As a business owner, your goal is to make a profit. Generally, you may turn toward your accounting profit to see how your company is doing. You also need to consider other types of profit, such as economic profit. But, what’s the difference between accounting profit vs. economic profit? Keep reading to get the scoop.

Accounting profit vs. economic profit

Again, profits are an important part of being a business owner. After all, without them, you wouldn’t be in business. So, what is the difference between accounting profit and economic profit? To start off, let’s take a look at a couple of definitions.

What is accounting profit?

You can find your accounting profit on your business’s income statement. Accounting profit, also known as net income or your bottom line, can be found by subtracting your expenses and costs of goods sold from your revenue. Accounting profit is the amount left over after you deduct the explicit costs of your running business (which we’ll get more into later). And, it is specified by the generally accepted accounting principles (GAAP).

Costs generally include:

- Labor

- Inventory

- Raw materials

- Rent

- Interest

- Taxes

- Transportation

- Sales and marketing

- Production costs

- Overhead

- Depreciation and amortization

You report your accounting profit to the IRS and analyze it to see how your business is doing financially.

What is economic profit?

Economic profit is a little trickier than accounting profit. With economic profit, you look at revenue, explicit costs, and implicit costs. Unlike accounting profit, economic profit includes the opportunity costs for taking one course of action versus another. Your economic profit can vary depending on economic principles and opportunities.

Knowing how to find economic profit can help determine whether to enter or exit a market. It can also tell you how efficient your company is in resource allocations.

Economic and accounting profit differences

By now, you’ve probably noticed a few key differences between economic profit versus accounting profit. Let’s recap those differences, and go over a few others, shall we?

Economic and accounting profit differ when it comes to:

- Implicit vs. explicit costs

- Reporting profits to the IRS

- Accounting

- Uses

1. Implicit vs. explicit costs

Remember those implicit and explicit costs we mentioned earlier? Yep, those make a difference when it comes to economic vs. accounting profit.

Again, both accounting and economic profit factor in explicit costs. However, only economic profit looks at implicit costs.

So, what exactly are these types of costs? Let’s take a look:

- Explicit costs: Actual costs of the business that are direct payments made to others, such as wages, material costs, rent, or costs of goods sold.

- Implicit costs: The opportunity cost equal to what a business must give up to use factors that it doesn’t purchase. Implicit costs are the costs associated if you would do something, like make an investment or take a job. Here are some additional examples:

- Annual cash flow from stocks if you sold your business

- Payments you would earn from a rented property

Basically, implicit costs are the opportunity costs of factors of production that a business already owns. And, implicit costs are what the company would give up to use its resources (e.g., using an asset instead of renting it).

2. Reporting profits to the IRS

When it comes to accounting profit vs. economic profit, you only have to report accounting profit to the IRS. Do not report economic profit to the IRS or any other government agency. Only use economic profit internally to determine if you are making smart investments.

3. Accounting

You cannot bookkeep for implicit costs because there are no transactions you can enter for making a business decision. Therefore, you cannot account for economic profit. However, you can account for accounting profit by looking at revenue and explicit costs (e.g., expenses and COGS).

Because it’s subjective, analyze economic profit separately from your books. Again, do not record anything in your books for economic profit.

4. Uses

You can use accounting profit to look at your business’s financial performance and see how profitable your business is.

On the other hand, you can use economic profit to determine investments and decide when to enter or exit a market.

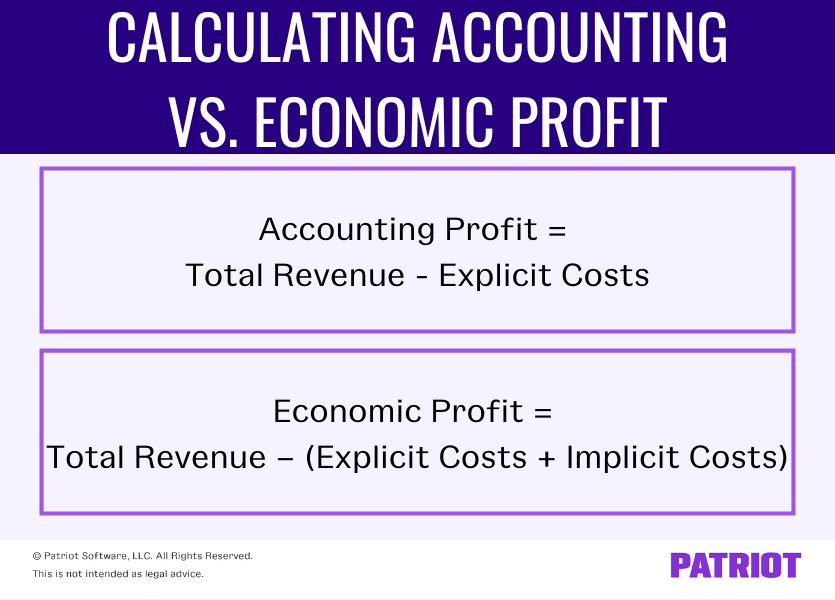

Calculating accounting vs. economic profit

Calculating accounting profit is a little more straightforward than computing economic profit. Check out how to calculate accounting profit and how to calculate economic profit below.

Accounting profit formula

To calculate accounting profit, you need to know:

- Total revenue

- Explicit costs

Use the following formula to calculate accounting profit for your company:

Accounting Profit = Total Revenue – Explicit Costs

Find totals using your profit and loss statement. Then, plug your revenue and costs into the above formula to find your accounting profit.

Economic profit formula

To calculate economic profit, you need to know:

- Total revenue

- Explicit costs

- Implicit costs

Use the following formula to calculate economic profit:

Economic Profit = Total Revenue – (Explicit Costs + Implicit Costs)

You can also find economic profit simply by subtracting explicit and implicit costs from your total revenue:

Economic Profit = Total Revenue – Explicit Costs – Implicit Costs

Like with accounting profit, you can also find totals by looking at your income statement.

Economic profit vs. accounting profit example

Check out a couple of examples of how accounting and economic profit work in the real world.

Accounting profit example

Say you were looking at your income statement. On it, you notice you have $40,000 in revenue, $9,000 in total expenses, and $6,000 in costs of goods sold.You deduct $15,000 ($9,000 + $6,000) from $40,000 to get your net income, or your accounting profit. Your accounting profit for the period is $25,000.

Economic profit example

Say you have $60,000 in revenue for the accounting period. You also have $13,000 in explicit costs and figure you have $8,000 in implicit costs (or opportunity costs). Plug your amounts into the economic profit formula:

Economic Profit = Total Revenue – (Explicit Costs + Implicit Costs)

Economic Profit = $60,000 – ($13,000 + $8,000)

Your economic profit would be $39,000.

This is not intended as legal advice; for more information, please click here.