Your customers are your business’s top priority. But do your practices back that up? When it comes to things like customers’ rights, there’s no room for errors. Understand consumer protection laws to stay compliant.

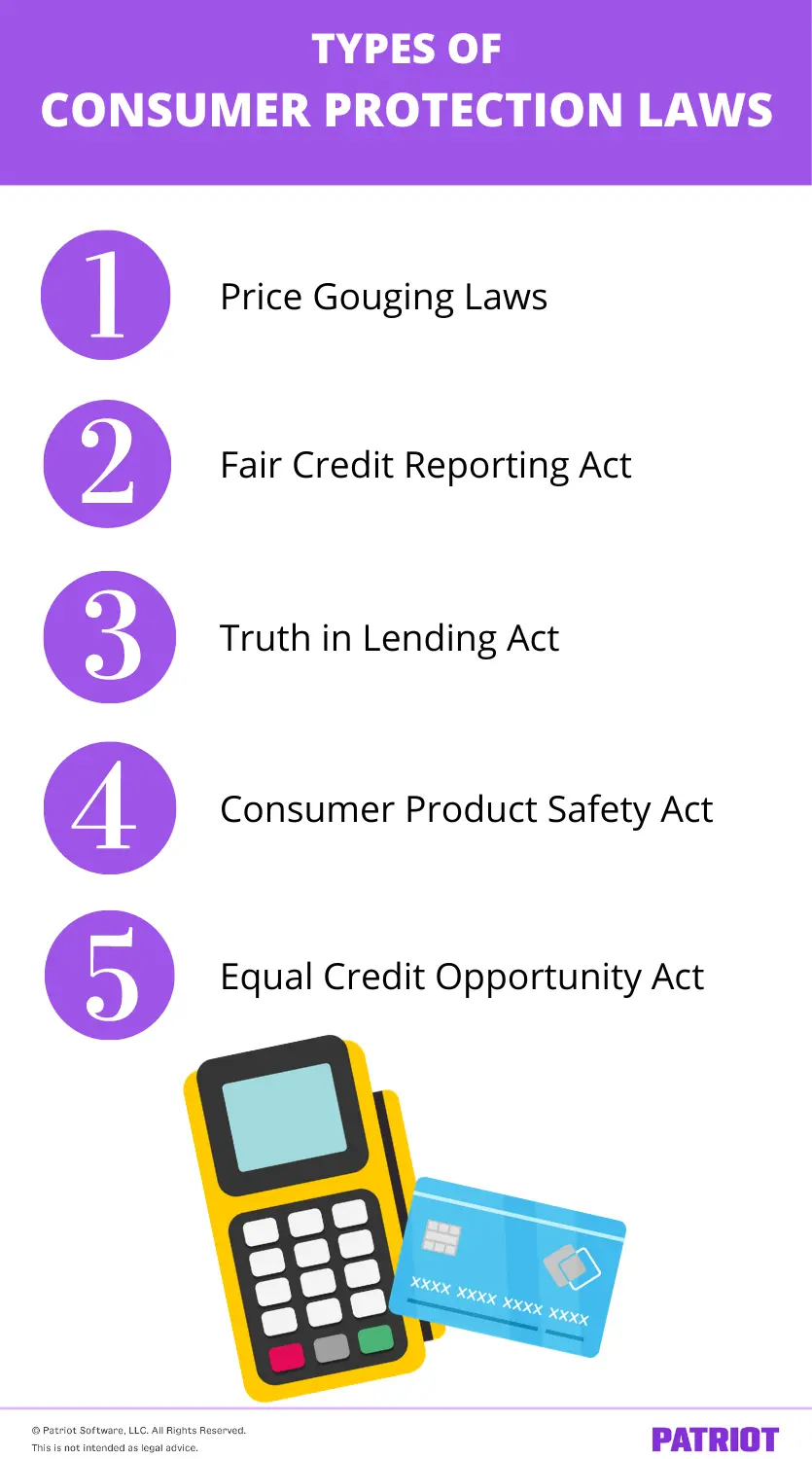

Consumer protection laws

There are a number of consumer laws aimed at protecting customers from unfair practices. Consumer acts prevent businesses from:

- Withholding important information

- Marking up prices significantly

- Invading consumers’ privacy

- Discriminating against consumers

- Deceiving consumers

Read on to learn about some that you might come across in your business.

Price gouging laws

How familiar are you with the art of price gouging? Price gouging is when a business significantly and excessively marks up their products or services. Generally, a seller does this when demand skyrockets (e.g., during an emergency or disaster situation).

Price gouging laws protect consumers from having to pay unreasonable prices for basic necessities (e.g., water and food) during emergencies or market downturns.

Some states monitor businesses for price gouging. And, states encourage consumers to report price gouging suspicions to the Attorney General’s office.

There is no federal law against price gouging. However, the majority of states have explicit price gouging laws that ban sellers from increasing prices by a certain percentage during a state of emergency. Some states’ price gouging laws (e.g., Michigan) apply all of the time.

If there’s a price gouging law in place in your state, it defines price gouging, when the law is activated, the products or services it applies to, and what lookback period to compare price increases to.

Fair Credit Reporting Act

The Fair Credit Reporting Act (FCRA) protects consumers’ credit information in terms of privacy. Under the FCRA, you can’t just go digging around when conducting a credit check on a customer.

You must follow the FCRA so you know what kind of information you can collect. And, you likely need to get the customer’s written permission before starting the credit check.

The Fair Credit Reporting Act also requires you to tell consumers about any information you use against them.

The FCRA also protects your rights as a business owner. You are entitled to one free credit report every 12 months under the Fair Credit Reporting Act.

Truth in Lending Act

The Truth in Lending Act (TILA) requires lenders and creditors to tell borrowers certain information about the loan or credit they’re about to take out.

If you extend credit to your customers, you must adhere to TILA regulations. You cannot withhold important information from prospective borrowers.

So, what do you need to tell your customers? If you lend or extend credit to a customer, TILA requires you to tell them the total amount, annual percentage rate (APR), fees and penalties, and repayment plan and amount.

Consumer Product Safety Act

If you own a product-based business, the last thing you want is for one of your products to malfunction when a customer is using it. Or worse … consumer injuries as a result of using your products.

The Consumer Product Safety Act (CPSA) aims to reduce injuries related to product usage. It requires businesses to provide clear and sufficient warnings or instructions on products to prevent or reduce injuries. Depending on the product, the act may regulate the warnings or instructions you include.

Equal Credit Opportunity Act

The Equal Credit Opportunity Act (ECOA) protects consumers from credit discrimination due to race, color, religion, national origin, sex, marital status, or age.

If you extend credit to customers, you can only base terms on factors such as income, expenses, debts, and credit history.

Do you have a reliable accounting method to stay on top of your books? Fear not—Patriot’s accounting software makes it easy to manage your books. Plus, we offer free, USA-based support. Get your free trial now!

This is not intended as legal advice; for more information, please click here.