As an employer, you are likely familiar with the federal Family and Medical Leave Act (FMLA). However, are you aware that your state might have additional programs in place for family and medical leave? If you are a Massachusetts employer, you must learn about the Massachusetts paid family leave program.

What is Massachusetts paid family leave?

Massachusetts Paid Family Medical Leave (PFML) is a statewide program that gives eligible employees paid time off for family and medical leave. All Massachusetts employers must participate.

Businesses that employ one or more workers are subject to the PFML law. Employers must submit contributions on behalf of employees and covered individuals.

Employers with fewer than 25 employees do not have to contribute the employer portion of MA family and medical leave.

Businesses with more than 25 employees must pay an employer contribution for PFML.

Which employees are covered by PFML?

You are responsible for knowing which employees are eligible for PFML.

PFML is available to employees and covered individuals beginning January 2021. Workers who may be eligible for PFML include:

- Employees who work for a business or a state or federal governmental agency in Massachusetts

- Qualifying independent contractors

- Self-employed individuals

- Employees who work for a city, town, or local governmental employer

Independent contractors who work for a business that issues Form 1099 for an average of 50% of its workforce are considered covered individuals. Contractors must check with any businesses they work for to determine whether they are covered.

Self-employed individuals can opt to obtain coverage. But, they are not required to participate.

Employees who work for a city, town, or local governmental employer are only covered if their employer opts in.

Unemployed workers are also eligible for PFML. However, they cannot receive PFML and unemployment benefits at the same time.

What can employees use PFML for?

Workers can utilize MA PFML for various family- and medical-related issues.

Employees can receive PFML to:

- Deal with a serious medical condition

- Care for a family member with a serious health condition

- Bond with their child during the first 12 months after the child’s birth

- Spend time with an adopted child during the first 12 months after placement via foster care or adoption

- Care for a family member who is a covered service member (e.g., military) with a serious injury or illness

- Deal with a family member being on active duty or ordered to active duty in the Armed Forces

PFML will provide employees up to 12 weeks of paid family leave, 20 weeks of paid medical leave, or up to 26 weeks of leave to care for a family member who is a service member.

Benefit amounts vary depending on the employee’s average weekly wage. The maximum weekly benefit is $1,170.64 in 2025. Employees can “top off” their PFML benefits with accrued paid leave.

Full-time, part-time, and seasonal workers are eligible for PFML, including:

- Employees working for a business in Massachusetts or state agency

- Those who have earned at least 30 times the benefit they’re eligible for

- Workers have earned at least $6,000 in wages in the past four calendar quarters 12-month period

Massachusetts PFML contribution rates

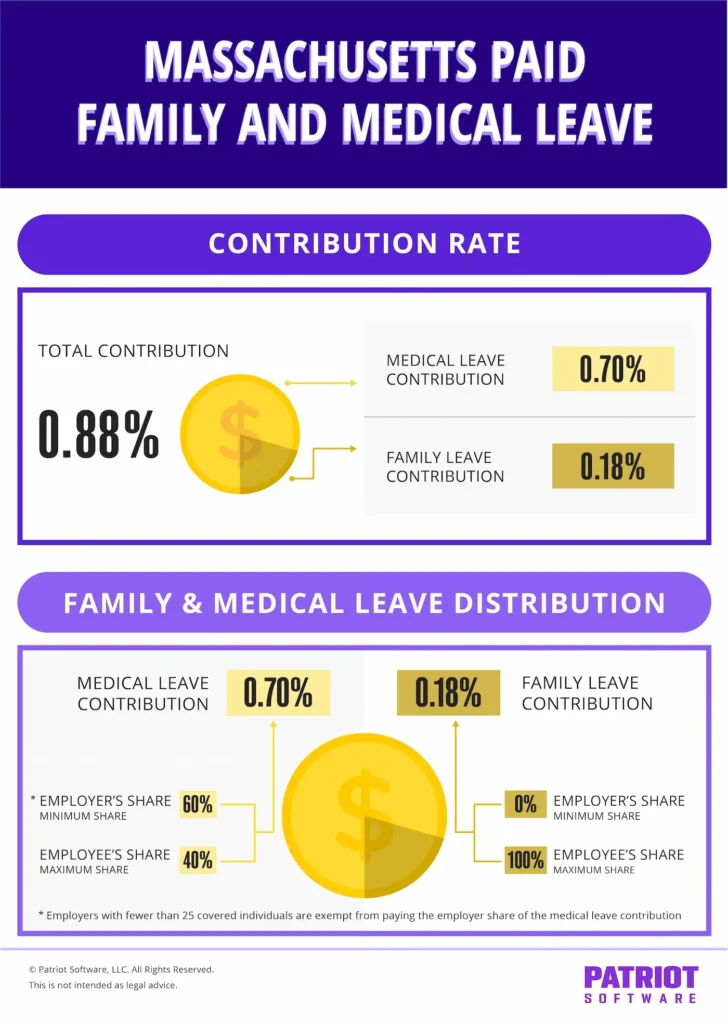

The shared PFML contribution rate for 2024 and 2025 is 0.88% of an employee’s earnings for employers with 25 or more covered individuals. Between 0.88%, the medical leave contribution is 0.70% and the family leave is 0.18%.

For medical leave, employers can deduct a maximum of 40% of the contribution from the employee’s wages, or 0.28%. And, employers can deduct up to 100% of the contribution required for family leave from employees’ wages, or 0.18%.

If you have fewer than 25 covered individuals, send a contribution rate of 0.46% of the employee’s wages (0.28% employee share for medical leave and 0.18% for family leave).

The contribution is limited to the Social Security wage base. After an employee meets the year’s wage base, they no longer pay into the contribution. Keep in mind the wage base can fluctuate each year.

Massachusetts determines the portions that go toward family and medical leave contributions each year.

Employers are responsible for remitting contributions on behalf of their workers. And, employers can choose to pay the employee’s portion.

PFML contribution rate example

Let’s look at an example of calculating PFML contributions. Say your employee earns $1,000 per week. You have more than 25 employees.

The total weekly contribution between you and your employee is $8.80 (0.0088 x $1,000).

Medical leave

As a reminder, the medical leave portion is 0.70%. So, the total medical leave contribution equals $7.00 (0.0070 x $1,000).

The $7.00 for medical leave also gets broken down for the employee and the employer portions. The employee contribution can be no more than 40%, meaning that your employer portion is no greater than 60%. Your employee’s medical leave contribution is $2.80 ($7.00 x 0.40). And, your employer contribution for medical leave is $4.20 ($7.00 x 0.60).

Family leave

Now, let’s take a look at calculating the family leave contribution. As mentioned, family leave is 0.18%. The total family leave contribution is $1.80 (0.0018 x $1,000).

Again, you can deduct up to 100% of the family leave contribution from employee wages. In this case, you can deduct $1.80 from the employee’s wages for family leave contribution.

Totals

Your total employer contribution for PFML is $4.20. And, your employee’s total contribution is $4.60 ($2.80 for medical leave and $1.80 for family leave).

Exemption for PFML

Employers can apply for annual exemptions from making contributions for both medical leave and family leave. To be eligible for exemption from PFML, employers must offer an equivalent private plan option to employees. Businesses that receive the exemption will not be covered by the PFML plan.

Check Massachusetts’ website for more questions regarding the MA paid family leave program.

Calculating contributions and taxes can be tricky. With Patriot’s online payroll software, you don’t have to worry about computing contribution amounts or payroll taxes. And, we offer free, USA-based support. Get your free trial today!

This article has been updated from its original publication date of April 8, 2019.

This is not intended as legal advice; for more information, please click here.