When you have employees, payroll is one of your most important tasks. Because payroll is oh-so-important, you need to know how to calculate payroll. That includes knowing how to calculate taxes and other deductions accurately. Read on to learn more about how to calculate payroll by hand.

How to calculate payroll taxes: The basics

Before calculating payroll, you need to know how much and how often you pay your employees.

For hourly employees, multiply the total hourly rate by the number of hours worked for the pay period. If the employee works overtime and is nonexempt, multiply the hourly rate by 1.5 (or the rate according to the overtime rules by state) to get the overtime rate. Then, multiply the overtime rate by the number of hours the employee worked over 40 in the week. Add the employee’s total regular wages and overtime together (if applicable).

If your employee is salaried, determine their annual wages and divide it by the number of pay periods in the year (e.g., 26 pay periods for biweekly). The amount is the employee’s gross wages for the pay period. For example, if an employee makes $40,000 annually and is paid biweekly, divide their annual wages ($40,000) by 26 to get their total gross pay for the period ($40,000 / 26 = $1,538.46).

Generally, there are a few taxes you need to calculate to process payroll correctly, including:

- Federal income tax (FIT)

- Social Security tax

- Medicare tax

- State income tax (SIT), if applicable

- Local income tax, if applicable

In some states (e.g., Pennsylvania), you may need to calculate state unemployment taxes for your employees. Additionally, some states have state-specific taxes employees and/or employers may need to pay (e.g., Oregon transit tax).

Federal income tax

The IRS releases a new Publication 15-T each year with instructions on how to calculate federal income tax. How to calculate federal income tax depends on a variety of factors, including:

- Which version of Form W-4 you have on file for the employee (pre-2020 or post-2020)

- Pay frequency

- Employee’s filing status (e.g., single)

- If the employee has multiple jobs (i.e., the employee checked the box in Step 2 for multiple jobs)

- Dependents amount (or withholding allowances, if using the pre-2020 Form W-4)

- Deductions

- Additional withholdings

Once you know your employee’s information, you can use Publication 15-T to determine how much to withhold for FIT.

Determine which calculation method to use before you start. The IRS offers two methods: percentage and wage bracket. Publication 15-T gives both the percentage method and wage bracket method worksheets. Use the applicable worksheet to calculate each employee’s federal income tax withholding.

Social Security tax

Social Security tax is a payroll tax that both employers and employees contribute to equally. The total tax amount is 12.4%. The employee pays half (6.2%), and the employer pays the other half (6.2%). Stop withholding and contributing Social Security tax after the employee earns above the Social Security wage base.

Multiply 6.2% by the employee’s gross taxable wages for the pay period to find their Social Security tax amount.

Medicare tax

Medicare is the other tax that both employers and employees contribute to. The total tax is 2.9%, so employees pay 1.45%, and employers pay 1.45%.

Multiply the employee’s gross taxable wages by 1.45% to determine how much to withhold for Medicare tax. Medicare does not have a wage base. However, you need to withhold an additional 0.9% from employee wages if they earn above $200,000. Employers do not have to contribute to the additional Medicare tax amount, but they must continue to contribute 1.45% each paycheck.

State income tax

Some states do not have income tax, including:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

If your employee works in a state without income tax, do not withhold state income taxes from their wages.

Some states have a flat tax rate, meaning that the rate does not change depending on how much an employee earns. These states include Arizona, Colorado, and Utah.

Some states have a progressive tax rate, meaning that the rate increases the more an employee earns. These states include Arkansas, Hawaii, and Maine.

If your state has a flat tax rate, multiply the tax rate by the gross taxable wages to determine the amount of tax to withhold from your employees’ checks.

If your state uses a progressive tax rate, use the tax tables in your state’s income tax withholding documentation to determine how much SIT to withhold from your employees.

Check with your state for more information on their tax rates.

Local income tax

Not all states have local income tax, even if the state has state income tax. Check with your local government to determine if your employees must pay local income tax.

Rates can vary from locality to locality. If your employees must pay local income tax, use the documentation from the local government to determine how much local income tax to withhold.

Other deductions to consider when calculating payroll

Sometimes, calculating payroll is as easy as only determining the amount of taxes to withhold. Other times, you have employee deductions to calculate, too. There are two types of tax deductions to consider when calculating payroll:

- Pre-tax

- Post-tax

Pre-tax deductions

Pre-tax deductions are what they sound like: the deduction comes out of an employee’s wages before you calculate the taxes. A pre-tax deduction is tax-free and reduces the taxable income for an employee’s federal, state, and local taxes, including:

- Federal income taxes

- FICA (Social Security and Medicare taxes)

- State income taxes, if applicable

- Local income taxes, if applicable

Unfortunately, not all pre-tax deductions are so simple. For example, a 401(k) is a pre-tax deduction for federal income taxes but not for Social Security and Medicare taxes. So, you would only subtract the cost of the deduction from the employee’s gross wages to calculate FIT. To calculate Social Security and Medicare taxes, you would not subtract the amount of the deduction.

Post-tax deductions

Post-tax deductions are a bit simpler to calculate. Subtract the deduction from the wages after you calculate and deduct all of the payroll taxes.

Payroll how-to example

Your employee, Bob, earns a biweekly salary of $3,000. He uses the new Form W-4 and is single with no dependents or deductions. He did not check the box for multiple jobs. And he does not have additional withholdings, other tax deductions, or pre- or post-tax deductions. Bob lives and works in Texas, so he does not have state or local income taxes.

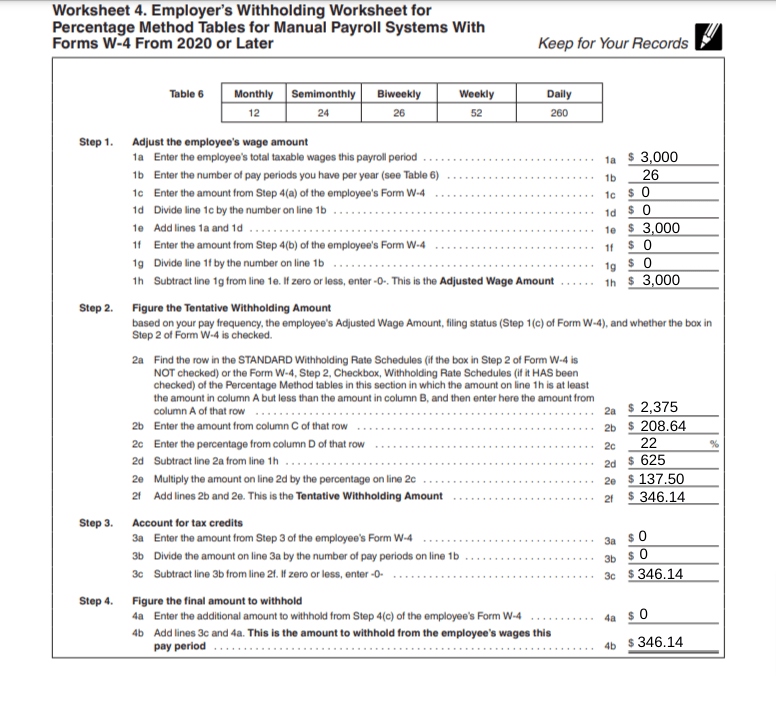

Using Publication 15-T, you decide to use the percentage method to calculate Bob’s federal income tax withholding. Complete Worksheet 4 for the percentage method tables. You do payroll manually, so you must use the percentage method tables for manual payroll systems with Forms W-4 from 2020 or later.

Here is Bob’s information using Worksheet 4 for Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later:

- $3,000 per payroll period

- 26 pay periods in the years (biweekly)

Bob uses the 2024 Form W-4. Complete the section for this version of the form:

- Enter “0” on line 1c because Bob does not claim other income (not from jobs).

- Enter “0” on line 1f because Bob does not claim other deductions.

- Bob did not check the box for multiple jobs and is filing as single.

- Bob’s Adjusted Wage Amount is $3,000, the same as his total taxable wages per payroll period.

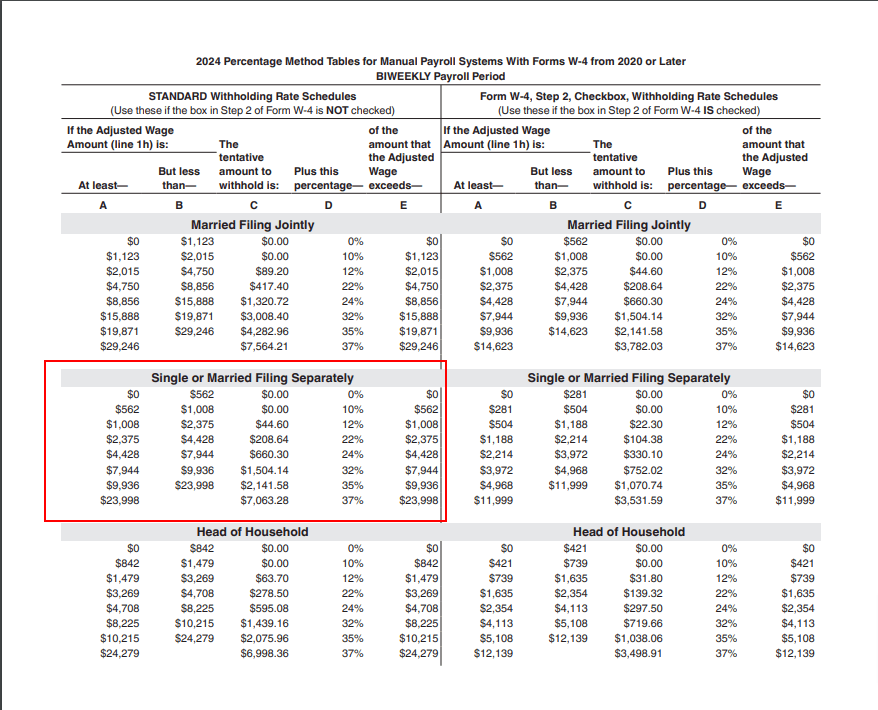

You must now calculate the tentative withholding amount for Bob’s wages. Use the percentage method tables for biweekly payroll. The left side of the table applies to employees who did not check the box on Step 2 of Form W-4.

To calculate Bob’s FIT, use the area outlined in red. Use the section for Single or Married Filing Separately to determine the tentative withholding amounts:

- Bob’s biweekly pay is $3,000, which is greater than $2,375 and less than $4,428. Enter $2,375 on line 2a.

- Column C is $208.64. Enter this number on line 2b of Worksheet 4.

- Column D’s percentage is 22%. Enter 22% on line 2c.

- Subtract $2,375 from $3,000 to get $625. Enter $625 on line 2d.

- Multiply $625 by 22% to get $137.50. Enter this amount on line 2e.

- Add together $208.64 and $137.50 to get $346.14. Enter $346.14 on line 2f.

Then, account for the tax credits listed on Bob’s Form W-4. Bob does not have any dependents, so enter a 0 on lines 3a and 3b on Worksheet 4.

Bob also does not list additional withholdings on his W-4 form. Enter a 0 on line 4a.

The total amount of FIT to withhold from each of Bob’s paychecks remains $346.14.

Calculating other taxes and net income

Calculating Social Security and Medicare tax is much simpler than calculating FIT. Simply multiply $3,000 by 6.2% to determine how much Social Security tax to withhold ($3,000 X 6.2% = $186). Withhold $186 from each of Bob’s paychecks (unless he hits the SS wage base).

Multiply $3,000 by 1.45% to determine how much Medicare tax to withhold ($3,000 X 1.45% = $43.50).

Because Bob does not have state or local income taxes, you can now subtract the tax withholdings from the gross income to determine Bob’s net income (aka take-home pay):

Gross Pay – FIT – SS Tax – Medicare Tax = Net Income

$3,000 – $346.14 – $186 – $43.50 = $2,424.36

Bob’s net income is $2,424.36.

Double-check your work

Before you rush off to start writing paychecks, check and double-check your work. You can use different calculators to make sure your math is right. Often called a paycheck calculator, paycheck tax calculator, payroll calculator, or payroll tax calculator, these tools can assist you in checking your work.

Or, make it easy by using payroll software that has the tax rates and your employee’s Form W-4 information entered. Payroll software does all of the calculations for you, including FIT, SIT, Social Security, and Medicare taxes. And, most software also calculates additional state payroll taxes.

This article has been updated from its original publication date of January 3, 2022.

This is not intended as legal advice; for more information, please click here.