The fact is, business owners should know a little about accounting. And yes, hiring an accounting professional is a tremendous help. But, what about the day-to-day cash flow of your business? What about invoicing, bill payments, data entry, and other accounting tasks? That’s where accounting software can help. So, how does accounting software work?

How does accounting software work?

Before we can dive into answering How does accounting software work?, we need to talk about what it is. Accounting software is a tool that helps businesses track and manage their finances.

There are two types of accounting software: cloud accounting and desktop software. Cloud accounting software is internet-based software that you can access anywhere, anytime. Desktop accounting software is a program you download to your laptop or desktop computer. With desktop software, you are generally limited to using solely the device that you downloaded the program onto.

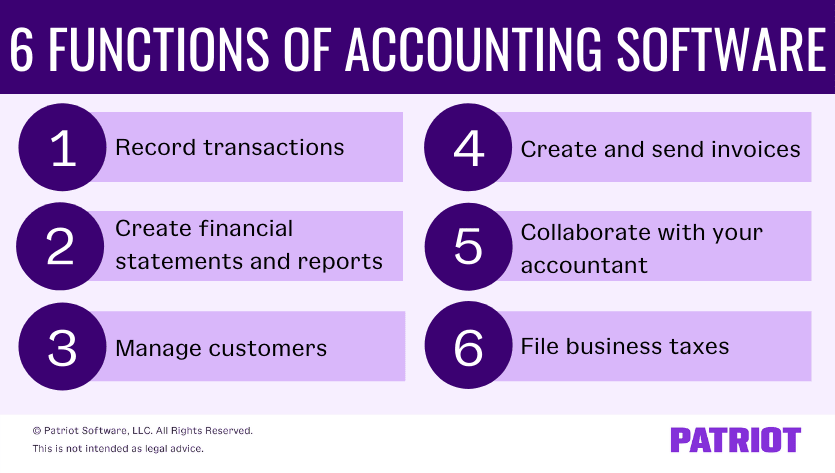

So, how does cloud accounting work? It comes with features that allow you to process financial data and other tasks. For example, businesses can use software to:

- Record transactions

- Download financial statements and reports

- Manage customer information and payments

- Create and send invoices

- Share reports and financial information with an accountant

- File business taxes

As a tool, accounting software allows company owners to accurately manage their finances to help prevent errors. As a bonus, it can also help you save time.

Using accounting software

Again, you can accomplish many tasks with accounting software. Most software comes with many features you can use to streamline your business and make managing your books a little bit easier. Here are some common accounting software features and functions:

- Record transactions: Transactions in accounting run a wide range. With software, you can enter in all of your transactions to track each purchase, expense, revenue, and more.

- Create financial statements and reports: Using the transactions you record in your software, you can generate and analyze different reports to create a clear picture of your financial health. And, you can use the reports to create an idea for how to move forward (e.g., creating a business budget).

- Manage customers: When you build a customer base, it’s important to keep track of various bills and outstanding invoices. With accounting software, you can see various information about your customers (e.g., past due balances).

- Create and send invoices: Invoicing is a crucial part of most businesses. Quickly creating uniform invoices with a few clicks of a button allows you to save time and money. With some software, you can even automate the invoicing process to send a new invoice at set intervals, depending on the reason (e.g., past due or every three months).

- Collaborate with your accountant: An accountant can help you analyze and manage your business’s finances. But, you can make the process even easier by using accounting software. Well-managed software allows you to produce a variety of reports to help your accountant in their financial tasks. And, you can spend less time poring over receipts and other documents if you organize everything in one place.

- File business taxes: Taxes are mandatory. So, you must be ready to prepare and file each quarter and at the end of the year. By using software, you can locate the necessary data to enter onto your tax forms. And, most software also automatically calculates sales tax or allows you to add a sales tax rate. As a bonus, you can pass the information along to your accountant to prepare the forms for you (saving time and money!).

As a reminder, your accounting software is only as accurate as your data entry. So, review your financial statements routinely (e.g., once a month) to ensure accuracy.

Common features of accounting software

Accounting software can vary by provider, but there are some common elements business owners need. Most accounting software uses double-entry bookkeeping, so make sure you understand the basics before you begin using the software.

Look for these features when selecting accounting software:

- Robust reporting capabilities (e.g., income statements)

- Invoice processing

- Bill pay

- 1099 e-Filing

- Bank account imports

- Customer creation and tracking

Another thing to check before selecting a software program is customer support. After all, most business owners are not accountants, so strong customer support can be vital.

And if you need the ability to access your information anywhere, anytime, consider a cloud accounting software option over a desktop version. Cloud accounting software uses the internet to securely store encrypted information in the cloud so you can get into your account even when you’re not in the office.

Example of using accounting software

Now that you know the features and functions of accounting software, let’s take a look at an example of how you can use it in your business.

Your business has four recurring bills you track in your software:

- Utilities

- Rent

- Loan payments

- Small business insurance

To track your bills, you enter the payments into the software and assign them to the applicable accounts. You can monitor how much you’re spending on your bills and evaluate if you need to make any changes.

In addition to your expenses, you also have four customers you invoice each month for services. You enter each customer’s information and create a recurring invoice for each one. The software automatically creates and sends a new invoice to the customer on the date you select. And, you add a payment reminder for 30 days past due to ensure that each customer receives a notification if they do not pay.

At the end of the quarter, your accountant requests the following information from you to prepare your tax statements:

- Income statement (aka profit and loss statement)

- Balance sheet

- Cash flow statement

Because the software contains these financial statements, you can easily download and send them to your accountant.

When year-end comes around, you sit down with your accountant to prepare a new budget for the upcoming year. You need to pull reports like:

- Accounts receivable

- Accounts payable

- Profit and loss statement

- Balance sheets

- Beginning balances

Again, your accounting software has all of the reports you need. So, you can easily gather the financial statements and use them to evaluate your budget for the new year.

This is not intended as legal advice; for more information, please click here.