As the year comes to a close, you might be gung-ho about all the goals you want to achieve next year. But before you can get the ball rolling in the new year, you must wrap up some things in the current year—including your payroll.

Employers must complete several timely payroll requirements at the end and beginning of each year. Use a year-end payroll checklist to help you stay on top of your responsibilities.

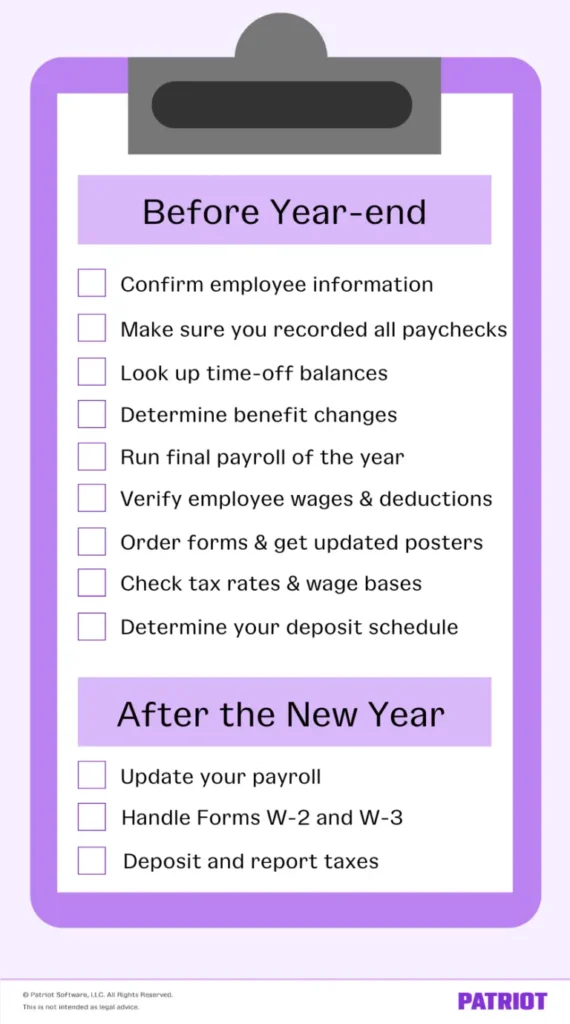

We know you’re busy. So to help you check “Making an end-of-year payroll checklist” off your to-do list, we made one for you.

2024 Year-end payroll checklist: Cheatsheet

Sure, you’re eager to get out with the old and in with the new. But you can’t do that in your business without setting aside time to wrap up your payroll at year-end.

Use our end-of-year payroll checklist to complete all your payroll tasks on time and set your business up for a successful new year.

For your convenience, we’ve split up our checklist into two groups:

- Year-end procedures to finish before the new year

- Tasks you should do at the beginning of the new year

Take a closer look at your responsibilities by learning more about each task of the year-end checklist for payroll.

2024 Payroll year-end checklist

Don’t enter a new year with disorganized records and loose ends. Get your employer end-of-year checklist in shape by completing the following tasks before your New Year celebrations begin.

1. Confirm employee information

Is all of your personal employee information correct? Your records need to be accurate when it comes to each employee’s:

- Full legal name

- Social Security number

- Current address

- Other contact information

Confirm and correct your records before distributing a W-2 form to employees in the new year. Although you may have employee information on file, your records could have mistakes. If you have a missing or incorrect Social Security number or name on the W-2 form, you could face penalties.

You could also mail the Form W-2 to the wrong address if an employee recently moved.

2. Make sure you recorded all paychecks

Did you miss recording some paychecks from the year? Did you pay anything to employees outside of the regular payroll? If so, it’s time to update your records.

Include all payments for commissions, bonus pay, and anything run outside of the normal payroll (e.g., retro pay).

Don’t forget to include handwritten checks. And, make sure you accurately recorded any voided paychecks you had throughout the year.

3. Look up time-off balances

If you offer employees paid time off (PTO), find out each employee’s used and remaining time-off balances.

Depending on your policy, determine whether employees want to roll over their accrued time off or cash it out. Or, if you have a use-it-or-lose-it policy, notify employees of when they need to use their accrued PTO by. Keep in mind that there are PTO payout laws by state you must follow.

If employees decide to cash out their unused paid time off, calculate their payment and run payroll for the amount.

4. Determine benefit changes for next year

Open enrollment lets employees update their benefits for the following year. Hold open enrollment so employees can change things like their health, dental, and vision insurance plans.

And if they do make changes, implement these changes beginning January 1 in the new year. Keep these changes in organized records.

5. Run the final payroll of the year

Ah, the last payroll of the year. For many employers, the pay date lands around the holidays. And if payday falls on a bank holiday (or around it), you must adjust your payroll schedule to accommodate for bank holidays.

Keep in mind that December 25 and January 1 are bank holidays.

6. Verify employee wages and deductions after final payroll

You know that creating Forms W-2 is one of your top responsibilities come January. After you run your final payroll in the current year, check your records to verify employee wages and deductions are correct before reporting them on the W-2.

Use payroll software? Great! Software accurately calculates payroll based on the hours worked and employee pay rates you provide. But if there is a user error, you could wind up with incorrect employee wages and deductions. Verify everything you’ve entered into the software is accurate and correctly set up to report in the right boxes on Form W-2.

7. Order forms and get updated posters

Getting your paperwork in order now means one less thing you have to scramble to do in the new year, when things are already pretty hectic.

Order Forms W-2, Wage and Tax Statement, and W-3, Transmittal of Wage and Tax Statements, as part of your year-end payroll checklist. You can buy these forms from the IRS or another authorized provider.

Get updated federal and state labor law posters to hang up next year (e.g., Fair Labor Standards Act). Consult the U.S. Department of Labor to determine which federal posters you need. Also check state and local laws for non-federal posters.

8. Check tax rates and wage bases for new year

Tax rates and wage bases are subject to change annually. Check your tax rates for federal, state, and local taxes, including:

- Federal income tax

- FICA tax (Social Security and Medicare taxes)

- Federal unemployment tax (FUTA tax)

- State income tax

- State unemployment tax (SUTA tax)

- State-specific taxes (e.g., Oregon transit tax)

- Local income tax

In addition to checking up on general tax rates, also find out if there are new wage bases in the upcoming year. Pay attention to Social Security, SUTA, and state-specific tax wage bases.

9. Determine your deposit schedule in the new year

What is your next year’s deposit schedule for payroll taxes?

You must pay these taxes on a monthly or semiweekly basis. Your deposit schedule is based on a lookback period.

Your deposit schedule can change every year, so determine your schedule before the beginning of the new year.

2025 Beginning-of-year payroll checklist

Your payroll year-end checklist doesn’t finish when one year ends. Some tasks carry over into the next year.

Take a look at your payroll year-end checklist tasks that carry into the new year.

1. Update your payroll

Once you’ve gathered information from your employees (e.g., health insurance), update your payroll.

If you’re doing payroll by hand, account for any new tax rate changes. Using a previous year’s income tax withholding tables or Social Security wage base will throw off your payroll in the new year.

If you’re using online payroll software, the software will automatically update to reflect federal tax rates and wage bases. But, you must notify your provider of tax rate notices you’ve received that are specific to your business (e.g., SUTA tax).

Make sure all of your information is correct when you run the first payroll of the year.

2. Handle Forms W-2 and W-3

If you followed the year-end payroll checklist portion from the previous year, your records should be in tip-top shape.

So, it’s time to create and distribute Forms W-2 to each employee. Send employees Form W-2 by January 31, or the next business day (if January 31 falls on a weekend).

You also can’t forget to send Forms W-2 and Form W-3 to the Social Security Administration by January 31. If applicable, also send the forms to state and local governments by their deadlines (most states also have a deadline of January 31).

3. Deposit and report taxes

Another part of your payroll year-end process should be to deposit and report FUTA, federal income, and FICA taxes from the previous year.

File your FUTA tax return—Form 940—by January 31. Also deposit your fourth quarter FUTA taxes by January 31.

And, file your federal income tax and FICA tax returns in the new year. You will either use Form 941 or 944, depending on how often you must file. Both the quarterly Form 941 tax return and the annual Form 944 are due by January 31.

Sick and tired of your old payroll system? Now’s the best time to switch to Patriot’s payroll. Our customers love how easy it is to use … and how much time and money they save! Start your FREE trial and fall in love with a simpler way to manage payroll. Start the year off right with Patriot Software!

This article has been updated from its original publication date of December 18, 2014.

This is not intended as legal advice; for more information, please click here.