Looking for information on the ERC Voluntary Disclosure Program? Check out our article for more information.

Think it’s too late to take advantage of the Employee Retention Credit? Think again. Employers now have until 2024 (and in some cases, 2025) to claim the credit retroactively. So, how do you know if you qualify for the credit? And, what are the steps for claiming Employee Retention Credit retroactively? Keep reading to find out.

Employee Retention Credit overview

The Employee Retention Credit (aka ERC or ERTC) is a fully refundable credit that businesses can claim on qualified employee wages. This credit was established under the CARES Act in 2020 during the beginning of the coronavirus pandemic to help relieve businesses across the country.

Other legislation, like the Consolidated Appropriations Act and American Rescue Plan Act, made some tweaks to the credit along the way. Here’s how the credit changed over the past few years:

- CARES Act: Employers could claim the credit against 50% of qualified wages (up to $10,000 per employee annually) paid between March 13, 2020 – December 31, 2020.

- Consolidated Appropriations Act: Qualified employers could claim a credit against 70% of qualified wages up to $10,000 per employee per quarter paid between January 1, 2021 through June 30, 2021.

- American Rescue Plan Act: Employers could claim a credit against 70% of qualified wages up to $10,000 per employee per quarter (no change). This extended the deadline to December 31, 2021 for qualified businesses.

To claim the credit in 2020 and 2021, employers had to use Form 941, Employer’s Quarterly Federal Tax Return.

Although businesses cannot take advantage of the ERC anymore, they now have until 2024 (and for some companies, 2025) to retroactively claim the credit by doing a look back on their payroll. You can do this by filing an amended return using Form 941-X.

Claiming Employee Retention Credit retroactively

Again, the Employee Retention Credit program is no longer available to businesses. But, some businesses may be able to claim the credit retroactively.

How? Businesses can conduct a look back to see if wages paid March 13, 2020 to the end of the program are eligible.

Most businesses can claim the credit on wages until September 30, 2021. However, some businesses can claim the credit on wages through December 31, 2021 (i.e., recovery startups with annual gross receipts of up to $1 million).

The deadlines for claiming ERTC retroactively have been extended until 2024 and 2025. Here is a quick look at the new deadlines:

- April 15, 2024: File amended returns for Quarters 2, 3, and 4 of 2020

- April 15, 2025: File amended returns for Quarters 1, 2, 3 and 4 of 2021

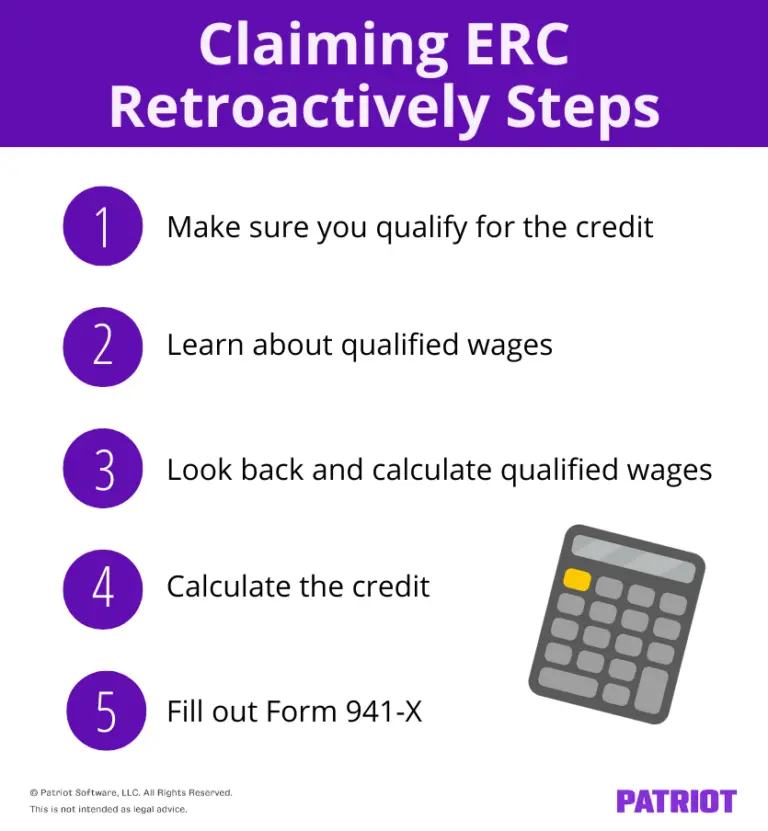

Keep in mind that not every employer is able to claim the credit retroactively. You have to meet a few requirements first. To take advantage of the retroactive Employee Retention Tax Credit, follow the steps below:

1. Make sure you qualify for the credit

Before you do anything, make sure you actually qualify for claiming Employee Retention Credit retroactively.

Originally, only eligible employers could qualify for the Employee Retention Credit program. Eligible employers include employers who:

- Had to fully or partially suspend operations during any quarter in 2020 due to the coronavirus; OR

- Experienced a significant decline in gross receipts as a result of the coronavirus during any quarter in 2020 (e.g., drop below 50% of the comparable quarter amount in 2019)

Over time and with new legislation, this expanded to also include:

- Businesses who took out a Paycheck Protection Program (PPP) loan

- Companies that experienced a revenue decline of 90% or more

- Employers who began operations on or after February 15, 2020, and had average annual gross receipts under $1 million (aka Recovery Startup Businesses)

- Some employers who experienced a full or partial shutdown due to COVID-19 or a qualifying decline in their receipts in 2021

- New employers (including employers that did not exist for all or part of 2019) who were eligible for the credit

2. Learn about qualified wages

The ERC revolves around qualified wages. But, what exactly are they?

Qualified wages are wages and compensation you pay to employees (including tips subject to FICA tax). This includes qualified health plan expenses associated with said wages. For the credit, these wages had to be paid to some or all of your employees between March 13, 2020 – September 30, 2021 (or December 31, 2021 for some businesses).

Qualified wages partially depend on how many full-time equivalent (FTE) employees you had in 2019.

Legislation increased the small employer threshold from 100 FTE employees to 500. Employers with up to 500 FTE employees in 2019 can claim the ERC for 2021 on wages paid for working or non-working periods.

An employer with fewer than 500 employees was eligible for the credit, even if employees are working. Employers with more than 500 full-time equivalent employees in 2019 may claim the credit only for wages paid to an employee while the employee is not performing services for the employer.

3. Look back at qualified wages and employees

After you determine if you qualify for claiming retroactive employee retention credit, you need to look back and see if the wages paid from March 13, 2020 to the end of the program are eligible for the credit (September 30, 2021 for most businesses).

Do a look back on your payroll to see:

- Qualified wages paid to employees

- Number of FTEs

- How many employees you had during the period

To calculate the number of FTEs your business had during the period, you can use the following formula:

[(# of Part-time Employees X Total # of Part-time Hours Worked Per Period) / (Full-time Hours for the Period)] + # of Full-time Employees = FTEs

4. Calculate the credit

Next, calculate the credit. Keep in mind that the year and quarter can impact how much the credit is:

- March 13, 2020 – December 31, 2020: 50% of the wages paid up to $10,000 per employee, capped at $5,000 per employee per quarter

- 2021: 70% of the wages paid up to $10,000 per employee, capped at $7,000 per employee per quarter

Let’s say you have three employees in Quarter 3 of 2020. You pay two out of your three employees $10,000 in qualified wages during the quarter, and you pay the third employee $20,000 in qualified wages. Because the maximum is $10,000 in qualified wages per employee per quarter, your credit would be $15,000 ($5,000 X 3 employees) for the quarter.

Now, say you have one employee and you pay them $10,000 in qualified wages in Quarter 1 of 2021. As an employer, you would get a credit of $7,000 ($10,000 X 70%).

5. Fill out Form 941-X

Qualify for the claiming credit retroactively? Great! Now it’s time for one final step: Filling out Form 941-X.

Use Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, to claim the Employee Retention Credit retroactively. You must fill out a separate form for each applicable quarter (e.g., one form for Q3 2020 and another for Q4 2020).

To fill out Form 941-X,gather the following information:

- Employer Identification Number (EIN)

- Business name

- Trade name, if applicable

- Business address

Fill out the five parts of the form. Once you complete the form, you can mail it to the IRS for review.

Again, you have until 2024 (and, in some cases, 2025) to fill out this form for the credit.

Need an easy and affordable way to manage employee wages and payroll taxes? Patriot has your back with our online payroll software. See for yourself how easy it is today with a free trial!

This is not intended as legal advice; for more information, please click here.