do! One way to drive up your earnings is to offer services that allow for a recurring revenue stream—like payroll.

Offering payroll services helps you:

- Increase profits

- Meet clients’ needs (e.g., you can upsell and cross-sell payroll services!)

- Grow your client base

If you’re worried payroll will soak up your time, here’s the good news: It won’t, thanks to cloud payroll.

Cloud payroll software automatically updates as tax rates and laws change. That way, you won’t have to worry about keeping track of changes, especially if you have clients with employees in multiple states and cities. And if you opt for a full-service payroll option, the provider handles payroll tax deposits and filings on your clients’ behalf. So, you can sit back and watch the recurring revenues stream in—while reserving your time for the other accounting services you offer.

To make more money as an accountant by offering payroll, you can:

- Partner with a payroll software provider (some, like Patriot Software, offer special pricing)

- Set up payroll for your accounting clients

- Run payroll using the payroll software, or give your client the control to run payroll

- Invoice your clients according to your practice fees

5. Earn passive income for accountants

If you’re interested in going beyond your typical accounting services to increase earnings, you may look into passive income. Passive income requires minimal labor. It helps you increase your earnings from an activity you’re not actively involved in.

Examples of passive income opportunities include:

- Dividend stocks

- Blogging and learning how to do affiliate marketing

- Peer-to-peer lending

- Rental properties

You can also make more money as an accountant through side jobs like freelance accounting or tutoring students interested in accounting.

The real secret to making more money as an accountant? Finding the right software provider to partner with. Join Patriot Software’s Partner Program and get discounted pricing on our award-winning payroll software for accountants, free USA-based support, and more. Schedule a call with us to get started!

This article has been updated from its original publication date of December 2, 2022.

This is not intended as legal advice; for more information, please click here.