The year-end and new year are filled with payroll responsibilities, like filing and distributing Forms W-2 to your team. But first, you need to know how to generate a W-2 form for your employees.

Generating W-2s doesn’t have to be complicated, especially with tools like payroll software. Learn how to create W-2s for small business below.

What is a W-2 form?

Form W-2, Wage and Tax Statement, is an information return that reports your employees’ wages and taxes. You must complete a W-2 form for each employee you paid during the year. Do not use Form W-2 to report payments to independent contractors.

Send Form W-3, Transmittal of Wage and Tax Statements, with Forms W-2.

You must file W-2s electronically if you have 10 or more information returns, including other forms like Form 1099-NEC. You can send paper forms if you have less than 10 total returns.

Form W-2 is due by January 31. Send copies to the Social Security Administration (SSA); the state, city, or local tax department (if applicable); and your employee. Keep a copy for your business records.

Do employers need to provide W-2 forms?

Yes, employers must complete and file W-2 forms for each employee.

The deadline for giving employees W-2s is January 31. Employees cannot file their income tax returns without a W-2.

What information do I need to create a W-2?

You need access to your payroll records to generate W-2 forms. Necessary information includes:

- Taxable wages

- Taxes withheld

- Benefits information

You must also input business identification information (e.g., Employer Identification Number) and employee identification information (e.g., Social Security number).

How do employees use W-2s?

Employees use W-2 forms to file their income tax returns (i.e., Form 1040).

W-2 forms tell employees how much they earned, taxes withheld, and benefits received during the calendar year.

Before generating W-2 forms…

W-2 form errors happen. But, it’s best to avoid them and the extra headache that comes with making a Form W-2 correction.

Before generating W-2 forms, verify your payroll records are accurate and error-free. Review:

- Total wages paid

- Taxes withheld

- Deductions and benefit information

Can I generate my own W-2?

Employees do not create Forms W-2.

You can create W-2 forms for your employees by using payroll software or manually filling in the form.

Can you manually create a W-2?

Yes, you can manually create a W-2 if you don’t use payroll software. You can obtain official W-2 forms from the IRS or an authorized supplier.

When filing W-2 forms with the Social Security Administration, you can use the fill-in version.

Are handwritten W-2 forms legal?

The IRS discourages employers from completing entries by hand, in script, or in italic fonts. Type W-2 entries using black ink and 12-point Courier font to ensure the form is machine-readable.

Can I print an employee W-2 on plain paper?

Yes, you can print W-2 forms on standard plain paper (8.5” X 11”). Do not print W-2s on double-sided paper.

The IRS requires that paper Forms W-2 be machine-readable, so be sure to use black ink.

Remember that the IRS requires you to file Forms W-2 electronically if you have 10 or more information returns. This electronic filing threshold includes W-2 and 1099 forms.

How to generate a W-2

“How do I make a W-2 for my employees?” You’ve come to the right place if you’re asking this question.

You can create W-2s for employees automatically (using payroll software) or manually.

1. Use payroll software (automatic)

Payroll software typically generates W-2s for your employees using the payroll data you input during the year.

Full-service payroll services file the forms with government agencies (SSA and state). Typically, your only responsibility is posting the forms in your employees’ online portals (with consent) or mailing them to employees.

The benefits of using payroll software include:

- An easy way to pay employees throughout the year

- Automatic W-2 form generation

- Hands-free filing with full-service payroll

- The ability to review all information before generating W-2s

2. Fill out a paper or electronic form (manual)

Don’t want to use payroll software? You can manually complete W-2 forms using your payroll records.

Order official W-2 forms from the IRS or an authorized supplier, or create fill-in versions with the SSA.

Carefully input the information from your payroll records. Double-check your work to avoid data entry errors.

When you’re done filling out a paper or electronic form, file it with the SSA and state government agencies. Then, distribute them to your employees.

How to generate a W-2 manually

- Order official W-2 forms

Order official W-2 forms from the IRS or an authorized supplier. Or, you can create fill-in versions with the SSA.

- Input information from your payroll records

Add information for each employee from your payroll records, including annual wages, federal income tax withheld, Social Security tax withheld, and Medicare tax withheld.

- Double check your work

Data entry errors happen with manual work. Double check your numbers to avoid time-consuming mistakes.

- File the form and distribute to employees

File W-2s with the SSA and state government agencies. Also distribute the forms to your employees.

How to create W-2 forms with payroll software

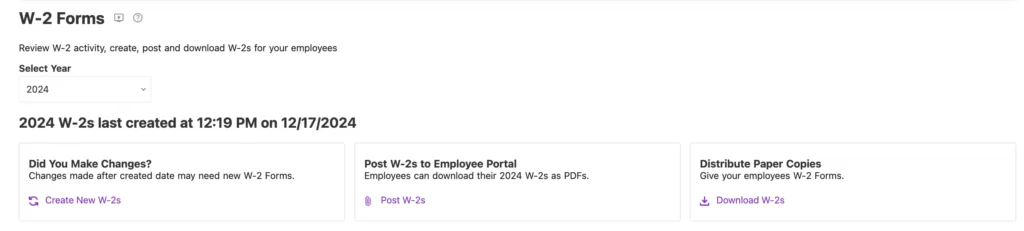

Log in to your payroll software account to create W-2 forms. Your software should generate W-2s based on the information you entered into the system during the year.

Follow your software’s specific instructions to generate W-2 forms. Typically, you can do this in a few clicks.

Generate W-2s with Patriot’s payroll software

Easily and automatically generate your employee W-2 forms with Patriot’s award-winning payroll software.

Patriot Payroll™ generates W-2 forms using your payroll records. You can preview W-2 forms before filing to review details and ensure all information is accurate.

Full Service payroll software users enjoy automatic filing with the SSA and any state government agencies.

You can either post W-2s to your employees’ portals (if employees have given consent) or print forms to mail to employees.

Streamline your year-end tasks (and your responsibilities during the year) with Patriot’s online payroll. Run unlimited payrolls, pay employees with free direct deposit, generate W-2s, and so much more. Get your free trial now!

This article has been updated from its original publication date of December 17, 2024.

This is not intended as legal advice; for more information, please click here.