Nearly 80% of small businesses have and use credit cards for business purposes. If you’re part of this majority, you’ll receive a credit card statement each month.

Your credit card statement is more than just a reminder to pay. It details your financial activity so you can track spending, reconcile your accounts, file a small business tax return, and dispute fraudulent charges.

If you don’t know how to read a credit card statement, you could miss out on key financial insights that can help you grow your business.

Skip Ahead

- Credit card statement definition

- How to read your credit card statement

- Credit card statement example

- How to use your credit card statement

- Credit card statement FAQs

Credit card statement definition

A credit card statement is a summary of all transactions made with your credit card during a billing cycle.

Use your business credit card statement to view information like your:

- Transaction history

- How much you owe

- Minimum payment due

- Payment due dates

- Interest charges and fees

- Rewards summary

- Available credit

Credit card statements typically cover one month of transaction history. Your provider sends you a paper or digital copy of the statement at the end of the billing cycle.

A high credit card balance can hurt your business credit score. Use your business credit card statement to avoid missing payment deadlines, review transactions and spending, and check that you’re on budget.

How to read your credit card statement

Like a business bank statement, your credit card statement includes everything you need to know about your account activity during the billing cycle.

Understand how to read your credit card statement to take full advantage of the information it’s telling you. And to read your statement, you need to know the parts of a credit card statement.

Here are the main sections in a typical credit card statement:

- Account details

- Account summary

- Payment information

- Fine print

- Transactions

- Fees and interest charged

- Rewards summary

1. Account details

This section details account information such as:

- Credit card provider name

- Your name and mailing address

- Your account number

- Billing cycle dates

2. Account summary

Your account summary section includes key credit card statement at a glance, including:

- Previous balance: Your balance for the previous month

- Payments and credits: Credit card payments you made during the billing cycle

- Purchases: How much you spent on transactions during the billing cycle

- Fees charged: Any fees the credit card company charged (e.g., late payment fees)

- Interest charged: Any interest the credit card company charged

- Statement (or “new”) balance: The total amount you owe at the end of the billing cycle

- Credit line: The total amount you can spend on your credit card

- Available credit line: The current amount available for you to spend after subtracting your balance

- Cash advances: The total amount you can take as a cash advance, and your available cash advance amount

3. Payment information

The payment information section details the following information:

- Statement balance

- Minimum payment due

- Payment due date

The payment information section may also contain a late payment warning and a minimum payment warning.

A late payment warning details how much the company will charge you in interest and fees if you do not make on-time payments.

A minimum payment warning shows you how long it would take to pay off the balance if you only made minimum payments each month.

4. Fine print

There’s plenty of fine print on each month’s credit card statement. You might have a page or two dedicated to information about your account.

This information may include your rights as a cardholder, credit reporting, an interest rate explanation, and credit card provider contact information.

5. Transactions

Your transaction, or purchase, section lists each purchase you made line-by-line. You should carefully review this section to make sure each transaction listed is legitimate.

Your transaction section includes:

- Purchase date: When you used the card

- Vendor information: Where you made the purchase at

- Merchant category: What type of transaction you made (e.g., “groceries”)

- Amount: How much you paid

If you see a purchase at a business you haven’t heard of, don’t panic. Some vendors have a different registered name than their “doing business as” name (aka the name on their storefront or website).

If you see a transaction that doesn’t look familiar, contact your credit card provider to ask for more information.

6. Fees and interest charged

With an average interest rate of around 20%, credit cards have arguably one of the highest interest rates of all types of borrowed money.

This section of your credit card statement shows you how much you’re paying in interest and other fees, like late payment fees and cash advance fees.

Pro Tip: Pay off your full statement balance by the due date to avoid interest.

7. Rewards summary

Most credit card companies offer cash back or other rewards to encourage you to spend money with the card.

Your rewards summary should detail:

- Previous rewards balance

- Rewards earned during the billing cycle

- Rewards redeemed, if applicable

- Available rewards

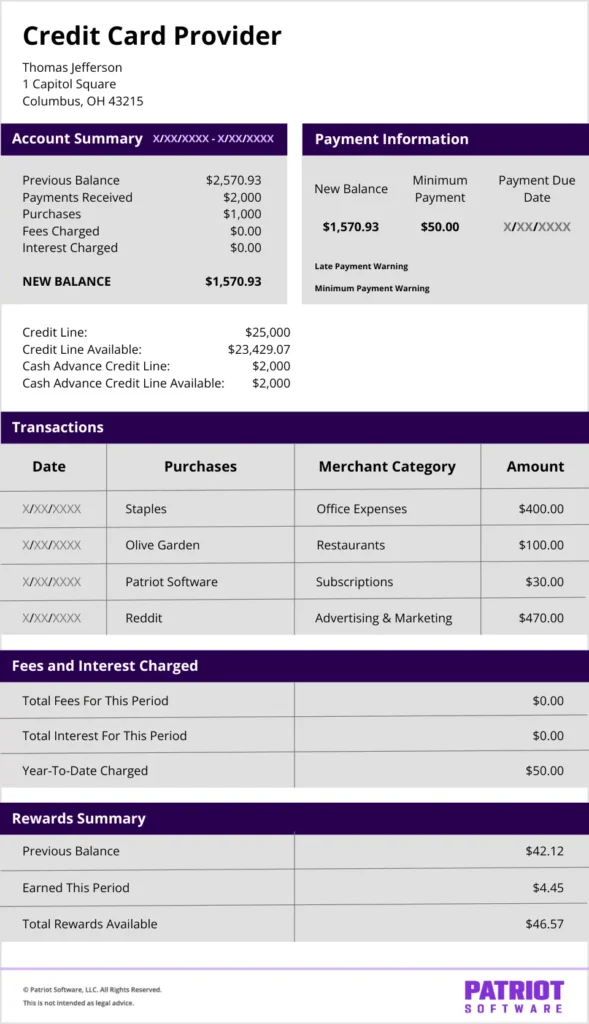

Credit card statement example

Statement formatting varies by credit card company, but here’s a simple example of a credit card statement.

How to use your credit card statement

Your credit card statement is an important document for your business. Here are four ways you can use your statement.

1. Disputing charges

You’re reviewing your monthly credit card statement, and everything’s pretty standard. But then, you see it—a $450.00 transaction for … professional bass fishing equipment?!

You know you never bought that. So, you dispute the unauthorized charge immediately.

Luckily, credit card providers offer fraud and billing error protections. But without reviewing your statement, you could miss erroneous or unauthorized transactions and fail to report them.

You can dispute charges with your credit card company over:

- Unauthorized or fraudulent transactions you never made

- Billing errors, like duplicate charges

- Canceled services or subscriptions you’re still being charged for

- Returns or refunds the merchant never processed

2. Tracking spending

Are you wasting money on unnecessary expenses? How does your spending line up with your budget?

Use your credit card statement to track expenses and make sure you’re not going over your business budget.

Through consistent monitoring, you can start seeing spending patterns and adjust unhealthy habits, like overpaying for payroll software.

Your credit card provider may even provide tools that categorize expenses, like:

- Utilities

- Gas stations

- Rent or commercial mortgage payments

- Insurance

- Subscriptions

Do your employees have company credit cards? Use your monthly statement(s) to monitor their purchases and ensure purchases comply with your business policies.

3. Reconciling your accounts

Account reconciliation is a key part of making sure your books are accurate, up-to-date, and error-free.

You can do this by comparing an account (e.g., liability) to your monthly statement to make sure they match.

Accounting software can streamline the process of reconciling your accounts.

4. Filling out tax returns and claiming deductions

Credit card statements are just one of the many supporting business documents the IRS requires you to keep in your records.

Statements document purchases, like the cost of raw materials or parts, and other expenses you incur to run your business.

Your credit card statements act as supporting documents for tax-deductible business expenses.

Look to the IRS to learn how long to keep business records, like credit card statements. Keep copies of your statements for at least three years. In some cases, you may need to keep records for six years, seven years, or indefinitely.

Credit card statement FAQs

Your credit statement lists your billing cycle dates, transaction history, how much you owe, minimum payment due, due date, and available credit.

It also includes any applicable interest charges, rewards summary, and fees.

Your provider should issue a digital or paper credit card statement every month on your billing date. Log in to your online account or mobile app to access your digital statement.

Not necessarily. Your credit card statement summarizes your account activity during the billing cycle. You should receive a statement each month, regardless of if you have a balance due or not.

You can find your balance on your credit card statement or by logging in to your online account.

Your statement balance is the total amount you owe on the last day of the billing cycle.

Your current balance is the total amount you owe in real-time. It might be more or less than your statement balance if you made purchases or payments after the statement date.

At the very least, keep credit card statements until you’ve had a chance to review them. If there’s a billing error, keep the statement until the dispute is over.

Keep business credit card statements related to your income tax returns (e.g., business deductions) for anywhere from three to six years in case of an IRS audit.