Approximately 70% of businesses have outstanding debt. Does yours? If so, it’s time to learn how to minimize debt and get your finances back on track. Read on to learn more about business debt and ways to eliminate it.

Business debt overview

So, what exactly counts as business debt? For starters, debt is money your business owes to another party.

There is both long-term and short-term debt. Long-term debt has maturity of a year or more (e.g., bonds, contracts, etc.). Short-term debt is due within a 12-month period (e.g., accounts payable).

Small businesses may go into debt because they:

- Overspend

- Don’t pay bills on time

- Don’t understand their finances

- Have bad cash flow management

- Make poor financial decisions

In many cases, a business may intentionally take on debt to grow their company (e.g., take out a loan to open a new location). However, some businesses take on too much debt, which can cause financial issues.

How to minimize debt in business

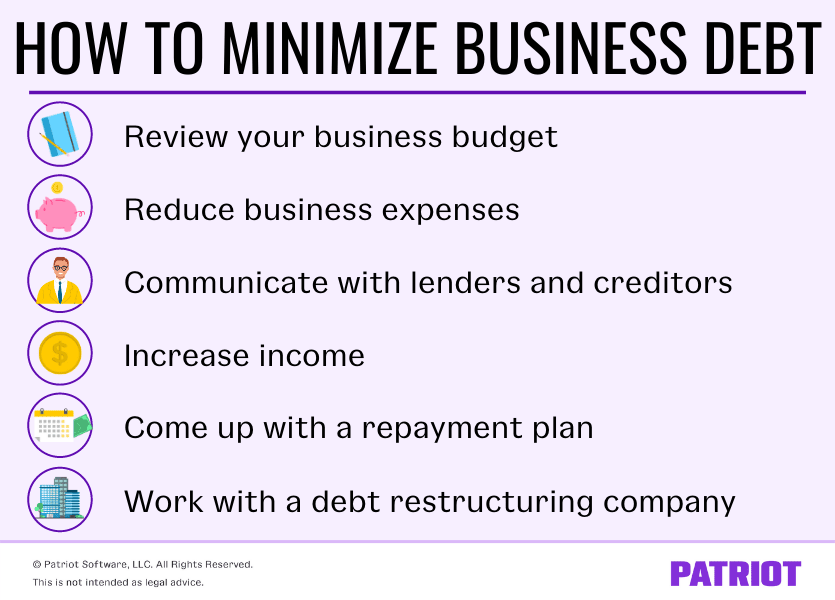

Feel like your business is drowning in debt? If so, don’t panic just yet. You still have time to turn things around by using some debt reduction strategies. Check out these six tips to get started.

1. Review your business budget

So when it comes to minimizing debt, where do you start? First things first, get to know your numbers by assessing your small business budget.

Your business budget is an important tool for your business. It can help you track progress, project cash flow, and reduce risks. Ultimately, it shows you exactly where your money is going.

Before you can even begin reducing your business debt, you need to have a thorough understanding of your budget. Ask yourself some questions like:

- What am I spending money on?

- Should I be spending money on XYZ?

- Where can I cut costs?

- What kinds of debt do I have?

- What are my priorities?

Once you know the answers to the questions above, you can begin reworking your budget and coming up with a game plan to bounce back from debt.

2. Reduce business expenses

One of the other ways to eliminate debt is reducing expenses. Now, this may not come as a shocker to most of you, but it’s definitely a necessary step for minimizing debt.

Take a look at your budget and determine what your business can live without. What business expenses can you cut out? Which ones are necessary to run your business? Here are some expenses you can potentially cut back on:

- Subscriptions

- Memberships

- Utilities

- Advertising

- Office supplies (e.g., paper)

Depending on your expenses, you may even be able to negotiate reduced prices with vendors. Or, you may be able to take advantage of a payment plan. Before cutting any costs (especially ones you are on the fence about), research your options. Which leads us to Step 3…

3. Communicate with lenders and creditors

If you find yourself falling behind on payments, consider contacting your creditors and lenders to see if you can negotiate payment arrangements. After all, the worst they can say is “no,” right?

Check with your creditors or lenders to see if you can:

- Extend payment terms on any outstanding invoices

- Use a loan consolidation program (aka consolidate your loans into one payment)

- Apply for a hardship plan for a lower interest rate and payment extension

- Renegotiate the terms of your loans

- Negotiate an early payment discount on new purchases

Use your cash flow statement to determine where to start. It will show you the payments you’ve missed and your delinquent accounts. If you’re unsure about the best route to take, consider consulting an accountant for assistance.

4. Increase income

It’s no secret that the more income you generate, the better. And if you want to get rid of business debt, you need to have income to pay it off.

So, how can you give your revenue a boost? Here are some ways:

- Raise your prices

- Lower your prices

- Upsell and cross-sell

- Sell unused inventory

- Diversify (e.g., add an additional product to your offerings)

- Offer discounts

- Follow up with customers who owe you

Boosting your income is no easy task. But, trying a few of the above techniques can help you get there.

5. Come up with a repayment plan

If you’re serious about wanting to reduce business debt, you need to come up with a plan and set a timeline for yourself.

To motivate yourself to minimize debt, establish a timeline for when you want to pay off your debts to keep yourself accountable. Set debt repayment goals on your calendar. For example, you may set a goal of paying off $2,000 of debt by the end of March.

To create your plan:

- Determine how much money you owe in total, including interest

- Decide how soon you want to pay off your debt (e.g., five years)

- Set your deadline (and stick to it)

- Set repayment goals (e.g., pay off $X per month for the next X years)

6. Work with a debt restructuring company

If your debt is too much to handle or you’re struggling to get out of debt on your own, consider working with a debt restructuring company.

A debt restructuring company works with creditors and debt collection agencies for you and can negotiate or change existing credit agreements.

Keep in mind that hiring a debt restructuring company will cost you. But depending on your debt situation, it might be well worth it in the long run.

Want to better manage your business’s finances? Give accounting software a go. With Patriot’s online accounting software, you can take complete control of your money and streamline the way you record transactions. Try it for free today!

This is not intended as legal advice; for more information, please click here.