As a business owner, you juggle a number of tasks, including accounting. You’re responsible for creating journal entries after every transaction. But that’s not all. You also need to know how to post journal entries to the general ledger. Learn how here.

General ledger overview

Your general ledger is a record used to sort and summarize business transactions. In your ledger, record transactions using debits and credits. Debits and credits must always balance. They are equal but opposite entries. If they don’t balance, your books and financial statements will be inaccurate.

There are five main account types in a general ledger:

- Assets

- Liabilities

- Equity

- Revenue / Income

- Expenses

Each account type can have various sub-accounts within them. For example, assets may include checking or savings accounts.

To post to the general ledger, you must use double-entry bookkeeping. With double-entry bookkeeping, you record two entries for every transaction using debits and credits.

Your general ledger provides the necessary information to create financial statements, like your business balance sheet, cash flow statement, and income statement. In turn, your financial statements can give you a clear snapshot of your business’s finances.

Journal entries overview

Every time your business makes a transaction, you must record it in your books. There are a few steps you have to follow when accounting for a transaction. The first step is to record transactions in a journal.

Use your journal to identify transactions. Your journal gives you a running list of business transactions. Each line in a journal is known as a journal entry. And, each journal entry provides specific information about the transaction, including:

- Date of the transaction

- Description / Notes

- Account name

- Amount (e.g., $100)

Journal entries also use the five main accounts and sub-accounts to stay organized. And, journal entries use/require debits and credits. When recording journal entries, make sure your debits and credits balance.

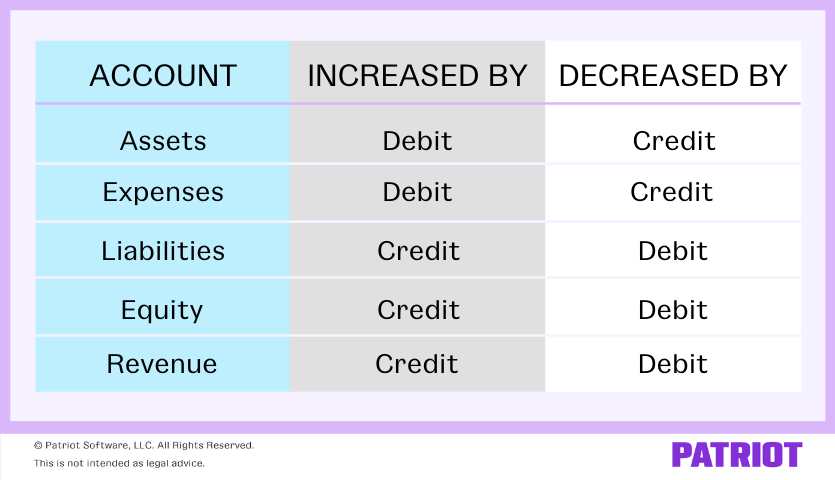

Debits and credits affect the five main accounts differently. Some accounts are increased by debits while others are increased by credits. Use the chart below to see how debits and credits affect accounts:

Journal entries: Example

Journal entries may sound confusing at first. But once you get the hang of it, recording journal entries will be less intimidating. Take a look at how it’s done below.

Say you paid rent for your business location. Your rent is $1,500 per month. Your journal entry would look something like this:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| XX/XX/XXXX | Expense | Paid rent | 1,500 | |

| Cash | 1,500 |

Your Expense account increases with a debit. Debit your Expense account 1,500 to show an increase from the rent expense. Your Cash account is an asset. To decrease your Cash account, credit it 1,500.

Posting journal entries to the general ledger

After you record transactions in your journal, it’s time to transfer them to your general ledger. To keep your books accurate, post every transaction from your journal to your general ledger.

Use your ledger to classify and organize transactions. When posting entries to the ledger, move each journal entry into an individual account.

Transfer the debit and credit amounts from your journal to your ledger account. Your journal entries act like a set of instructions. When posting journal entries to your general ledger, do not change any information. For example, if you debit an account in a journal entry, debit the same account in your ledger.

Keep in mind that your general ledger lists all the transactions in a single account. This allows you to know the balance of each account. But to find the balance, you need to do some math. After posting entries to the ledger, calculate the following balances:

- Asset and expense accounts: Subtract total credits from total debits

- Liabilities, equity, and revenue accounts: Subtract total debits from total credits

If you don’t want to mess with the calculations yourself, consider investing in accounting software. With accounting software, you can record transactions in your ledger and the software handles the calculations for you.

If you’re a little lost—don’t stress. Instead, follow the steps below to post journal entries to the general ledger:

- Create journal entries

- Make sure debits and credits are equal in your journal entries

- Move each journal entry to its individual account in the ledger (e.g., Checking account)

- Use the same debits and credits and do not change any information

- Calculate account balances in your general ledger

How to post journal entries to the general ledger: Example

To keep your records accurate, you should post to the general ledger as you make transactions. At the end of each period (e.g., month), transfer journal entries into your ledger.

Ledger entries are separated into different accounts. The accounts, called T-accounts, organize your debits and credits for each account. There is a T-account for each category in your accounting journal.

Here’s an example of what your general ledger account may look like after posting journal entries:

| Date | Description | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Deposit | 2,000 | |

| XX/XX/XXXX | Rent | 1,500 | |

| XX/XX/XXXX | Deposit | 1,000 | |

| XX/XX/XXXX | Deposit | 3,000 | |

| Inventory | 1,000 | ||

| Subtotal | 6,000 | 2,500 | |

| Total | 3,500 |

The Subtotal row gives you details about the subtotals for your debits and credits. Because this is a Checking (asset) account, deduct the credits from your debits to get the account’s total balance.

Why are ledger entries important?

There are several reasons why ledger entries are oh-so-important. Ledger entries:

- Keep you organized

- Make it easier to find transactions

- Compartmentalize transactions

- Let you see the big picture of your company’s financial health

- Show you patterns in income and expenses

Along with the above perks, posting entries to the general ledger helps you catch accounting mistakes in your records. Catching mistakes early on helps you steer clear of bigger problems down the road, like inaccurate financial reports and tax filings.

Keeping your ledger up-to-date can help you avoid penalties and ensure that your records give you an accurate picture of your business’s finances.

Recording transactions in your books doesn’t have to be a painful process. Patriot’s online accounting software makes it a breeze to keep your books up-to-date and accurate. Try it for free today!

This article was updated from its original publication date of May 11, 2017.

This is not intended as legal advice; for more information, please click here.