“Do you have a permit for that?” If you want to operate your small company legally, you likely need some business licenses and permits. There are federal, state, and local licenses and permits you might have to apply for. It all depends on your business.

So, do you know which types of business licenses and permits you need to keep things legal? Read on to learn more about your responsibilities.

What are business licenses and permits?

Licenses and permits allow a business to operate in their locality or perform specific functions (e.g., license to collect sales tax). You must apply for and obtain the required licenses and permits before you can do the things they let you do. Without a necessary small business license, you could face consequences.

You may need to get several licenses before providing goods and services.

The licenses and permits you need depend on a number of factors, such as what you do and where your business is located. To stay compliant, check with your state and locality for specific permissions your business needs.

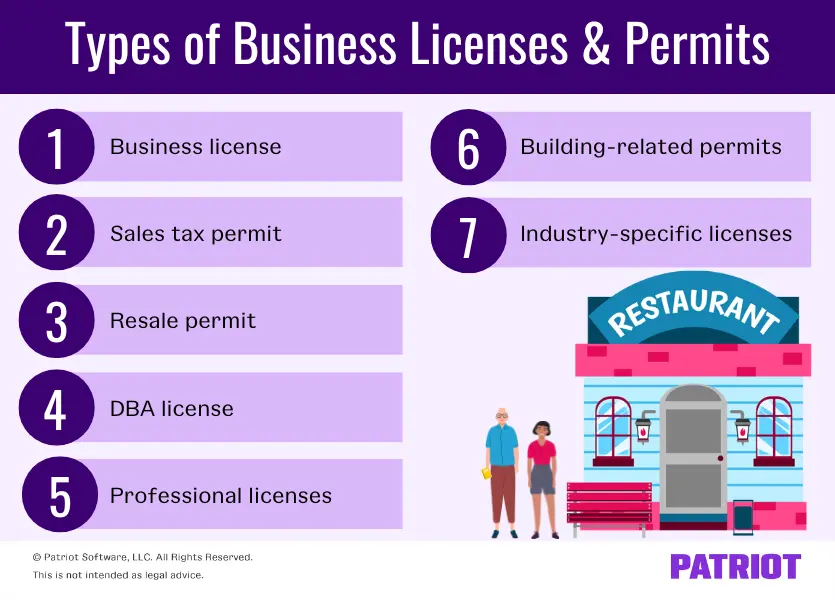

Types of business licenses and permits

What do you need a business license for? Most businesses need to apply for a general business license to operate. You may be able to apply for a general license when you form your business structure and register with the state. Depending on your state or locality’s requirements, you may also need to apply for a business license with your locality.

You should familiarize yourself with common types of licenses and permits so you have an idea of what you’ll need to operate. Keep in mind that this is not an all-inclusive list.

Business license

All businesses should have a general business license to operate. You may need to apply for this with your locality if you didn’t register with your state to form your business structure.

A business that registers with their state (e.g., LLC) might not need to apply for a business license with their locality. Check with your city or county for more information.

Sales tax permit

Most businesses need to obtain a sales tax permit before they can sell products and collect sales tax from customers.

If you are required to collect sales tax, you need a permit. You must collect sales tax if you have nexus (a presence) in a state with sales tax laws that apply to your offerings.

Some states charge businesses a fee to apply for sales tax. Although most states require you to apply for a permit online through your state’s government website, some have a mail-in option.

Resale permit

Depending on your business, you might—in addition to a sales tax permit—need to get a resale permit.

Businesses with resale certificates are not required to pay sales tax when they purchase goods that are part of the products they sell.

Resellers, retailers, and businesses with tax-exempt status might consider applying for this type of permit.

DBA license

If you want to operate your business under a different name than your company’s legal name, you need to apply for a doing business as (DBA) license.

To obtain a DBA license, apply with your state and pay a registration fee. And, depending on your business location, you might also need to publish a notice about your doing business as name in the local newspaper.

Professional licenses

Sometimes, required business licenses apply to workers. Depending on your industry, you and your employees may need to have professional licenses before you can work for your business.

Here are a few examples of professionals who need licenses:

- Doctors, nurses, and other medical professionals

- Lawyers

- Nail technicians

- Cosmetologists

- Engineers

- Certified Public Accountants (CPAs)

Building-related permits

Your locality may require you to obtain building and/or zoning permits if you plan on building or making changes to a building. If you run your business out of your home, you may also need zoning permits.

You might also need to get a sign permit before putting up a business sign.

Industry-specific licenses

Depending on your industry, you may need additional licenses or permits to operate. Here are just a few of the special licenses and permits you may need:

- Liquor license

- Health permit

- Firearms license

- Tobacco license

- Fire department permit

How much is a business license?

You might be curious about business licenses and permit fees. Do you have to pay for each license and permit? How much do they cost? Not all licenses come with fees.

The cost of a business license depends on several factors, including:

- License type

- Business location

- Additional fees

A business license can cost anywhere from tens of dollars to hundreds of dollars. Not to mention, you may need to pay additional fees for processing or annual renewals.

Like anything in business, research learn the costs of obtaining a business license before diving into applications. That way, you know how much to allocate for your business license application(s) and can build any recurring fees into your budget.

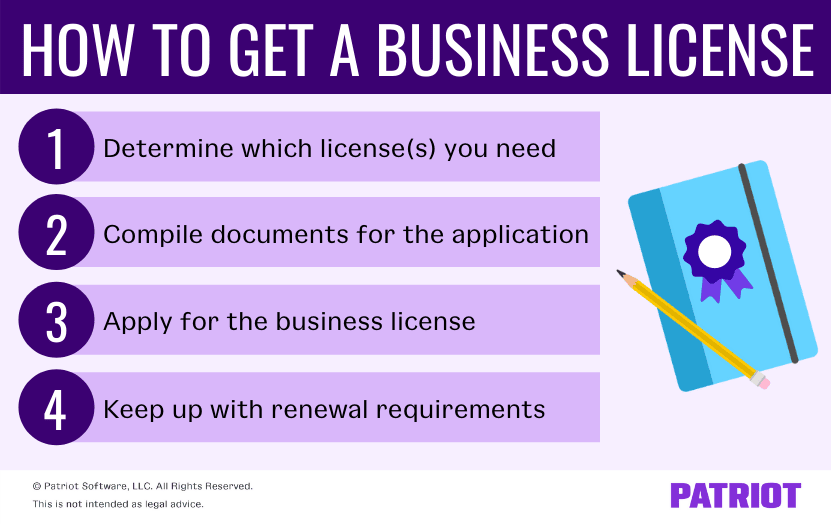

How to get a business license

The steps you need to follow to obtain a business license depend on if you’re applying for a federal, state, or local license. For example, if you need a state business license, you would apply through your state.

However, there are some general steps you need to take to obtain a business license.

Before applying for licenses, form your business entity (e.g., corporation, sole proprietorship, S Corp, etc.) and apply for an employer identification number (EIN). That way, you can get your general business license and have everything you need to begin applying for additional licenses.

After you choose your business structure and apply for an EIN, you can follow these four steps to apply for a business license. Again, keep in mind that steps may vary depending on which license you’re applying for.

1. Determine which license(s) you need

Research which licenses you need to operate. The type of business licenses can vary depending on the type of business you’re running.

You can find out which licenses and permits you need by:

- Contacting your state’s Secretary of State office, Department of Revenue, or similar agency

- Looking at available resources through your local SBA office or visit the Small Business Administration’s website

- Working with a business lawyer or another professional

Whatever you do, don’t go into applying blindly. The last thing you want to do is apply for business licenses you don’t need or fail to obtain the licenses you do need.

2. Compile documents for the application

When you apply for a license, you typically need to provide a variety of documents and information for your application.

Many applications ask for:

- A description of the business and its planned activities

- EIN

- Business location

- Copies of business records (e.g., articles of incorporation)

- Proof of state or local tax status (e.g., sales tax permit)

- Lists of owners and managers

Many applications may also require a filing fee to submit your application. Before applying, make sure you have all of your documents in order and payment for a filing fee handy (if applicable).

3. Apply for the license

Keep in mind that each application is different, so follow the instructions to a T and take your time. Depending on the application, you may be able to submit the application online. Some applications may require you to mail in or fax the paperwork or fill out the application in person.

Once you apply for the license, you need to wait for approval. In some cases, you may need to provide additional documents after submitting the application.

4. Keep up with license renewal requirements

After you’re approved and receive your business license, your job doesn’t stop there. Depending on the license, you may need to renew the license regularly (e.g., every two years).

Read the fine print and make note of which licenses you need to renew and how frequently you must renew them. Mark your calendar or set a reminder to avoid accidentally letting your license expire. If your license expires, you’ll have to renew it according to the regulations.

How long does it take to get a business license?

The length of time it takes to get a business license varies. Many licenses can take anywhere from a few days to a few weeks.

Consider applying online (if possible) to help expedite the application process and potentially receive your business license sooner. Online applications are quicker (and generally easier) than mailing a paper application or filling one out in person.

Another way to ensure your license is in your hands sooner is to follow all directions and submit all necessary paperwork. Forgetting to follow a step in the application process, making an error, or forgetting to include a document can prolong the process.

Business license requirements by state [Chart]

Ready to apply for a business license? To get the ball rolling, check out your state’s business licensing requirements and steps to apply below.

Do you have your business licenses and permits? Great! Once you’re open for business, don’t forget to manage your accounting books. Use Patriot’s online accounting software to track your expenses and income. Start your free trial now!

This article has been updated from its original publication date of December 19, 2019.

This is not intended as legal advice; for more information, please click here.