As an employer, you probably offer your employees some types of fringe benefits. From health insurance to employee stock options to paid time off, there are a number of benefits out there. These benefits can impact your fringe benefit rate. So, what is a fringe benefit rate?

Fringe benefits overview

Before you can dive into learning about a fringe benefits tax rate, you need to know what fringe benefits are. Fringe benefits are benefits employees receive in addition to their wages. Independent contractors and business partners can also receive fringe benefits (not taxed). Examples of fringe benefits include:

- Company car

- Health insurance

- Life insurance coverage

- Education assistance

- Childcare reimbursement

- Employee stock options

Although fringe benefits are typically taxable, some are nontaxable. Taxable fringe benefits can include personal use of a company car, bonus pay, and paid time off. Some nontaxable fringe benefits include group-term life insurance up to $50,000 and employee discounts.

Keep in mind that some fringe benefits are only nontaxable in certain situations. And, some taxes could apply (e.g., some types of fringe benefits are only exempt from FICA tax).

What is a fringe benefit rate?

So … what is a fringe benefit rate? A fringe benefit rate is the percent of an employee’s wages relative to the fringe benefits they receive. Calculate a fringe benefit rate by dividing the cost of an employee’s fringe benefits by the wages they receive.

Employers can use a fringe benefit rate to examine the total cost of labor per employee. The fringe rate shows you how much an employee actually costs your business beyond their base wages.

Fringe benefit rates vary from business to business. The rate depends on how much you pay employees and how much an employee receives in benefits. Although rates vary, according to the Bureau of Labor Statistics, the average fringe benefit rate (aka benefit costs) is 30%.

How to calculate fringe benefit rate

The fringe benefit rate equation is pretty straightforward. To calculate an employee’s fringe benefit rate, add up the cost of an employee’s fringe benefits for the year (including payroll taxes paid) and divide it by the employee’s annual wages or salary. Then, multiply the total by 100 to get the fringe benefit rate percentage.

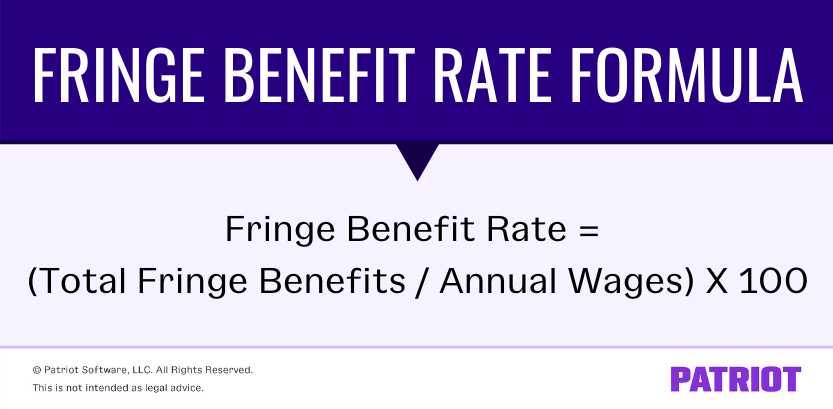

Use the following formula to calculate an employee’s fringe benefit rate.

Fringe Benefit Rate = (Total Fringe Benefits / Annual Wages) X 100

When adding together your employee’s total fringe benefits, remember to include all of their fringe benefits, such as:

- Employer portion of Medicare tax

- Employer portion of Social Security tax

- Unemployment insurance

- Workers’ compensation insurance

- Disability insurance

- Health insurance

- Life insurance

- Pension plan contributions

- Employee education assistance

- Adoption assistance

For a full list of fringe benefits, check out Publication 15-B.

Fringe benefit rate calculation example

Ready to see how to calculate fringe benefits in action? Check out examples of calculating fringe benefits rates for salaried and hourly employees below.

Salaried employee

Let’s say your salaried employee makes $80,000 annually. The employee’s total annual fringe benefits are $20,000, broken down as follows:

- Employer portion of SS tax: $4,960

- Employer portion of Medicare tax: $1,160

- Unemployment tax: $1,300

- Worker’s compensation: $1,000

- Employee’s health, life and disability insurances: $7,500

- Retirement benefits: $4,080

Divide the employee’s annual fringe benefits of $20,000 by their annual salary of $80,000.

$20,000 / $80,000 = 0.25

Next, multiply your total from above (0.25) by 100 to get your fringe benefit percentage.

0.25 X 100 = 25%

Your fringe benefit rate for this employee is 25%. This means your company is paying an additional 25% on top of the base salary for the employee.

If you want to find the employee’s total hourly rate (including their fringe benefits), you can divide the employee’s annual salary by the number of weeks per year and hours per week:

$80,000 / 52 weeks per year / 40 hours per week = $38.46

The employee’s hourly rate is $38.46. Multiply the hourly rate by your fringe benefit rate of 0.25. Then, add that total to the hourly rate to find the employee’s total wages plus fringe benefits per hour:

$38.46 X 0.25 = $9.61 (fringe benefit cost per hour)

$9.61 + $38.46 = $48.07

This employee’s “hourly rate” including the fringe benefits cost would be $48.07.

Hourly employee

Say you have a full-time hourly employee who gets paid $25 per hour. The employee has the following annual fringe benefits:

- Employer portion of SS tax: $3,224

- Employer portion of Medicare tax: $754

- Unemployment tax: $800

- Worker’s compensation: $722

- Employee’s health, life, and disability insurances: $3,740

- Retirement benefits: $2,200

The employee’s total fringe benefits are $11,440. Divide the total fringe benefits by the employee’s annual salary. To get the employee’s annual wages, multiply the hourly rate by the number of weeks in a year (52) and the number of hours worked per week (40).

$25 per hour X 52 weeks X 40 hours = $52,000 in annual wages

($11,440 / $52,000) X 100 = 22%

Your fringe benefit rate for this hourly employee is 22%. This means your company is paying an additional 22% of the employee’s wages for this employee.

Need help withholding taxes from employee fringe benefits? Patriot’s online payroll software will handle the calculations for you. And, we offer free, USA-based support. What are you waiting for? Try it for free today!

This is not intended as legal advice; for more information, please click here.