If you hire an independent contractor and pay them $600 or more during the tax year, you must create, distribute, and file Form-1099-NEC. You might wonder, How do I file a 1099?

Read on to learn how to file a 1099 and streamline the process with software. Plus, get answers to frequently asked questions relating to 1099 filing.

How do I file a 1099 for my independent contractors?

You must file 1099-NEC forms with the IRS and the state (if applicable), as well as provide a copy to the recipient. Do this for every contractor you pay $600 or more to during the tax year.

Use the following steps to learn how to do a 1099 for independent contractors.

Step #1: Gather information

Do you have the information you need to complete the form? This includes:

- W-9 form for the contractor

- Total amount you paid during the tax year

- Your business information

You should have Form W-9, Request for Taxpayer Identification Number and Certification, in your records from when you first hired the contractor. This form includes information you need to fill out the 1099-NEC, such as the contractor’s name, taxpayer identification number (TIN), and address.

You should be able to find the total amount you paid the contractor during the year in your records. Check the invoices you’ve received and reference your general ledger to find your list of transactions. If you use accounting software or payroll software, you can easily view how much you’ve paid the contractor.

Gather your business information, including your name, address, and taxpayer identification number.

Step #2: Fill out the 1099 form

Do you know how to fill out a 1099-NEC? Although the form is relatively short and simple, it’s important that you fill it out carefully.

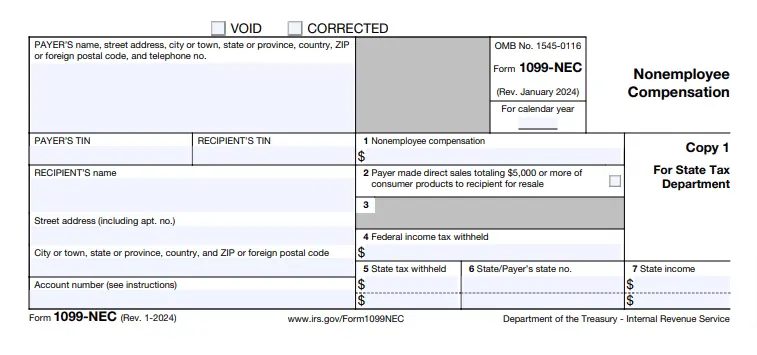

Here’s a screenshot of the 1099-NEC:

Fill out the form using the information you gathered in Step 1. Or, use software to automatically generate the 1099-NEC based on payment records in the system.

Keep in mind that most business owners do not withhold federal or state income tax from contractor wages. However, you must fill this out if you withheld federal income (aka their wages were subject to backup withholding) or state income taxes.

Step #3: File the 1099 with the IRS (and state, if applicable)

There are two ways you can file your 1099s with the IRS: paper or electronic.

E-filing is the fastest and easiest way to send Forms 1099. The IRS encourages e-filing. You can e-file through the Information Returns Intake System (IRIS) or your accounting or payroll provider, if applicable. You must e-file if you have 10 or more total information returns.

You can mail paper forms to the IRS only if you have less than 10 total information returns, including your W-2s and other 1099s. Also send Form 1096, Annual Summary and Transmittal of U.S. Information Returns, if you file 1099 forms by mail.

| Paper File | E-file | |

|---|---|---|

| Can You Use This Method? | Only if you have less than 10 information returns | Yes |

| Deadline | January 31 | January 31 |

| Do You Need to File Form 1096? | Yes | No |

Your state may require that you also file the 1099-NEC with the state. Many states participate in a combined federal/state filing program, which lets you e-file 1099s with the IRS and participating states. Keep in mind that 1099 state filing requirements vary.

Step #4: Send a copy to the contractor

Send Copy B and Copy 2 of the form to the contractor.

You can do this by distributing a paper copy or posting an electronic copy to a contractor portal—if they consented to a digital form.

Distribute Form 1099-NEC to the contractor by January 31.

Speed up 1099 filing with software

Filling out 1099 forms manually and filing with the IRS may seem daunting and time-consuming.

Use accounting software or online payroll to:

- Automatically generate Forms 1099-NEC (and 1099-MISC) based on payment records

- Download 1099 forms and Form 1096

- Post 1099s to a contractor portal so they receive electronic copies

- E-file with the IRS and state (if applicable) on your behalf

- Keep digital files in your records

Both Patriot’s accounting software and payroll software make it easy to create, view, file, and post 1099 forms! You can view pricing and more information here.

How do I file a 1099-NEC? FAQs

Looking for more information about filing your 1099s? Check out the following commonly asked questions.

You can e-file or paper file 1099s with the IRS. You can e-file through the Information Returns Intake System (IRIS) or through your accounting or payroll provider, if applicable.

Follow the IRS instructions—information to input, deadlines, and electronic filing requirements—to file 1099s correctly.

File 1099-NEC for any contractor you paid $600 or more to during the year. E-file the form if you have 10 or more information returns. Send 1099-NEC forms to the IRS and recipient by January 31.

Yes, business owners can file 1099s without an accountant or other tax preparer.

You can use the IRS Information Returns Intake System, mail the forms to the IRS, or let your accounting software or payroll provider e-file for you.

File Form 1099-NEC if your business pays a contractor $600 or more during the year.

Send Copy B of Form 1099 to your contractor. You can distribute paper 1099s or electronic 1099s (if the contractor consented to receive a digital copy).

You may be able to post electronic 1099s in a contractor portal if you use accounting software or payroll software.

You may face penalties from the IRS if you don’t file the required 1099s.

The penalties range from $60 – $660 for each information return you don’t file on time and each payee statement you don’t provide on time.

File 1099-NEC forms with the IRS and send 1099-NEC to the recipient by January 31.

If filing paper forms, you can order official forms from the IRS website or buy them from an office supply store.

Keep in mind that you must e-file Forms 1099 if you have 10 or more returns (W-2s, 1099-NECs, 1099-MISCs, etc.).