Like most employers, you likely had a lot of questions about the executive order payroll tax deferral. And now that you’re in the collection and repayment phase of the employee Social Security tax deferral, you probably have some more.

If you haven’t heard the latest buzz on the deferral of employee Social Security taxes, we’ve got your rundown. To start, the due date for the deferred tax repayment is coming up—fast. And (the part you’ve been waiting for) employers are responsible for collecting and remitting the postponed taxes.

Employee Social Security tax deferral: FAQs

On August 8, 2020, then-President Trump issued four executive orders, one of which was the Social Security payroll tax deferral. And on December 27, 2020, the Consolidated Appropriations Act extended the payroll tax deferral repayment deadline.

The deferral period is over. The repayment period is now. Take a look at this Q&A segment to learn more.

What is it all about?

The payroll tax deferral executive order let eligible employees temporarily defer the employee portion of Social Security tax in 2020. Because this was a deferral and not a cut, employees pay the taxes back in 2021. In short, the deferral was like a penalty-free loan. Employees who took advantage of it got more money in their paycheck in 2020 but less money in 2021.

Here’s how it worked: Employees’ wages are subject to payroll and income tax. Payroll taxes include Social Security and Medicare taxes, which collectively are known as FICA tax. The payroll tax deferral only applied to Social Security tax.

The employee portion of Social Security tax is 6.2%. Employers pay a matching 6.2% for the employer portion of Social Security tax. As an employer, you’re responsible for withholding the employee’s portion from their wages and remitting it to the IRS.

Through the Social Security deferral, certain employees (i.e., those whose pay was less than $4,000 biweekly, or $104,000 annually) could temporarily stop paying the employee portion. If they did, you held off on withholding and remitting payment to the IRS during the deferral period in 2020.

Did employers have to defer employees’ SS tax?

We get it (and the IRS did, too). It’s a hassle to pause your employee Social Security tax withholding only to apply it back alongside regular withholding when the deferral period ended.

So no: Employers could choose to pass on deferring the employee portion of Social Security tax. The employee Social Security tax deferral was not mandatory for employers, so you may have chosen to opt-out.

If you did defer employees’ SS tax obligations, you are responsible for paying the deferred tax.

Stay informed!

Get the latest payroll news delivered straight to your inbox.

Subscribe to Email ListWhen was the Social Security deferral period?

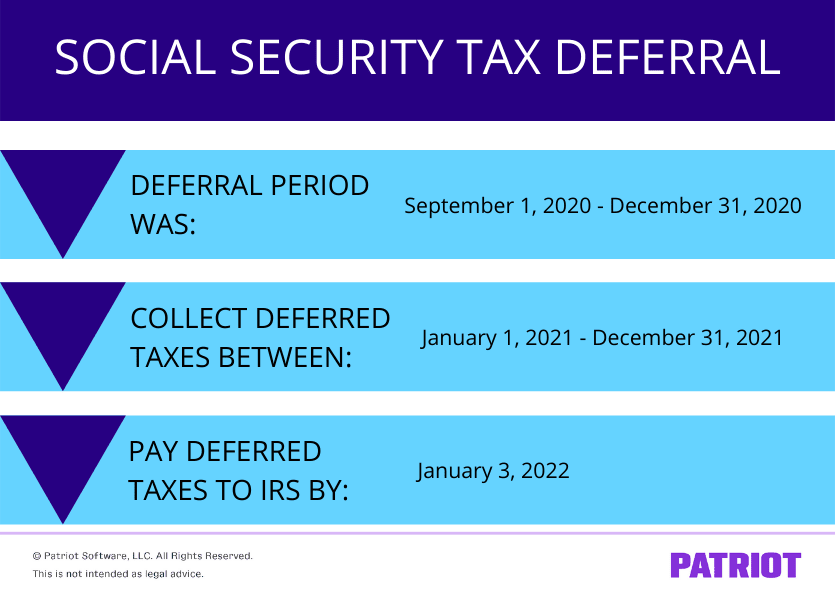

The deferral period took place between September 1, 2020 and December 31, 2020.

Employees could defer Social Security tax on wages paid between September 1, 2020 and December 31, 2020 if they met the eligibility threshold.

When are deferred taxes due?

The deferred Social Security tax repayment period takes place January 1, 2021 – December 31, 2021.

Because New Year’s Eve is a federal holiday, deferred employee Social Security taxes are due by January 3, 2022.

How do employers collect the deferred taxes?

If employees deferred their Social Security tax liability, you are responsible for withholding the complete amount by a deadline of December 31, 2021. How?

Starting January 1, 2021, you should have begun withholding the employee portion of Social Security tax as normal.

You also need to withhold a portion of the deferred Social Security tax. Or, you can make another arrangement to collect the deferred taxes from the employee. Again, you have until December 31, 2021 to withhold the deferred tax without penalties.

Interest, penalties, and other additions begin accruing on any unpaid deferred tax if you miss the deposit deadline of January 3, 2022. For more information, view the IRS website.

How do employers repay the deferred taxes?

You can make deferral payments through one of the following payment methods:

- Electronic Federal Tax Payment System (EFTPS)

- Debit or credit card

- Money order

- Check

If you use full-service payroll software, your provider should handle remittance payments on your behalf.

If you’re handling repayments on your own, be sure to separate the deferred taxes from other tax payments.

Paying via EFTPS? Select “deferral payment.” Learn more about deferred employee Social Security tax deferral repayments on the IRS’s website.

What if an employee quits?

If an employee quits before you can withhold the deferred taxes from their wages, what can you do? Aren’t employers the ones on the hook?

If the employee no longer works for the organization, the employer is responsible for repayment of the entire deferred amount. The employer must collect the employee’s portion using their own recovery methods.”

What does this mean? You must work with the terminated employee to get back the unpaid employee Social Security tax.

How do employers report the collected, deferred Social Security tax?

According to the IRS, fill out Form W-2c, Corrected Wage and Tax Statement, as soon as you finish withholding the deferred taxes in 2021.

On the W-2c, you must:

- Enter tax year “2020” in box c

- Report deferred Social Security tax you withheld in 2021 and did not report on the 2020 Form W-2 in box 4 on Form W-2c

Be sure to send Forms W-2c, along with Form W-3c, to the Social Security Administration as soon as possible. Also distribute Forms W-2c to the appropriate employees.

What about the employer portion of Social Security tax?

Because this deferral only applied to the employee portion of Social Security tax, you might feel a little jilted. But if you think employers got the short end of the stick, think again.

Employers have been able to defer their SS tax payment since March 27, 2020 thanks to the CARES Act.

Under the CARES Act, employers could defer the employer Social Security tax due between March 27, 2020 – December 31, 2020. And, you have a longer repayment period than employees got under the executive order deferral.

If you deferred the employer portion of Social Security tax, your repayment period is:

- December 31, 2021 (50% of the deferred amount)

- December 31, 2022 (remainder)

So, 50% of your employer deferred Social Security tax has the same due date as 100% of deferred employee Social Security taxes.

Time is ticking. Here’s a quick Q&A for skimmers

You’re busy. So, here’s a snapshot of the above FAQ section, made especially for skimmers:

- What is it all about? Employees could defer the employee portion of Social Security tax

- Who was eligible? Employees who earn under $4,000 biweekly, or $104,000 per year

- Did employers have to defer my employees’ SS tax? No, it wasn’t mandatory

- When was the deferral period? September 1, 2020 – December 31, 2020

- When are deferred taxes due? January 1, 2021 – December 31, 2021 (no later than January 3, 2022)

- How do employers collect the deferred taxes? Ratably throughout the year or through another arrangement

- How do employers pay the deferred taxes? EFTPS, credit or debit card, money order, or check

- What if an employee quits? Not directly answered, but you may be able to make other arrangements to collect the deferred taxes from employees

- How do employers report the collected, deferred Social Security tax? File Form W-2c as soon as you finish withholding the deferred taxes

- What about employers? Employers are able to defer the employer Social Security tax portion under the CARES Act

This article has been updated from its original publication date of September 1, 2020.

This is not intended as legal advice; for more information, please click here.