As an employer, you know you have to pay certain taxes, like unemployment taxes. But you may be wondering, Do employees pay into unemployment insurance? Get the scoop on whether or not your employees need to pay into unemployment.

Overview of unemployment

What is unemployment insurance? When an employee becomes unemployed through no fault of their own, they can receive unemployment insurance benefits. These benefits are funded by payroll taxes.

Unemployment insurance is jointly run by federal and state governments. Each state has its own unemployment insurance program, and the federal government oversees each state’s program.

To receive unemployment insurance benefits, a worker must be eligible. An employee cannot receive unemployment if they:

- Opt not to work

- Quit their job voluntarily

- Are fired due to performance issues

Workers who are eligible for unemployment receive a percentage of the wages they would have earned if they were still employed.

Types of unemployment taxes

There are two types of unemployment taxes that you have to pay into as an employer:

- FUTA tax

- SUTA tax

Learn more about the two types of unemployment taxes below.

FUTA tax

The Federal Unemployment Tax Act (FUTA) is a federal law that imposes an unemployment tax on employers. FUTA tax is an employer-only tax. Employees do not have to pay into federal unemployment.

Most employers have to pay FUTA tax. However, some employers are not required to. You must pay FUTA tax if you have:

- At least one employee for at least part of a day in any 20 or more different weeks out of the year OR

- Paid $1,500 or more in wages to employees during any calendar quarter

The FUTA tax rate is 6%. Federal unemployment tax only applies to the first $7,000 you pay to each employee in a calendar year. Once an employee $7,000 or more during the year, stop paying FUTA tax on that employee’s wages. The most you can pay for FUTA tax per employee, per year is $420 ($7,000 X 6%). However…

…You may be able to take advantage of the FUTA tax credit. Most employers are eligible for a federal unemployment tax credit that reduces their FUTA tax rate. The largest credit you can receive is 5.4%. Employers with the maximum credit only have a rate of 0.6% (6% – 5.4%) on the first $7,000 of each employee’s wages. The maximum amount you would pay under the FUTA tax credit, per employee, per year, is $42.

Keep in mind that not all employers qualify for the FUTA tax credit.

SUTA tax

SUTA tax works similarly to FUTA tax, but it’s for state unemployment. The State Unemployment Tax Act (SUTA) tax is a type of payroll tax that states require.

There are a few names that SUTA tax goes by, depending on the state. SUTA tax may also be called:

- State unemployment insurance

- SUI tax

- Reemployment tax

Some states may exempt certain businesses from paying state unemployment tax. For example, in some states, nonprofit organizations and businesses with few employees are not required to pay SUTA tax.

Each state also has its own SUTA tax rate. When you register as an employer, your state typically tells you what your rate is. As you gain experience, your SUTA tax rate can change. The rate can vary depending on:

- The state

- If you’re a new employer

- What industry you’re in (e.g., construction)

- How many former employees file for unemployment

Each state sets its own SUTA tax wage base, or threshold, for all employers in the state. The wage base determines the maximum amount of an employee’s income that can be taxed. The wage base can vary from year to year, so be sure to keep an eye out for changes.

Do employees pay into unemployment?

Now, onto the question you’ve all been waiting for: Do workers pay into unemployment? The answer: Sometimes.

As you now know, FUTA tax is employer-only. This means that employees do not have to pay federal unemployment tax whatsoever.

…But what about state unemployment tax?

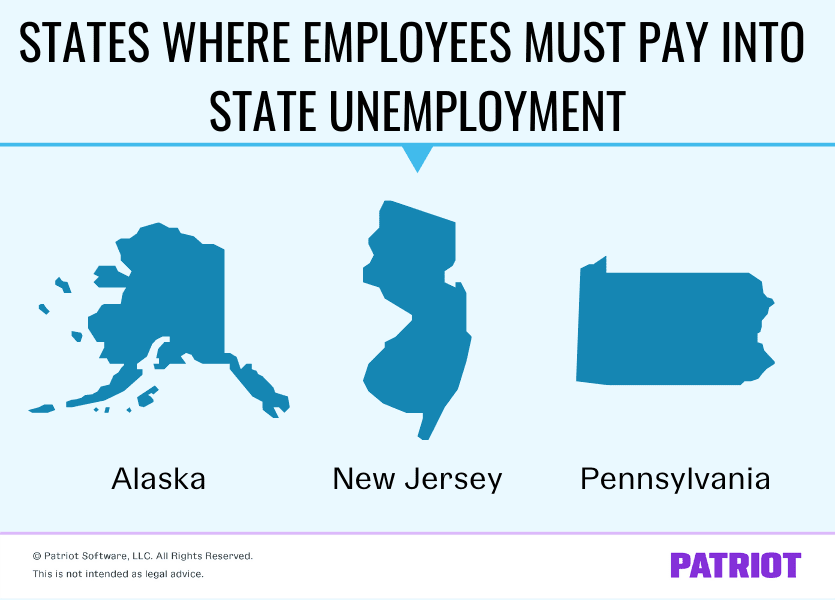

Believe it or not, some employees do need to pay state unemployment tax. Although the majority of employees can avoid paying state unemployment, employees in the following states must have state unemployment tax withheld from their wages:

In the above states, both employees and employers must pay into state unemployment.

Although some employees contribute to state unemployment, the employers still have to do the heavy lifting when it comes to deducting and remitting the tax. Employees are not responsible for remitting the tax to the state. Paying the employee portion of SUI to the state is the employer’s responsibility.

If you have employees in one of the above states, you must deduct SUI tax from employee wages and remit it to the state.

Paying unemployment tax

One of your responsibilities as an employer is remitting unemployment tax (and other payroll taxes) to the proper agencies.

If you have FUTA tax liabilities, contribute until each employee reaches the $7,000 wage base. Again, your rate can vary depending on if you have the FUTA tax credit. Typically, you must deposit your FUTA tax quarterly. But if your tax liability is $500 or less during a quarter, you can roll it over to the next quarter. To report FUTA taxes, file Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return, with the IRS annually. Again, do not deduct FUTA tax from employee wages.

Employers are responsible for reporting their SUTA tax liability to the state and making payments (employer and employee portions). In most cases, you will need to make quarterly SUTA tax payments.

If you have an employee in one of the states that require workers to pay into state unemployment, deduct the state unemployment tax from employee wages based on the state’s unemployment tax rate for employees. And, stop collecting SUTA tax from employees if they hit the state’s unemployment wage base. You also need to contribute to SUTA tax for the state based on the rate and wage base.

Stressing about the idea of having to calculate and remit unemployment taxes? Patriot’s payroll software accurately calculates your tax liability for you. And if you opt for our Full Service payroll services, we will deposit and file taxes on your behalf. Get your free trial today!

This is not intended as legal advice; for more information, please click here.