Business assets are items of value that significantly contribute to your small business net worth. You need to properly calculate, take care of, and record your business’s tangible assets. Learn about tangible assets below.

What are tangible assets?

Tangible assets are physical items of value that you can see and feel. Tangible assets include land, cash, equipment, vehicles, inventory, and other property your business owns.

Classifying your tangible assets is important for your records. You might have two types of tangible assets.

- Current assets

- Fixed assets

Current assets are liquid assets you can easily convert into cash within one year of purchasing them. Examples include inventory, cash and cash equivalents, accounts receivable, and other liquid assets.

These assets are more liquid than fixed assets. However, you generally can’t depreciate current assets.

Fixed assets are long-term assets that cannot be easily converted into cash within one year. Examples of fixed assets in business include buildings, machinery, and equipment.

Although fixed assets are not liquid, you can typically depreciate their value in your books to lower your tax liability.

Tangible assets aren’t the only valuable property your business has. You can also have intangible assets, which are items of value you can’t physically touch, like patents, trademarks, copyrights, and licenses. Tangible assets are the opposite of intangible assets.

Tangible assets accounting

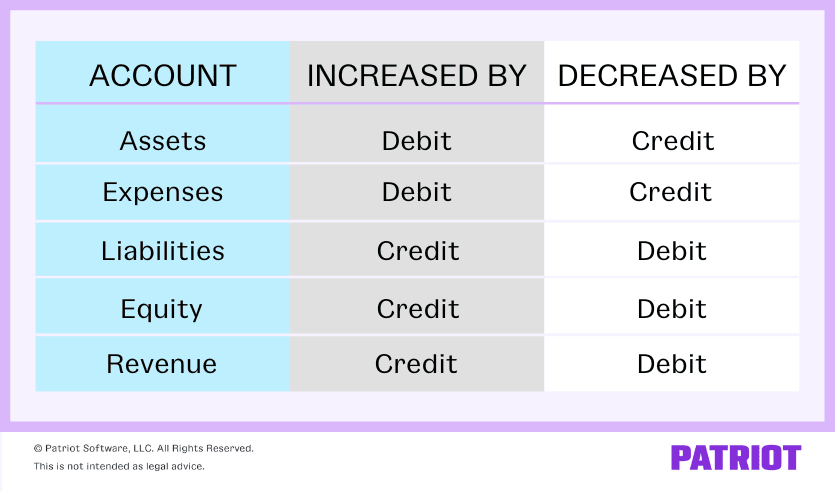

When you purchase tangible assets, you need to record the transaction in your accounting books. Use this chart to determine how to record assets:

Assets are increased by debits and decreased by credits. You must have balancing accounts in your double-entry books.

Let’s say you buy $10,000 worth of inventory. You need to debit your inventory account because you are increasing the amount of inventory you have. And, you need to credit your cash account because you are spending money.

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| 1/9/2018 | Inventory Cash | Supplies | 10,000 | 10,000 |

Depreciation

Businesses use fixed assets for a long time. But when you use the same asset for over a year, it can lose value.

Depreciation lets you allocate the cost of a fixed tangible asset over the course of its useful life. This decreases your tax liability. And, it lets you spread out the cost in your accounting books.

A tangible asset’s useful life is the duration it adds to your business’s value. For example, a computer would have a useful life of five years, per IRS Publication 946. You would depreciate the computer’s value over the course of five years in your books.

When you depreciate your assets, you must list the expense on your company’s small business income statement.

The IRS sets rules and limits for calculating depreciation expense. And, there are two methods of depreciation you can use:

- Straight-line depreciation: Spread the cost evenly across the asset’s expected lifespan

- Accelerated depreciation: Deduct a higher percentage of the property’s total cost in the first few years

When you depreciate assets, entries in your accounting books are different than recording current assets. You must debit your expense account and credit your accumulated depreciation account.

Let’s say you purchase a car for $10,000. Using Publication 946, you know that cars have a useful life of five years. You use the straight-line depreciation method to spread out the cost evenly.

$10,000 (Initial Cost) / 5 (useful life) = $2,000

Your annual depreciation expense is $2,000. So, you would record entries of $2,000 each year, debiting your depreciation expense account and crediting your accumulated depreciation account.

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| 12/29/2017 | Depreciation Expense Accumulated Depreciation | Car | 2,000 | 2,000 |

Tangible assets on balance sheet

You must record your tangible assets on your business balance sheet. A balance sheet is a type of financial statement that tracks your business’s progress by showing your assets, liabilities (what you owe), and equity (remaining money after paying expenses).

Separate current assets from fixed assets on the balance sheet. Record current assets for the same year you accumulate them. Because you can depreciate fixed assets, record them at their cost minus what you have depreciated. Using the above example, let’s say you have already recorded $4,000 as depreciation expenses. You would record your car as $6,000 ($10,000 – $4,000) on the balance sheet.

List assets on the balance sheet from most to least liquid. Current assets are first, followed by fixed assets and then intangible assets. Your liability and equity accounts are after your total assets.

You must list your assets on one side of the balance sheet and your liabilities and equity on the other. You want your assets to equal your total liabilities and equity.

Net tangible assets

Investors and lenders want to know your business’s worth before giving you money. If you are trying to obtain an investment or loan, you need to know the value of your business’s assets.

To learn how many physical assets your business has after deducting your liabilities and intangible assets, you need to know how to calculate net tangible assets.

Here is the net tangible assets formula:

Net Tangible Assets = Total Assets – Intangible Assets – Total Liabilities

Let’s say your business has $10,000 in total assets and $4,000 in intangible assets. You also have $3,000 in liabilities. Use the above formula to find your net tangible assets.

$10,000 – $4,000 – $3,000 = $3,000

Your business has $3,000 in net tangible assets.

Return on net assets

Sometimes incorrectly referred to as return on tangible assets, return on net assets (RONA) measures how well your business is using its assets. The higher your return on net assets, the better your business is performing.

To find RONA, divide net income (revenue – expenses) by your fixed assets and net working capital. You can find net working capital by subtracting your business’s current liabilities from its current assets.

RONA = Net Income / (Fixed Assets + Net Working Capital)

Let’s say you have a net income of $50,000, fixed assets worth $85,000, and net working capital of $40,000.

$50,000 / ($85,000 + $40,000) = RONA

RONA = 0.4

Your return on net assets is 40%.

Looking for a simple way to keep your accounting books up to date and accurate? Try Patriot’s online accounting software. Our software is easy to use because it’s made for the non-accountant. And, we offer free, U.S.-based support. Get your free trial today!

This article has been updated from its original publish date of November 4, 2015.

This is not intended as legal advice; for more information, please click here.