Over time, your small business gains assets when you purchase items that bring value to your company. These assets are an essential part of your business that can help generate revenue and increase your business’s value. So, what are assets?

What are assets?

Your business’s assets are items or resources of value, such as property, inventory, trademarks, or patents, that your business owns. Business owners can opt to convert assets to cash. Many business assets generate revenue and benefit the owner in the long-run.

A business balance sheet lists your assets and shows a snapshot of how you manage assets. Carefully track assets in your accounting records to ensure your books are accurate. You can record asset information manually or by using accounting software.

There are different types of assets in accounting. You can classify assets as:

- Tangible

- Intangible

- Current

- Fixed

Tangible vs. intangible assets

You can break down assets into tangible vs. intangible properties. Both types add value to your business.

Tangible assets

Tangible assets are physical items that add value to your company. Some examples of tangible assets include:

- Cash

- Equipment

- Land

- Inventory

- Bonds

- Stocks

Tangible assets depreciate over time. When you depreciate an asset, you spread its cost over a certain number of years.

Tangible assets can also be broken down further into two other categories: current and fixed assets. You’ll learn more about current assets vs. fixed assets later.

Intangible assets

Intangible assets are the opposite of tangible assets. Non-physical items that add value to your business are intangible assets. Unlike tangible assets, you cannot easily convert intangible assets into cash.

You can amortize intangible assets. The amortization of assets is when you distribute the cost of an intangible asset over time.

It can be difficult to determine the cost of an intangible asset because they are not physical property or items.

Intangible items include things like:

- Logos

- Patents

- Trademarks

- Copyrights

- Customer lists

- Business licenses

Current vs. fixed assets

There are a few differences between current vs. fixed assets.

Current assets

Current assets are items of value your business plans to use or convert to cash within one year. Most businesses use current assets in their day-to-day business operations. Current assets are also considered short-term investments because you can convert or use them within one year.

Some of your current assets may also be liquid assets. Liquid assets are assets you can quickly turn into cash, like stocks. You can convert assets in a short period of time, such as one month or 60 days.

Types of current assets may include things like cash, accounts receivable, inventory, and prepaid expenses.

Fixed assets

A fixed asset, or noncurrent asset, is a long-term asset that continually brings value to your business after one year. You can’t convert fixed assets into cash within one year. As you grow your business, fixed assets help bring long-term value to your company.

Because fixed assets are considered long-term assets, they typically depreciate in value over time. For example, the cost of a fixed asset, like property, is spread out over time versus only one year.

Fixed assets can be tangible or intangible. Some examples of fixed assets include cars, land, buildings, and machinery.

Determining the value of your assets

The value of an asset is not always the original cost. When determining an asset’s value, look at factors like fair market value and depreciation.

Fair market value is how much your asset would sell for in the current market. Your fair market value can be higher, lower, or equal to its original purchase price. To find the price of an asset, conduct a fair market value analysis. Gather asset information and compare your asset to other assets on the market. Consider consulting a professional, such as an accountant, to evaluate your assets.

As mentioned, depreciation is the process of spreading an asset’s cost over a longer period of time. To determine your asset’s value, calculate depreciation expense.

Recording your assets in accounting

Assets help show you the financial status of your small business. The more frequently you update your balance sheet, the more accurate your accounting books will be.

While reporting your assets on your business’s balance sheet, you must record them in descending order, based on their level of liquidity.

The more liquid an asset, the less time it takes to convert it into cash. List your most liquid assets first. Always list your cash first since you don’t need to convert it

Record both current and fixed assets on your balance sheet. Because current assets are more liquid, list them higher up on your balance sheet. Fixed assets are less liquid, meaning you list them further down on your balance sheet.

Here’s a breakdown of the order your assets should be in on your balance sheet:

- Cash (under current assets)

- Current assets (short-term and more liquid)

- Fixed assets (long-term and less liquid)

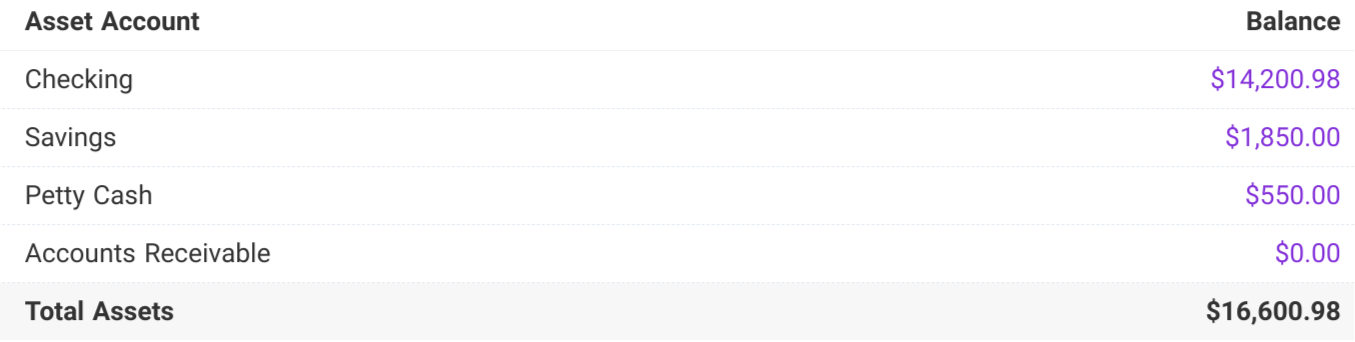

Example of assets on a balance sheet

Again, recording assets on your balance sheet is essential. You can use assets to determine how healthy your business’s financials are.

Take a look at an example of recording assets on a balance sheet:

Need a way to record your business’s assets and transactions? Patriot’s online accounting software lets you easily track your income and expenses. And, we offer free, USA-based support. What are you waiting for? Get started with a free trial today!

This article has been updated from its original publication date of August 2, 2013.

This is not intended as legal advice; for more information, please click here.