Did you structure your business as a sole proprietorship? Do you want to move beyond your sole proprietorship status? If your business structure just isn’t cutting it, one of your options is to change sole proprietorship to LLC.

And here’s the thing—you’re not alone. Although sole proprietorships are the most popular type of entity for non-employers, things change. Whether you experience business growth, want to reduce your personal liability, or both, you may decide the increasingly popular LLC is for you.

Read on to learn the difference between the two types of business entities, why it could help your business, and how to change from sole proprietor to LLC.

Sole proprietorship vs. LLC

Before we get into the process of going from sole proprietorship to LLC, let’s go over the difference between them.

| Sole Proprietorships | Limited Liability Companies |

|---|---|

| Owned by one person | Owned by one person or more (called members) |

| Easy and affordable to form | Moderately easy and affordable to form (in most states) |

| Considered the same legal entity as the owner | Considered different legal entities than the owners |

| Are taxed as sole proprietorships | Can be taxed as a corporation, partnership, or part of the owner’s tax return (i.e., a “disregarded entity) |

The biggest difference between the two? With a sole proprietorship, you are responsible for all business losses, debts, and liabilities. On the other hand, a limited liability company grants you—you guessed it—limited liability, meaning your personal assets aren’t at risk. This is just one of the benefits of running an LLC, which brings us to…

Benefits of switching from sole proprietor to LLC

It can be hard to know if changing from a sole proprietorship to an LLC is the right move for you. Take a look at some advantages of running an LLC to help you decide:

- Limited liability

- Pass-through taxation

- Ease of establishment

LLCs combine aspects of corporations and partnerships. An LLC separates business and personal liabilities, so your assets are protected (aka owners are not liable for business debts). There is also a shared tax responsibility between members of a multi-member LLC, like a partnership.

Like anything, consider the cons of structuring as an LLC before taking the plunge. Some disadvantages include having to file additional tax forms and the inability to issue stock.

Steps to change sole proprietorship to LLC

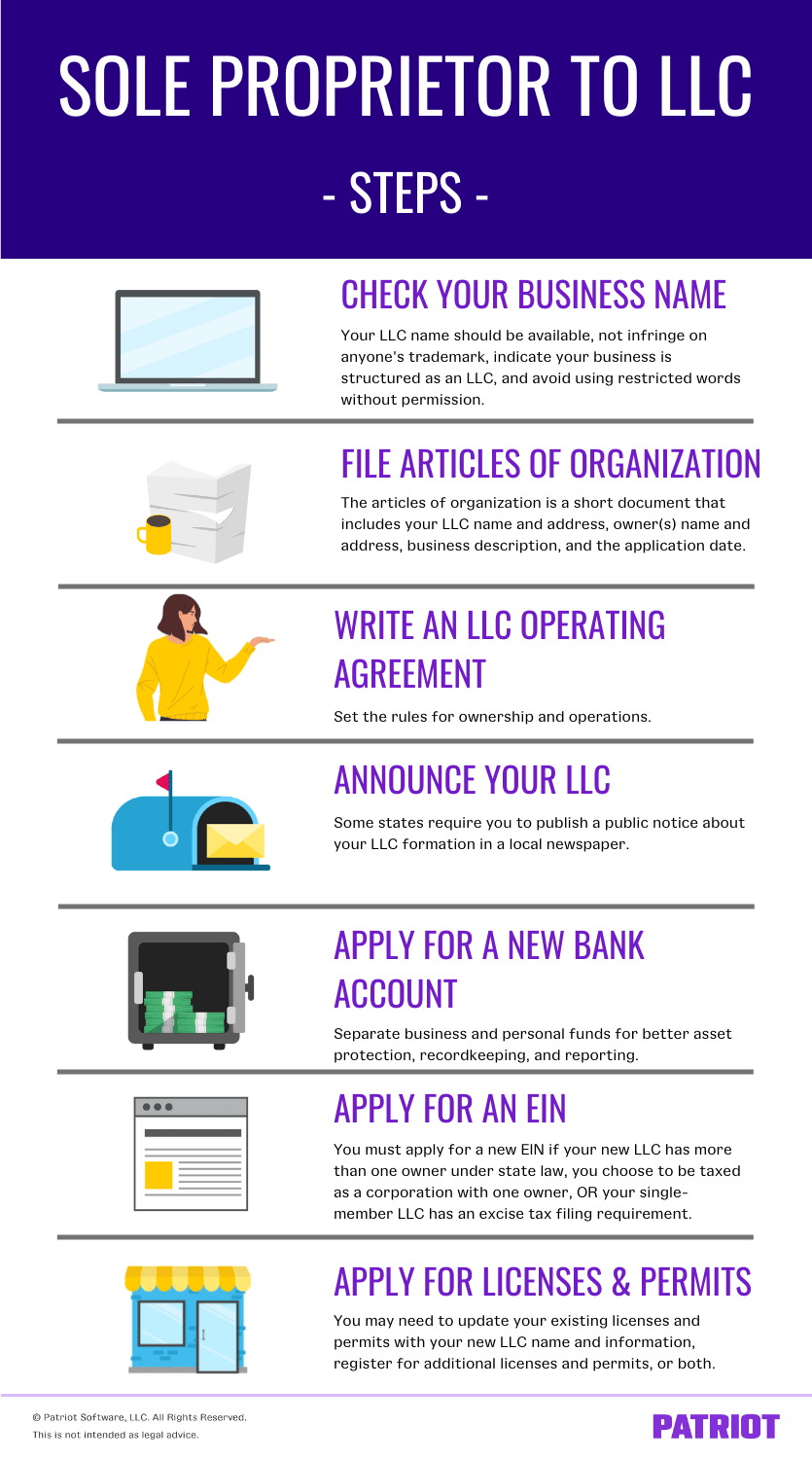

Ready to grow your business and protect your personal property? To convert your sole proprietorship to LLC, follow these seven steps.

1. Check your business name

One of your first questions might be: Can I switch from sole proprietorship to LLC? Absolutely! But generally, you need a unique business name that follows your state’s rules.

Your LLC’s name should:

- Be available for use. Your current business name might already be registered to another LLC in your state. If that’s the case, you cannot operate as an LLC under that name, even if you’ve been using it as a sole proprietorship. Contact your state’s secretary of state office or online database for registered business names for availability. You can also have a legal professional help you propose a name for your LLC.

- Not infringe on anyone’s trademark. Once you’re sure no one in your state uses your business name, make sure it doesn’t infringe on anyone’s trademark. Use the United States Patent and Trademark Office’s database to search trademarks.

- Indicate your business is structured as an LLC. Your new LLC name must include a variation of the words “limited liability company.” For example, your name may end in “Limited Liability Company,” “LLC, “Ltd,” or “Limited Liability.”

- Avoid using restricted words without permission. Many states prevent businesses from using certain words in a name without permission. Examples of words your state may restrict include “insurance,” “chamber of commerce,” and “bank.”

2. File articles of organization

To form an LLC, you must fill out an official form, known as articles of organization, and send it to your state’s filing office. Each state has different requirements for the articles of organization.

The articles of organization is a short document outlining details about your business. Information on the articles of organization include:

- LLC name and address

- Owner(s) name and address

- Business description

- Date of application

You need to pay a fee to submit your articles of organization. Submission fees can range from as little as $40 to as high as $3,000. However, most states have filing fees of around $100.

The articles of organization usually require a registered agent to receive legal papers. If you are the sole owner of the LLC, you are the registered agent. If you have a multi-member LLC, appoint one member as the registered agent.

Alert! Avoid confusing articles of organization with articles of incorporation. Articles of incorporation are the documents you need to form a corporation.

3. Write an LLC operating agreement

An LLC operating agreement sets the rules for ownership and operations. This document maps out how the business will be managed. The operating agreement includes details about the LLC members’ rights and responsibilities, voting power, and portions of profits and losses.

You don’t have to submit an operating agreement to any government or legal organization. But if you have more than one member, it’s a good idea to create one. An LLC operating agreement reduces conflict between members.

4. Announce your LLC

Extra, extra, read all about it! Some states (Arizona, Nebraska, and New York, to be exact) require you to publish a public notice about your LLC formation. You can publish the announcement in a local newspaper.

You might need to publish the notice several times and submit written proof to the LLC filing office. Check with your state to see the exact requirements for publishing a notice.

5. Apply for a new bank account

Don’t have a separate bank account for business? Opening a bank account under the name of your new LLC helps you separate business and personal funds.

Separating business and personal funds is key to:

- Protecting your personal assets

- Keeping records

- Reporting taxes

6. Apply for an EIN

In most cases, you need to register for a new Employer Identification Number (EIN) with the IRS, even if you already had one for your sole proprietorship.

According to the IRS, you need to apply for a new EIN if:

- Your new LLC has more than one owner under state law,

- You choose to be taxed as a corporation (C or S corporation) with one owner, OR

- Your single-member LLC has an excise tax filing requirement

For more information on whether you need a new EIN for your new LLC, check out the IRS’s website.

7. Apply for business licenses and permits

Have any licenses and permits for your sole proprietorship? You may need to update those with your new LLC name and information. And, you may need to register for additional business licenses and permits for your LLC.

Check with your state to find out which types of licenses and permits apply to your business. Examples include:

- Business license

- Seller’s permit

- Zoning permit

This article has been updated from its original publication date of October 5, 2017.

This is not intended as legal advice; for more information, please click here.