Do you make estimates or invoices for your business? The two terms aren’t interchangeable. In fact, you may need to make both an estimate and invoice for a project. So, what’s the difference between estimate vs. invoice?

Estimate vs. invoice

Both estimates and invoices are documents businesses give customers that outline product or service costs. But, the two documents are not the same. And, the difference between estimate and invoice matters—both to your business and your customers.

Because you’ll likely use one or both in your company, you should familiarize yourself with the terms, along with the documents themselves.

What’s an estimate?

A business estimate is a proposal that outlines products or services and estimated costs. You send an estimate to a customer before starting or completing a project or providing products.

The amount you estimate a project will cost is subject to change. An estimate is an approximate amount of money that doesn’t account for unforeseen expenses. The amount you charge the customer could be more or less than the estimate, depending on factors like time, materials, and labor involved.

The bottom line: An estimate is a project or product proposal. It does not ask a customer for payment.

What’s an invoice?

Now that you’re familiar with estimates, you may be wondering what is an invoice. A business invoice is a document that asks customers for payment after they receive a product or service. Invoices are bills that help you track accounts receivable so you know how much money customers owe your business.

Unlike an estimate, an invoice is final. The amount it asks customers for will not change. However, you can include an early payment discount on the invoice that lowers the total bill.

The bottom line: An invoice is a bill that asks customers for payment.

How to create an invoice vs. estimate

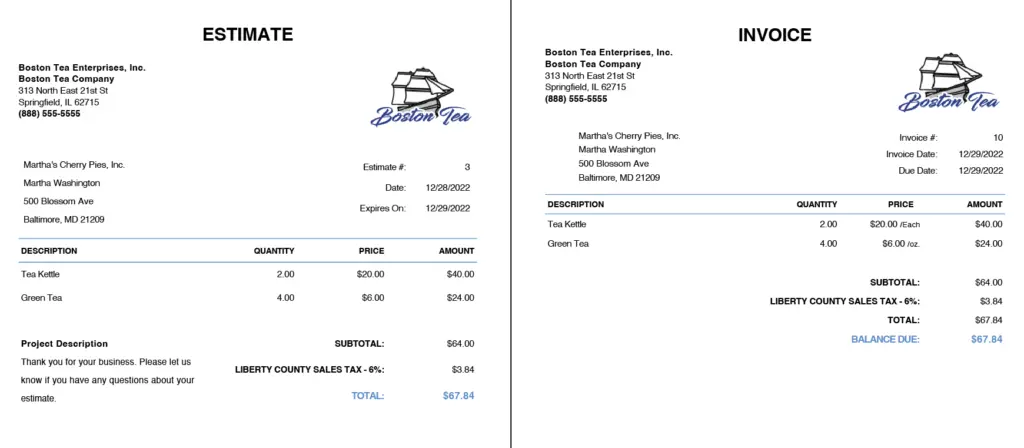

The parts of an invoice and estimate are similar. In fact, the two documents generally look pretty similar. Take a look at the following example of an invoice and estimate:

Let’s break it down even further. Below are the parts of an estimate and an invoice. You’ll see that they’re almost identical, except a few differences:

| Estimate | Invoice |

|---|---|

| Estimate number | Invoice number |

| Estimate date (+ expiration date, if applicable) | Invoice date |

| Customer information | Customer information |

| Seller information | Seller information |

| Products or services included | Goods and/or services purchased |

| Description of what you’re providing | Payment terms (due date, acceptable payment, discounts, etc.) |

| Estimate total (subject to change) | Total amount due |

Create estimates and invoices by hand, with templates, or using accounting software. For consistency and brand awareness, you can use an invoice generator to include your business logo and colors.

After creating estimates and invoices, you can distribute them electronically, in person, or via mail.

Converting an estimate to an invoice

Need to send an estimate and an invoice? No problem. Soon after giving customers an estimate, it might be time to bill the customer. This is when you need to send an invoice.

To make less work for yourself, simply convert your estimate to an invoice.

Some accounting software programs let you seamlessly convert estimates to invoices. If you don’t use software, reference the estimate information when creating your invoice. Be sure to account for any price changes, update the dates, and include your payment terms when converting an estimate to an invoice.

Keep in mind that not all estimates get converted into invoices. You may need to revise the estimate if your customer decides to cut back on the project or product order, add additional products or services, or change their order. And in some cases, the customer may cancel the project or product order after receiving the estimate.

Need to create estimates and invoices for your business? You can do both with Patriot’s Accounting Premium. Easily convert estimates to invoices, set up recurring invoices and payment reminders, accept payments, and more. Get your free trial today!

This is not intended as legal advice; for more information, please click here.