Your roof starts leaking. So, you hire a contractor to put in a new one. At the end of the job, you receive a piece of paper (an invoice) from the contractor billing you for their services. And if your business sells goods or services to customers and doesn’t collect money immediately, you’ll also have to send invoices. What is an invoice?

Invoicing is a key part of running a business. Read on to learn what is an invoice, how to create the document, and more.

Skip Ahead

What is an invoice?

An invoice is a bill sent to a customer after they receive a product or service. If a customer purchases something without paying immediately, you will send an invoice to collect payment. You might also receive invoices from your vendors if you purchase something on credit.

Businesses can distribute invoices electronically (known as e-invoicing), in person, or through the mail. You can give invoices to customers with a delivered product or after a certain number of days following a sale.

There are also different types of invoices for small business, including:

- Proforma invoice

- Interim invoice

- Final invoice

- Past due invoice

- Recurring invoice

The type of invoice you send depends on what action you want the customer to take, your business, and the circumstances of your sale. For example, you may send interim invoices to a customer while working on a large, ongoing project.

Invoice vs. estimate

If you send invoices to customers, you may also need to create and send estimates. But estimates and invoices aren’t the same.

An estimate is a document that goes over the approximate amount you plan on charging a customer. Typically, you create and send estimates before the project begins. Unlike an invoice, the estimate does not ask for payment.

Invoice vs. purchase order

A purchase order is a document buyers use to place an order with a seller. Whereas a seller creates an invoice to request payment from buyers, a buyer creates a purchase order to request a product or service from sellers.

What is the purpose of an invoice?

An invoice is more than a request for money. It also:

- Serves as a record for both you and your customer

- Helps you track accounts receivable

- Reminds customers to pay you

1. Serves as a record for both you and your customer

An invoice helps you stay organized and knowledgeable about sales and cash flow. It is also a record for the person receiving the bill.

If you use accrual accounting, record the invoice amount as accounts receivable (AR) in your books. Accounts receivable (AR) is any money owed to your business from a sale on credit. Invoices help you make sure your accounting books are accurate.

2. Helps you track accounts receivable

You can track invoice statuses through an aging of accounts receivable report. This report shows you the number of days payment is past due.

3. Reminds customers to pay you

When it comes down to it, an invoice is what leads to a payment from a customer. Without one, and without it done correctly, you could have slow cash flow. To get cash from customers, you need to remind them that they owe you money with an invoice.

You might need to send subsequent reminders if the customer won’t pay you. Continue to contact the customer (politely) if they have not paid past the due date. If a customer loses their invoice, send them another one.

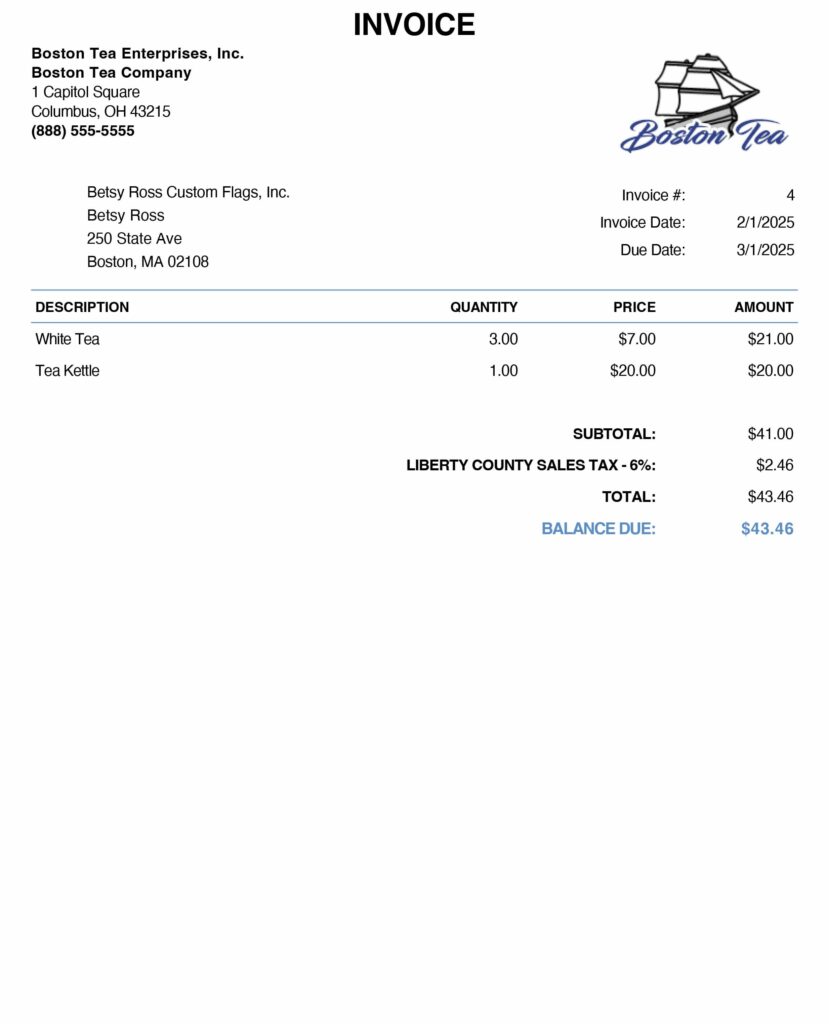

Parts of an invoice

Clearly label an invoice so a customer knows what it is. All invoices should include the same basic information:

- Invoice date

- Customer information

- Seller information

- Goods and/or services purchased

- Total amount due

- Payment terms

- Invoice number

Invoice date

Include the date you created the invoice. This shows customers when you recorded the transaction. And, customers can use the date to determine their due date, especially if you offer an early payment discount.

The date will make it easier for you to stay on top of past-due customer invoices as you move them through your aging of accounts receivable report.

Customer information

Who’s the customer you are billing? Include their information on the invoice for recordkeeping and to avoid confusion.

Clearly state the customer’s:

- Name

- Business (if applicable)

- Address

- Phone number

Seller information

In addition to customer information, you should also include your business information on the invoice. That way, customers know who is billing them and can contact you if they have any questions.

Include your company’s:

- Name

- Address

- Email address

- Phone number

Goods and/or services purchased

What did the customer buy? A good description of the purchase will alleviate potential confusion.

Clearly label the:

- Products or services

- Quantities

- Pricing of each

Total amount due

After adding up the total and sales tax (if applicable), list out the total amount the customer owes you. If they paid part of the total at the time of purchase, make sure to account for that.

Payment terms

You invoice the customer … but they’re confused about how to pay. So, there’s a payment delay. Nobody wants that! Include invoice payment terms detailing everything a customer needs to know to make the payment.

Payment terms include:

- When the payment is due

- Payment methods you accept

- Where the customer can make checks payable to

- Early payment discounts, if applicable

Invoice number

When you create an invoice, be sure to number it. And, make a note of the number in your business records. A number will let you easily look up the invoice in the future.

Let’s say a customer calls with questions about what they owe. They can give you the number so you can find them in your system.

How to create an invoice

Regardless of how you invoice customers, you should understand the above parts of an invoice. It’s an integral document for collecting money, after all.

You can create invoices by hand, or use an invoice generator to create invoices with templates or accounting software.

Accounting software is the easiest way to create and track your invoices. For example, Patriot’s Accounting Premium lets you:

- Customize invoices (choose a template, add your logo, and select an accent color)

- Convert estimates to invoices

- Create and track unlimited customers and invoices

- Accept credit card payments when customers pay their invoices

- Set up recurring invoices

- Set up invoice payment reminders

Steps to create an invoice:

- Know the parts of the invoice

Include the invoice date, customer information, seller information, goods and/or services purchased, total amount due, payment terms, and invoice number.

- Create by hand or use software

You can create invoices from scratch, use templates, or use accounting software.

- Double check your work

Review you invoice information before sending to your customer.

Example: Invoice template

You can use a free invoice template to make your job easier.

Here is a sample invoice:

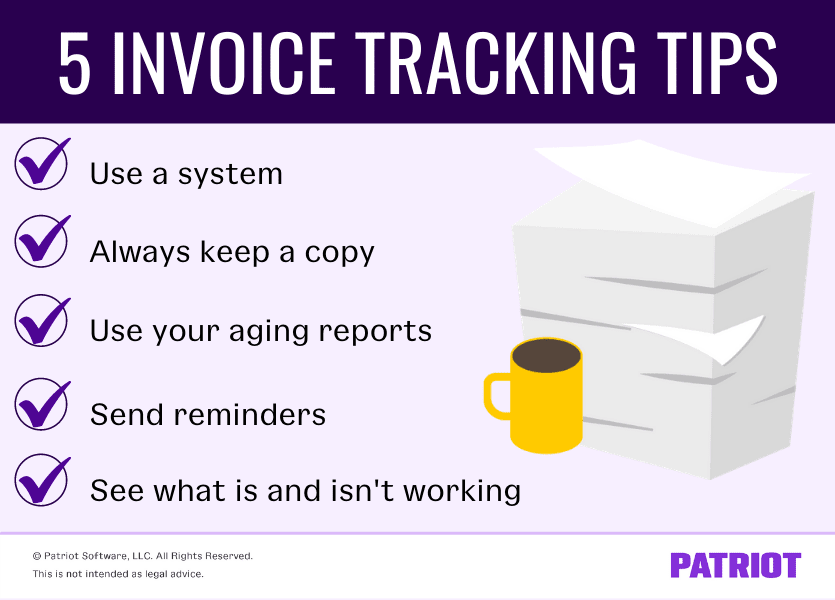

5 Invoice tracking tips

If you send invoices to customers, you need a tracking system. Why? Using a well-hashed invoice tracking system can help you:

- Monitor paid and unpaid invoices

- Take action when a customer’s payment is overdue

- Ensure you receive your accounts receivable

- Better balance your business’s cash flow

- Make decisions about letting customers make more purchases using credit

To make the process of getting paid smoother, take a look at the following invoice tracking tips.

1. Use a system

First things first: you need a system in place to help you track your invoices. Here are a few ways you can track invoices:

- Spreadsheet

- Invoice tracking software

- Accounting software

Using a spreadsheet means you must manually create an invoice tracker template to track your business’s invoices, which can be time-consuming. However, you don’t have to pay for this method with anything but your time.

Invoice tracking software does exactly what the name suggests: It gives you an automated way to create and track your invoices. However, invoice tracking software typically doesn’t provide detailed reporting like accounting software.

Using accounting software not only gives you the ability to track your invoices, but you also get extensive reports and other much-needed features for business. If you want to automate your invoices and your accounting books, accounting software may be the way to go. Not to mention, there are some providers that let you create and send estimates, convert estimates to invoices, accept credit card payments, and more.

2. Always keep a copy

Whether you’re sending out paper or electronic invoices, always save a copy of the invoice for your records.

If you’re using accounting software or invoice tracking software, the system acts as an automatic paper trail for you. That means you can access copies of your invoices whenever you want.

If you’re not using software, you can keep digital copies of each invoice you send out on your computer (e.g., in a folder). Or, you can keep paper copies stored in a filing cabinet.

3. Use your aging reports

Want to improve your invoice tracker process, identify and avoid cash flow problems, and easily see when all your accounts receivable are due? If so, create an aging of accounts receivable report.

Aging of accounts receivable reports show you the number of days an invoice is past due. Your accounts receivable (AR) is the money owed to you from customers. This report breaks it down even further to categorize overdue invoices in set blocks of time.

An accounts receivable aging report typically uses the following time frames:

- Current (due immediately)

- 1 – 30 days

- 31 – 60 days

- 61 – 90 days

- 91+ days

For example, you may have an invoice that’s 30 days overdue. The next day (31 days overdue), you’d move the customer into the 31 – 60 days time frame. This helps show you which customers have invoices overdue in which category. And, the report breaks down the amounts owed in each interval.

Your AR report may look something like this:

| Customer Name | Total Balance | Current | 1 – 30 Days | 31 – 60 Days | 61 – 90 Days | 90+ Days |

|---|---|---|---|---|---|---|

| Customer 1 | $4,000 | $0 | $1,200 | $800 | $2,000 | $0 |

| Customer 2 | $0 | $0 | $0 | $0 | $0 | $0 |

| Customer 3 | $500 | $150 | $0 | $100 | $0 | $250 |

| Totals | $4,500 | $150 | $1,200 | $900 | $2,000 | $250 |

Using an aging report is the best way to track your invoices by intervals to see who owes the most amount of money (and when).

Again, using software can streamline the process of managing your accounts receivable aging report. The software automatically moves invoices down the pipeline based on the number of days past due each invoice you’ve entered into the system is.

You can also opt for manually creating an AR report (e.g., invoice tracking spreadsheet) and updating it monthly.

4. Send reminders (+ automate the process!)

Using a system, creating copies, and creating an AR aging report give you the information you need to send reminders. That’s why sending reminders made our top five list of invoice tracking tips.

When tracking invoices, you need to send reminders to customers asking them for payment. These gentle nudges remind customers that their invoices are past due. And, payment reminders can help customers better track their accounts payable.

If you use software, you may not have to worry about sending reminders. You can set up automatic payment reminders for when invoices are past due a certain number of days.

5. See what is and isn’t working

Tacking on late fees? What about an early payment discount? Find out what is and isn’t working with your current process to improve invoice tracking.

Pay attention to your current payment tracker system to look for areas that you can improve on. You may find that you need to:

- Better articulate your payment terms

- Immediately invoice clients

- Offer a discount to customers who are willing to pay early

- Give customers an easier way to pay (e.g., accept digital payments)

- Set up a payment process for struggling customers

Ready to take your invoice process to the next level? With Patriot’s accounting software, you can create and track unlimited customers and invoices, accept credit card payments, and more. Take advantage of our free trial today!

This article has been updated from its original publication date of June 15, 2017.

This is not intended as legal advice; for more information, please click here.