As a business owner, you probably made a few mistakes when you started your venture. And, you probably haven’t seen the last of them. Mistakes happen, especially when you’re responsible for things like filling out accounting forms.

If you made a mistake on Form 1065, 1065-B, or 1066, you can correct errors using Form 1065-X. Read on to learn what Form 1065-X entails and whether or not you need to use one.

What is Form 1065-X?

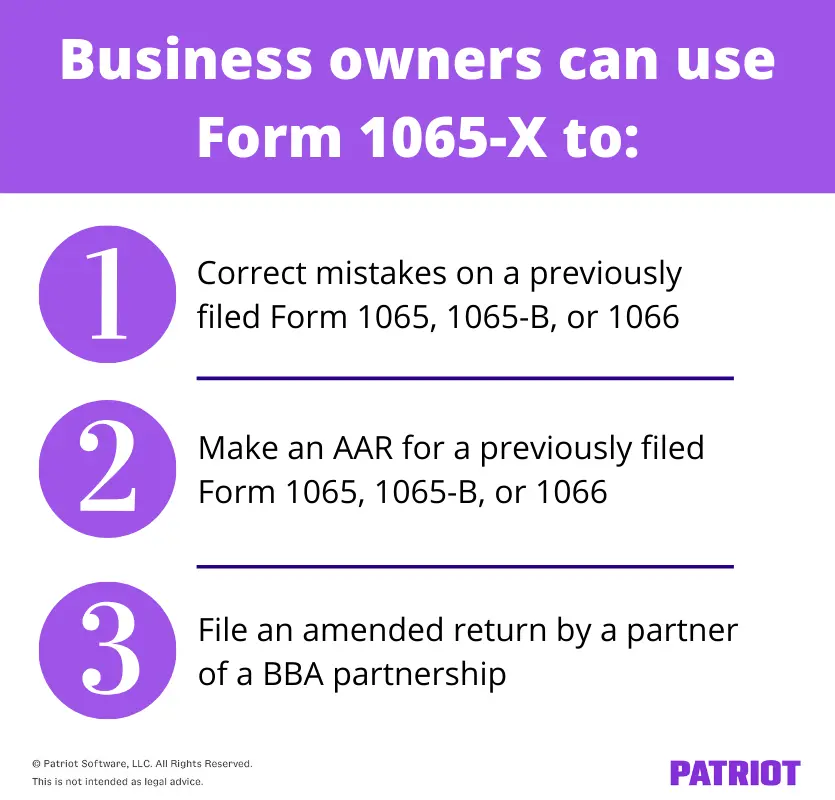

Form 1065-X, Amended Return or Administrative Adjustment Request (AAR), is a form business owners can use to:

- Correct mistakes on a previously filed Form 1065, 1065-B, or 1066

- Make an Administrative Adjustment Request (AAR) for a previously filed Form 1065, 1065-B, or 1066

- File an amended return by a partner of a BBA (Bipartisan Budget Act) partnership

Some errors you might need to correct include an incorrect total for gross receipts or sales, net income amount, or deduction total.

You can only use Form 1065-X if you are not filing electronically to correct items on the above forms. And, you must send Form 1065-X to the same IRS address you used to send Form 1065.

If you’ve never heard of Form 1065, 1065-B, or 1066, check out a breakdown of each form.

Form 1065, U.S. Return of Partnership Income, is a form partnerships use to file their business tax return. Partnerships use this form to report the business’s profits and losses to the IRS each year. Multi-member LLCs also file Form 1065. Partnerships and multi-member LLCs must file Form 1065 with the IRS by March 15.

Electing large partnerships must file Form 1065-B, U.S. Return of Income for Electing Large Partnerships, to report income, gains, losses, and deductions. Electing large partnerships are partnerships that consist of 100 or more partners (based on the preceding tax year).

Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return, is used to report income, deductions, gains, and losses from the operation of a real estate mortgage investment conduit. REMICs hold residential and commercial mortgages in trust and issue interest to investors.

Now that you know some background information on the forms you can amend using Form 1065-X, let’s dive further into all things Form 1065-X.

Form 1065-X sections

Form 1065-X has five parts. The parts include:

- Check the appropriate box

- Amended or Administrative Adjustment Request (AAR) Items for Partnerships Filing Form 1065 Only

- Amended or Administrative Adjustment Request (AAR) Items for ELPs and REMICs Only

- Imputed Underpayment Under the Centralized Partnership Audit Regime

- Explanations

Before you begin filling out Part I, fill out basic information, including your business name, Employer Identification Number (EIN), address, phone number, and tax year. Remember to also sign and date your amended Form 1065.

If the correction involves an item that must be supported with a schedule, statement, or form, attach the appropriate documents to Form 1065-X.

Send your completed Form 1065-X to the IRS. If you need help filling out Form 1065-X, check out the IRS’s 1065 amended return instructions.

Who must file Form 1065-X?

Partnerships and REMICs that find an error with income, deductions, etc. must use Form 1065-X to correct their previously filed return.

If you have a representative that filed the return on behalf of your business, the representative must use Form 1065-X to make corrections (BBA).

Partnerships can also use the form to file for an Administrative Adjustment Request. Certain REMICs must also use Form 1065-X to file for an AAR.

Electing large partnerships that are not required to electronically file Form 1065-B and need to correct errors on a previously filed Form 1065-B must use Form 1065-X.

When to file Form 1065-X

Typically, a partnership or REMIC can file an amended return or AAR to correct items on the return within three years after the date on which the partnership return for that year is filed or the last day for filing the partnership return for that year (whichever is later).

Need an easy way to record your business transactions? Patriot’s accounting software lets you streamline your books and get back to your business. Try it for free today!

Have questions, comments, or concerns about this post? Like us on Facebook, and let’s get talking!

This is not intended as legal advice; for more information, please click here.