Is your business in good standing with your state? Unless you have a certificate of good standing, you might not know the answer. And now, you might be wondering what is a certificate of good standing.

What is a certificate of good standing?

A certificate of good standing is a document proving a business is legally registered with and able to operate in a state. The certificate is also referred to as a certificate of existence, certificate of status, or a state-specific name. Business structures that are required to register with their state can request the certificate from their state agency.

To obtain the document, your business must be registered with your state and up-to-date on payments and other requirements. If your business is not in good standing, you cannot obtain a certificate of existence.

Even if you are not required to obtain or show an official certificate, you should always try to be in good standing. That way, you can ensure you are running your business legally. Otherwise, you might be subject to fees and other penalties.

Which businesses can obtain the certificate?

Again, only business entities that are required to register with their state can request a certificate of good standing. Depending on your business structure, you may not be able to obtain the document.

As a refresher, the types of business structures are:

- Sole proprietorships

- Partnerships

- Limited liability companies (LLCs)

- Corporations

- S corporations

Businesses that must register with their state when structuring include corporations, S Corps, LLCs, and limited partnerships.

Sole proprietorships and general partnerships do not need to register with the state. If you are a sole proprietor or partner in a general partnership, you cannot obtain an official certificate.

Why do you need a certificate of existence?

Although your business should always be in good standing, you don’t necessarily need to obtain a certificate of good standing. Your business does not need an official copy of the certificate to operate.

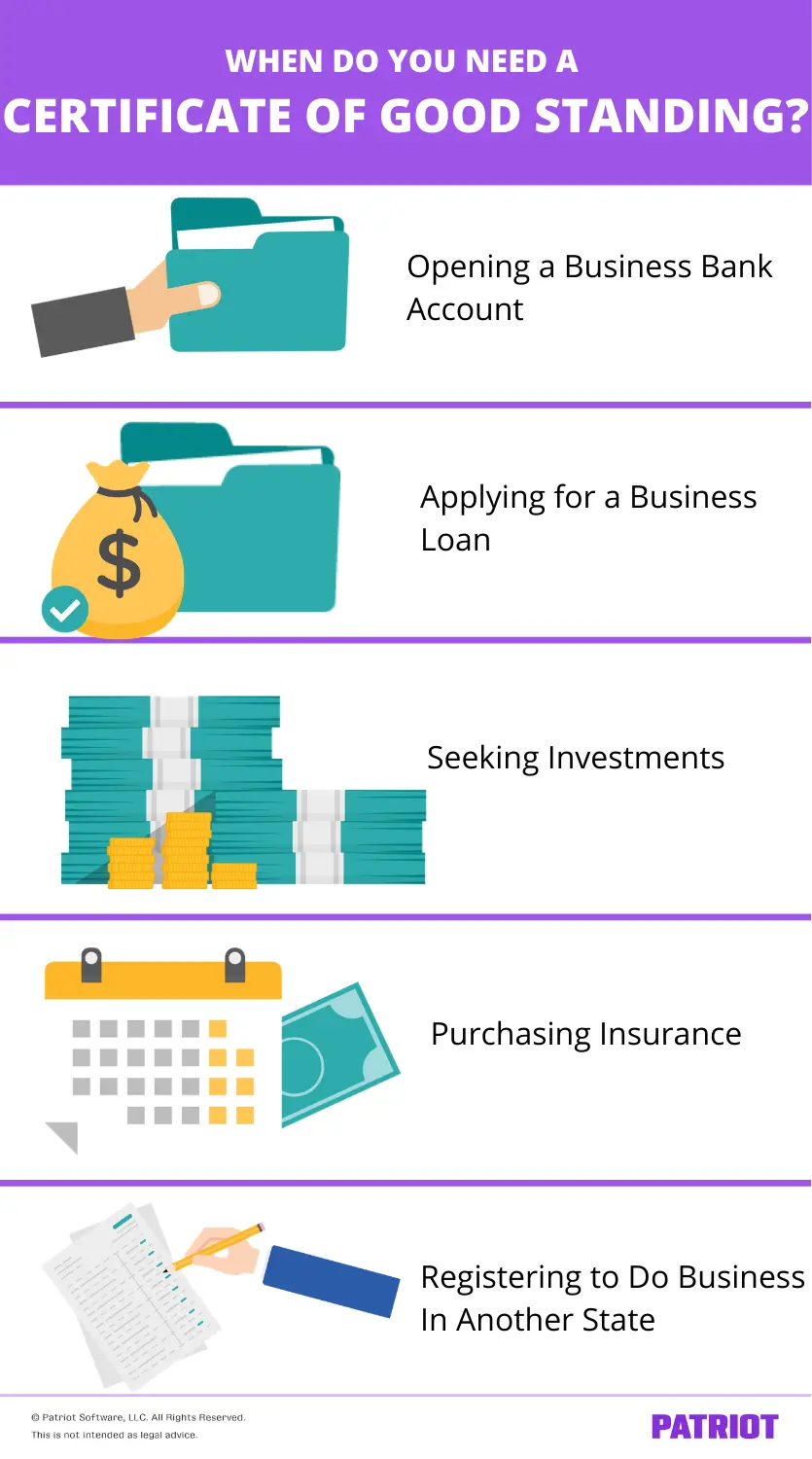

You may need to get a copy of your certificate when you:

- Open a business bank account

- Apply for a business loan

- Seek investments from investors

- Purchase small business insurance

- Register to do business in another state

Don’t panic if you own a sole proprietorship and general partnership. You can show other documents, like tax returns or financial statements, in lieu of a certificate of existence.

Not everyone asks for certificates of good standing. Even if you are registered with your state and do something like apply for a business loan, you may not be asked to show your certificate. Instead, the lender might want to look at other documents (e.g., tax returns).

If you do need to obtain a certificate of existence, keep in mind that it won’t last forever. Certificates of status expire. Your certificate may expire when you need to update your business’s state registration (e.g., end of calendar year).

Obtaining a certificate: State-by-state guide

So, you want to obtain a certificate of existence for your business, eh? You can request the certificate from the state agency where you registered your business.

Use our chart below to find out how you can request a certificate by state, as well as whether you can expect a fee.

| State | Certificate Name | State Agency | Fee |

|---|---|---|---|

| Alabama | Certificate of Compliance | Department of Revenue | $14 |

| Alaska | Certificate of Compliance | Department of Commerce, Community, and Economic Development | $10 |

| Arizona | Certificate of Good Standing | Arizona Corporation Commission | $10 |

| Arkansas | Certificate of Good Standing | Arkansas Secretary of State | $25 |

| California | Certificate of Status | Secretary of State | $5 |

| Colorado | Certificate of Good Standing | Secretary of State | Free |

| Connecticut | Certificate of Legal Existence | Secretary of the State | $50 |

| D.C. | Good Standing Certificate | Department of Consumer and Regulatory Affairs | $40 for nonprofits and $50 for profits |

| Delaware | Certificate of Good Standing | Division of Corporations | $10 |

| Florida | Certificate of Status | Division of Corporations | $5 (LLCs) or $8.75 (corporations and limited partnerships) |

| Georgia | Certificate of Existence | Corporations Division | $10 |

| Hawaii | Certificate of Good Standing | Business Registration Division; Department of Commerce and Consumer Affairs | $7.50 |

| Idaho | Certificate of Existence | Secretary of State | $11.50 (printed) $12 (official with signature) |

| Illinois | Certificate of Good Standing | Secretary of State | $25 |

| Indiana | Certificate of Existence | Secretary of State | $21 |

| Iowa | Certificate of Standing | Secretary of State | $5 |

| Kansas | Certificate of Good Standing | Secretary of State | $10 (online request) or $15 (paper request) |

| Kentucky | Certificate of Existence | Secretary of State | $10 |

| Louisiana | Certificate of Good Standing | Secretary of State | $20 |

| Maine | Certificate of Existence | Secretary of State | $30 |

| Maryland | Certificate of Status | Department of Assessments and Taxation | $25 (online) or $40 (in person) |

| Massachusetts | Certificate of Good Standing | Department of Revenue | Free |

| Michigan | Certificate of Good Standing | Department of Licensing and Regulatory Affairs | $10 |

| Minnesota | Certificate of Good Standing | Secretary of State | $5 (mail and in-person) or $15 (online) |

| Mississippi | Certificate of Good Standing | Secretary of State | $27 |

| Missouri | Certificate of Good Standing | Secretary of State | $10 |

| Montana | Good Standing Certificate | Secretary of State | $5 |

| Nebraska | Certificate of Good Standing | Secretary of State | $10 |

| Nevada | Certificate of Good Standing | Secretary of State | $50 |

| New Hampshire | Certificate of Good Standing | Corporation Division | $5 |

| New Jersey | Standing Certificate | Division of Revenue and Enterprise Services | $25-$100 |

| New Mexico | Certificate of Good Standing | Secretary of State | $10 (nonprofit), $25 (LLC), and $50 (everyone else) |

| New York | Certificate of Status | Department of State | $25 |

| North Carolina | Certificate of Existence | Secretary of State | $15 -$17 |

| North Dakota | Certificate of Good Standing | Secretary of State | $5 |

| Ohio | Certificate of Good Standing | Secretary of State | $5 |

| Oklahoma | Certificate of Good Standing | Secretary of State | $20 |

| Oregon | Certificate of Existence | Secretary of State | $10 |

| Pennsylvania | Certificate of Subsistence | Department of State | $40 |

| Rhode Island | Letter of Good Standing | Division of Taxation | $50 |

| South Carolina | Certificate of Existence | Secretary of State | $10 |

| South Dakota | Certificate of Good Standing | Secretary of State | $20 |

| Tennessee | Certificate of Existence | Secretary of State | $20 |

| Texas | Certificate of Good Standing | Secretary of State | $15 |

| Utah | Letter of Good Standing | State Tax Commission | Free |

| Vermont | Certificate of Good Standing | Secretary of State | $25 |

| Virginia | Certificate of Good Standing | State Corporation Commission | $6 |

| Washington | Certificate of Status | Secretary of State | $20 |

| West Virginia | Certificate of Existence | Secretary of State | $10 |

| Wisconsin | Certificate of Status | Department of Financial Institutions | $10 |

| Wyoming | Certificate of Good Standing | Secretary of State | Free |

Help keep your business in good standing by staying on top of your business tax returns. And to make things easier on yourself come tax time, keep accurate accounting books year-round. Patriot’s online accounting software makes it easy to record incoming and outgoing money. Start your free trial now!

This is not intended as legal advice; for more information, please click here.