From inventory valuation to sales forecasting, there are plenty of times you may need to calculate a weighted average in your business. And you don’t have to be a mathematician to find it. Learning how to calculate weighted average is a relatively easy process.

Skip Ahead

- What is a weighted average?

- How to calculate weighted average

- How do I calculate a weighted average? Examples

- FAQs for weighted average

What is a weighted average?

The weighted average is the average, or mean, of a data set that gives more weight to some numbers than others.

Calculate weighted average if some values in a data set are more important than others.

Finding your weighted average is more accurate than finding your simple average (aka unweighted average), where each data point receives the same “importance.”

Businesses use weighted averages to improve decision-making, cost calculations, forecasting, and financial analyses.

You might calculate the weighted average for:

- Inventory to see your average cost per unit of inventory (especially helpful if you have identical and intertwined inventory items)

- Revenue to see how different revenue streams contribute to calculations

- Sales forecasting to assign different weights based on historical trends, seasonal changes, or customer demand

- Cost of capital to see your average from sources like debt and equity

- Employee performance evaluations to view a total score with different evaluation criteria weightings

How to calculate weighted average

You can calculate weighted average with the weighted average formula:

Weighted Average = (Sum of the Products of Values and Weights) / Sum of All Weights

Sum of the Products of Values and Weights = Each Value X Assigned Weight

| Use Excel or Google Sheets to calculate weighted average! |

|---|

| Use the SUMPRODUCT and SUM functions (Excel) or AVERAGE.WEIGHTED function (Google Sheets). |

Confused? We’ll break it down for you step-by-step below.

How to calculate weighted average:

- Multiply each number by an assigned weight

Look at your set of numbers. Assign each number a weight.

You can assign percentages based on what’s most important to you. For example, you can assign Product ABC a weight of 60% (0.60) and Product XYZ a weight of 40% (0.40).

Or, you can assign a weight as a number of units. For example, you can assign Product ABC a weight of 300 units and Product XYZ a weight of 200 units.

Let’s say Product ABC is $50 and has an assigned weight of 60%. Multiply $50 by 0.60. Product XYZ is $25 and has an assigned weight of 40%. Multiply $25 by 0.40. - Add all the weighted values together

After you multiply each number by its assigned weight, you’ll get the “weighted values.” Add up all the weighted values together.

For example, Product ABC’s weighted value is $30 ($50 X 0.60). Product XYZ’s weighted value is $10 ($25 X 0.40). Add together $30 and $10 to get $40. - Divide the total weighted sum by the total assigned weight value

Lastly, add together your weights (e.g., the decimals if you used percentages or the units if you used units). Divide your total weighted sum by the total weight value.

For example, your total weighted sum is $40. Your total assigned weight value is 1 (0.60 + 0.40). Your weighted average is $40.

How do I calculate a weighted average? Examples

The following examples show how using the weighted average can benefit your business in three areas—revenue, employee performance evaluations, and inventory.

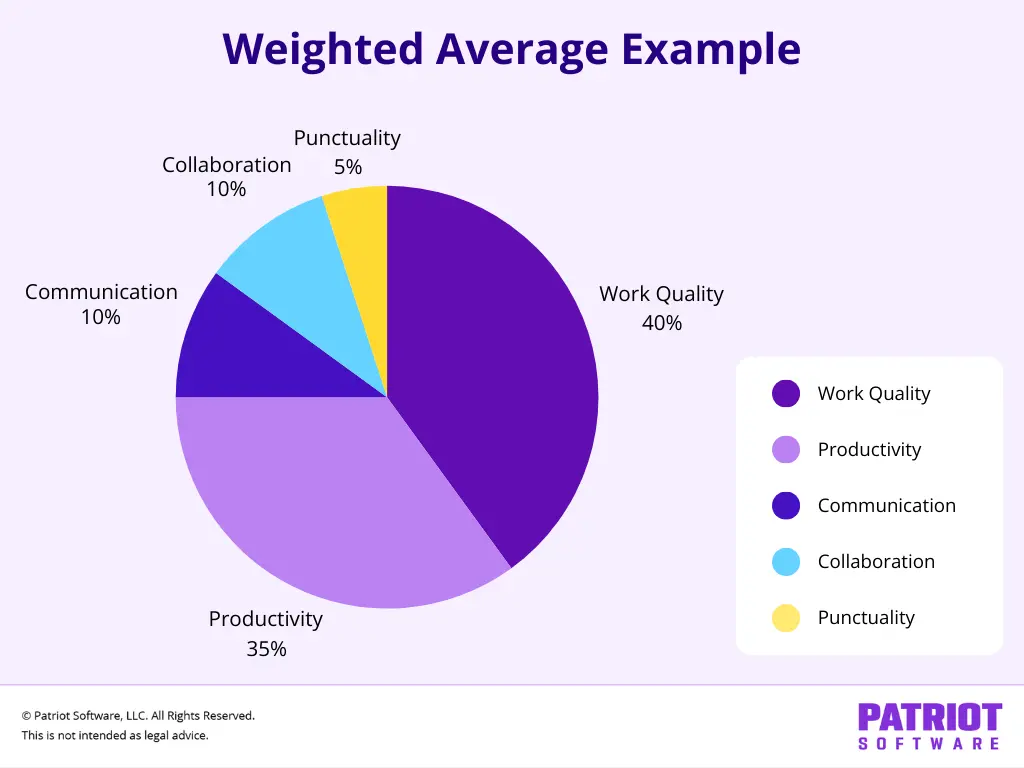

1. Weighted average for employee performance evaluation example

Let’s say you are evaluating your employee, Vanessa, for her annual performance review.

You take into account several factors, like work quality and punctuality. But some of these factors are more important than others. So, you need to find the weighted average.

Here are the five factors, along with your assigned weight for each:

- Work quality (40%)

- Productivity (35%)

- Communication (10%)

- Collaboration (10%)

- Punctuality (5%)

Your factors’ assigned weight must total 100%.

Next, you give Vanessa a score on a scale from 0-100.

| Evaluation Factors | Assigned Weight | Vanessa’s Scores |

|---|---|---|

| Work quality | 40% (0.40) | 90 |

| Productivity | 35% (0.35) | 90 |

| Communication | 10% (0.10) | 60 |

| Collaboration | 10% (0.10) | 60 |

| Punctuality | 5% (0.05) | 40 |

If you just found the simple average, Vanessa’s evaluation looks pretty low. She’d receive a 68 out of 100 [(90 + 90 + 60 + 60 + 60 + 40) / 5].

But because work quality and productivity are the most important factors to your business, you need to find the weighted average.

Weighted Average = [(90 X 0.4) + (90 X 0.35) + (60 X 0.10) + (60 X 0.10) + (40 X 0.05)] / [(0.4 + 0.35 + 0.10 + 0.10 + 0.05)]

Weighted Average = (36 + 31.5 + 6 + 6 + 2) / 1

Weighted Average = 81.5

Vanessa’s evaluation score is 81.5 out of 100 using the weighted average.

2. Weighted average for revenue example

Let’s say you have two main sources of revenue: product sales and affiliate marketing. You want to find your weighted average for your total revenue.

Product sales contribute significantly more revenue to your business than affiliate marketing.

Take a look at the revenue for both, along with its assigned weight (aka its contribution to your total revenue):

- Product sales: $80,000 (80%)

- Affiliate marketing: $20,000 (20%)

Weighted Average = [($80,000 X 0.80) + ($20,000 X 0.20)] / 1

Weighted Average = ($64,000 + $4,000) / 1

Weighted Average = $68,000

This weighted average of $68,000 shows you the combined impact of both product sales and affiliate marketing more realistically than a simple average. The simple average would show your average revenue is $50,000 [($80,000 + $20,000) / 2].

3. Weighted average for inventory example

Let’s say you purchased the same inventory—eggs—in different batches and at different prices to sell at your store. You want to find your weighted average for inventory.

Here’s a breakdown of the number of egg cartons you have and the cost per carton:

- Batch 1: 100 cartons at $3.00 per carton

- Batch 2: 150 cartons at $4.00 per carton

- Batch 3: 200 cartons at $6.00 per carton

Your simple average shows the average cost per carton is $4.33 ($3.00 + $4.00 + $6.00). But your weighted average tells a more accurate story.

Weighted Average = [(100 X $3.00) + (150 X 4.00) + (200 X $6.00)] / (100 + 150 + 200)

Weighted Average = ($300 + $600 + $1,200) / 450

Weighted Average = $2,100 / 450

The weighed average is $4.67.

FAQs for weighted average

To calculate the weighted average, multiply each number by an assigned weight, add all the weighted values together, and divide the total weighted sum by the total assigned weight value.

Average assigns the same weight to all numbers in a data set, whereas weighted average assigns different importance to some numbers.

Use the weighted average if some values in the data set are more important than others. Use the simple average if all values in the data set contribute equally.

Average = (Sum of All Numbers) / (Total Number of Numbers)

Add together the group of numbers. Then, divide by how many numbers you added together.

For example, you want to find the average of three sets of numbers—5, 10, and 15.

Average = (5 + 10 + 15) / (3)

Average = 10

Weighted Average = (Sum of the Products of Values and Weights) / Sum of All Weights

Sum of the Products of Values and Weights = Each Value X Assigned Weight

Let’s say you sell two products at different prices. You sell Product A for $100, and you sell 300 units during the month. You sell Product B for $50, and you sell 500 units during the month.

Weighted Average = [($100 X 300) + ($50 X 500)] / (500 + 300)

Weighted Average = ($30,000 + $25,000) / 800

Weighted Average = $55,000 / 800

Weighted Average = $68.75

Struggling with complex calculations and disorganized records? Use Patriot’s accounting software for small business to track expenses, generate reports, and stay tax-ready. Try it for free today!

This is not intended as legal advice; for more information, please click here.