If you sell products at your business, you likely have some form of inventory. Knowing how much inventory you have on hand, as well as how much you need to have in stock, is a crucial part of running your business. To help keep track of inventory, you need to learn how to record inventory journal entries.

Inventory overview

Before we dive into accounting for inventory, let’s briefly recap what inventory is and how it works.

Inventory, also known as stock, is all of the goods and materials your business stores to eventually sell. Inventory includes things like:

- Items

- Goods

- Merchandise

- Raw materials

- Supplies

Your business’s inventory includes raw materials used to create finished products, items in the production process, and finished goods.

Inventory can be expensive, especially if your business is prone to inventory loss, or inventory shrinkage. Inventory loss can occur if an item or product gets damaged, expires, or is stolen.

Perpetual and periodic inventory options

When it comes to inventory accounting entries, you have a few options:

- Perpetual inventory

- Periodic inventory

- Mixture of both methods

Perpetual inventory is an accounting method that records the sale or purchase of inventory through a computerized point-of-sale (POS) system. With perpetual inventory, you can regularly update your inventory records to avoid issues, like running out of stock or overstocking items.

A perpetual inventory system keeps continual track of your inventory balances. And, it automatically updates when you receive or sell inventory. Not to mention, purchases and returns are immediately recorded in your inventory accounts.

On the other hand, periodic inventory relies on a physical inventory count to determine cost of goods sold and end inventory amounts. With periodic inventory, you update your accounts at the end of your accounting period (e.g., monthly, quarterly, etc.).

Inventory journal entries

Now onto the part you’ve all been waiting for: recording an inventory journal entry.

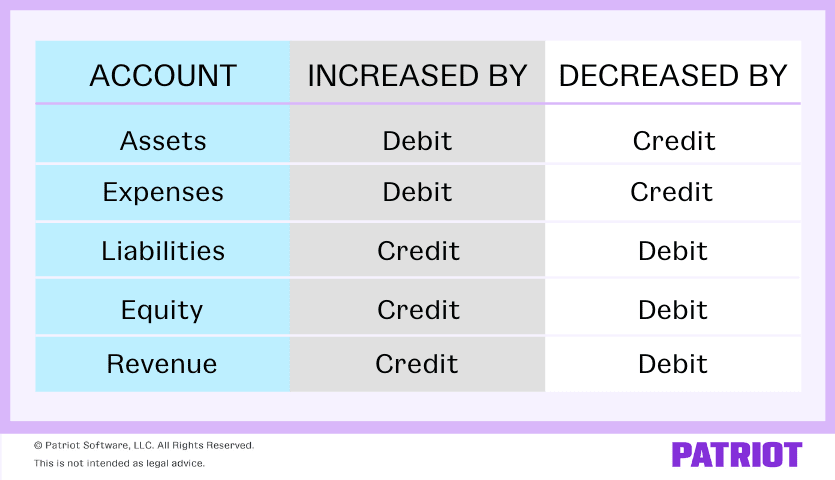

Your inventory is a type of asset. An asset is physical or non-physical property that adds value to your business. As you know by now, debits and credits impact each type of account differently. Assets are increased by debits and decreased by credits.

For reference while you’re making inventory journal entries, check out this chart:

There are a number of accounts that can come into play when it comes to recording journal entries for inventory. Here are a few you may recognize while recording inventory transactions in your books:

- Inventory (of course)

- Accounts Payable

- Cost of Goods Sold

- Raw Materials Inventory

- Merchandise Inventory

- Work-in-process Inventory

- Finished Goods Inventory

Keep in mind that the above accounts are not all-inclusive. Depending on your transactions and books, your accounts may look or be called something different.

Inventory journal entry examples

Let’s take a look at a few scenarios of how you would journal entries for inventory transactions.

Inventory purchase journal entry

Say you purchase $1,000 worth of inventory on credit. Debit your Inventory account $1,000 to increase it. Then, credit your Accounts Payable account to show that you owe $1,000.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Inventory | 1,000 | |

| Accounts Payable | 1,000 |

Now, let’s say you purchased your inventory using cash instead of credit. Your journal entry would look something like this:

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Inventory | 1,000 | |

| Cash | 1,000 |

Because your Cash account is also an asset, the credit decreases the account.

Manufacturing a product

Take a look at the inventory journal entries you need to make when manufacturing a product using the inventory you purchased. To do this, record three separate journal entries.

Raw materials

Now, let’s say you bought $500 in raw materials on credit to create your product. Debit your Raw Materials Inventory account to show an increase in inventory. And, credit your Accounts Payable account $500.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Raw Materials Inventory | 500 | |

| Accounts Payable | 500 |

Work-in-process

After you receive the raw materials, you will eventually use them to create your product. When that happens, record it in your books.

To show that raw materials have moved to the work-in-process phase, debit your Work-in-process Inventory account to increase it, and decrease your Raw Materials Inventory account with a credit.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Work-in-process Inventory | 500 | |

| Raw Material Inventory | 500 |

Finished goods

Finally, when you finish the product using the raw materials, you need to make another journal entry.

Debit your Finished Goods Inventory account, and credit your Work-in-process Inventory account.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Finished Goods Inventory | 500 | |

| Work-in-process Inventory | 500 |

Item ready to be sold

When an item is ready to be sold, transfer it from Finished Goods Inventory to Cost of Goods Sold to shift it from inventory to expenses.

Debit your Cost of Goods Sold account and credit your Finished Goods Inventory account to show the transfer.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Cost of Goods Sold | 500 | |

| Finished Goods Inventory | 500 |

Cash sale

When you sell to a customer, you’re getting rid of inventory. So, you need to record it.

Say a customer pays for a product in cash. Debit your Cash account to record the increase in cash. To account for how much the item cost you to make, debit your Cost of Goods Sold account. You also need to credit your Revenue account to show an increase from the sale, and credit your Inventory account to reduce it. Your journal entry should look something like this:

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Cash | 500 | |

| Cost of Goods Sold | 300 | ||

| Revenue | 500 | ||

| Inventory | 300 |

Recording inventory journal entries in your books doesn’t have to be a painful process. Patriot’s online accounting software makes it a breeze to record income and expenses so you can get back to business. Try it for free today!

This is not intended as legal advice; for more information, please click here.