Your small business budget is an important tool for your company. It guides your spending habits throughout the year, helps you avoid overspending, and helps you make important financial decisions. But, budgets aren’t one-size-fits-all. Every business’s budget looks a little different. And, there are a number of different types of business budgets to keep on your radar.

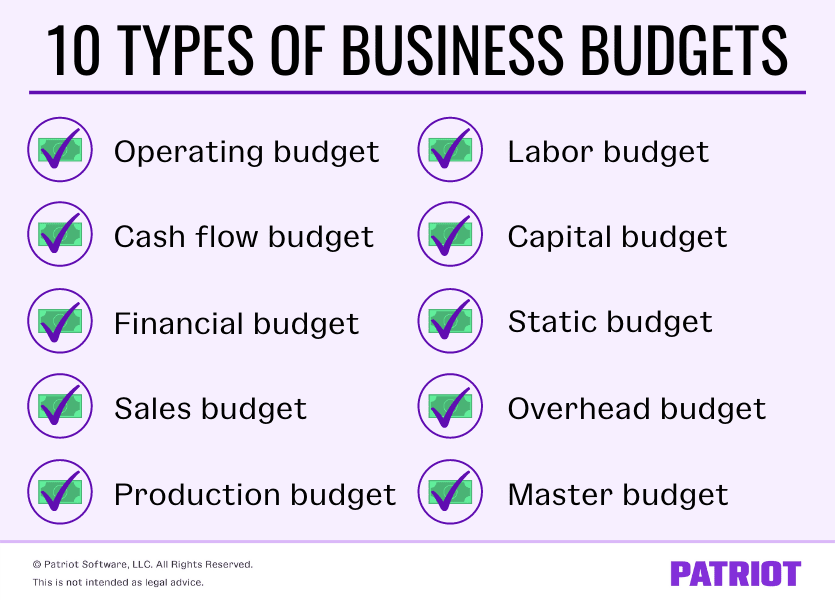

10 Types of business budgets

Business budgets are kind of like snowflakes. Each business has its own unique budget that they need to stick to. And, some businesses may have a set of different business budgets to keep track of. So, what are the types of budgets in business? Find out for yourself below.

1. Operating budget

An operating budget, or operational budget, consists of all expenses and revenues your business expects to use for its operations. Your operating budget outlines the funds your company needs to operate efficiently.

Generally, operating budgets break down things like fixed and variable costs, revenue, and other expenses. Like with all budget types in business, operating budgets can vary depending on the business and its operations.

In most cases, your operating budget is a combination of a few other budgets, including:

- Sales

- Production

- Direct materials

- Direct labor

- Overhead

- General and administrative expenses

2. Cash flow budget

One of the biggest components of business budgeting is managing and forecasting cash flow. Your cash flow, or cash, budget gives you a prediction of the money that comes in or goes out of a business during a certain period of time (e.g., a year).

Your cash flow budget can help you make important financial decisions, detect issues, and prevent overspending.

The goal of your cash budget is to ensure there is enough money coming in to cover any money that goes out. If you don’t have enough money to offset expenses, you could wind up in negative cash flow territory.

3. Financial budget

To understand how much money you need to reach short- and long-term needs, draft a financial budget. A financial budget factors in assets, liabilities, and equity (aka components of your balance sheet).

Your business’s financial budget can give you an overall idea of your company’s health and stability. This type of budget can be especially helpful if you’re seeking funding or considering an initial public offering.

4. Sales budget

Another type of budget you may want to consider establishing is a sales budget. A sales budget projects your sales revenue and expenses and how much you’ll sell in a specific period of time.

Creating a sales budget allows you to plan and make adjustments to your spending. To make your sales budget, you need to:

- Make a list of your business’s offerings

- List out each offering’s price point

- Review last year’s (or period’s) sales figures to create a projection

Having an accurate sales budget ensures you have plenty of materials and inventory on hand to keep up with customer demand. And, your sales budget helps lay the foundation for your…

5. Production budget

Your production budget tells you how much of each product to produce to meet sales needs and inventory requirements. This type of business budget helps determine operating aspects like:

- Direct labor

- Direct materials

- Overhead

To put together a production budget, you need the expected number of units to be sold (based on last period’s data), required level of ending inventory, and number of units in your beginning inventory (if applicable).

Your production budget helps determine the cost of production, and in turn, helps decide the price of the product.

Keep a close eye on your production budget. If sales and demand increase or decrease, adjust your production budget accordingly.

6. Labor budget

If you have employees or plan on hiring employees, consider creating a labor budget. A labor budget can help you determine how many employees you need to achieve a certain level of production and plan payroll costs.

In addition to helping you plan out staffing, a labor budget can assist you when it comes to allocating expenses for seasonal workers.

Use payroll forecasting to create your labor budget.

7. Capital budget

A capital budget can help you plan for purchases of large assets, such as:

- Machinery

- Property

- Vehicles

A business’s capital budget lays out the cost of the asset, the expected payback period, and the asset’s potential return on investment. Your capital budget can tell you whether or not the purchase would be a good investment.

8. Static budget

Some businesses with predictable sales and expenses may create a static budget. A static budget doesn’t change throughout the year. You can use a static budget to spot differences and evaluate sales performance.

A static budget is not impacted by sales volume or any other changes in the business. Some types of expenses in a static budget may include:

- Software

- Contractor fees

- Subscription fees

- Warehouse rent

- Utilities

- Supply costs

Include any expenses that remain unchanged (or fixed) throughout the period in your static budget.

On the other hand, if you have expenses that constantly change, use a flexible budget. A flexible budget fluctuates with changes in sales and production.

9. Overhead budget

An overhead budget includes fixed and variable overhead costs for a specific period.

Variable costs vary based on your sales activity (e.g., commissions). Fixed costs stay the same, no matter what happens to your sales. Fixed costs are the expenses you must pay to run your business (e.g., rent).

Outline all of your variable and fixed overhead costs in your overhead budget.

10. Master budget

A master budget is a combination of all of your business’s individual budgets. Your master budget gives you a complete financial picture of your company. And, it can show you where certain income and expenses fit in overall in the business.

Master budgets are more common for larger businesses. However, small businesses can also use a master budget to break down their finances by category or department.

Use your master budget to plan what you need to do to reach business and financial goals. Your master budget may consist of a number of different budgets, including:

- Sales

- Production

- Cash flow

- Operating

Preparing any type of business budget

Your business budget acts as a roadmap for your company’s finances. To ensure your budget keeps your finances on track, follow these steps when creating a budget for your business:

- Add up income

- List out variable costs

- Determine variable costs

- Account for additional and unexpected expenses

- Analyze your cash flow

- Outline your budget

- Tweak when necessary

Once you establish whichever types of business budgets your heart desires, revisit them from time to time to ensure that they’re up-to-date and accurate.

Are you on track with your business budget? Patriot’s online accounting software helps you record transactions and keep your books up-to-date. Plus, we offer free, USA-based support. What are you waiting for? Try it for free today!

This is not intended as legal advice; for more information, please click here.