Update! On April 29, 2022, Minnesota signed a Trust Fund Replenishment bill into law, changing the 2022 Special Assessment (Federal Interest Loan Assessment) from 1.80% to 0.00%.

The majority of employers must pay state unemployment insurance (aka SUTA or SUI tax). And if you’re an employer in Minnesota, you’re subject to a few additional taxes, including the Minnesota Federal Loan Interest Assessment. Get the scoop on the assessment, how much it is, and how to calculate it.

What is the Minnesota Federal Loan Interest Assessment?

The MN Federal Loan Interest Assessment was established in 2021.

The state created the assessment for employers because of the spike in unemployment due to COVID-19. In 2020, Minnesota used up the trust fund for unemployment benefits. Because of this, they had to borrow funds from the federal unemployment trust fund to pay for unemployment benefits.

Now, Minnesota must pay interest on the borrowed funds. To help cover the cost of interest, the state levied the Federal Loan Interest Assessment in addition to the state unemployment insurance tax.

How much is the MN Federal Loan Interest Assessment?

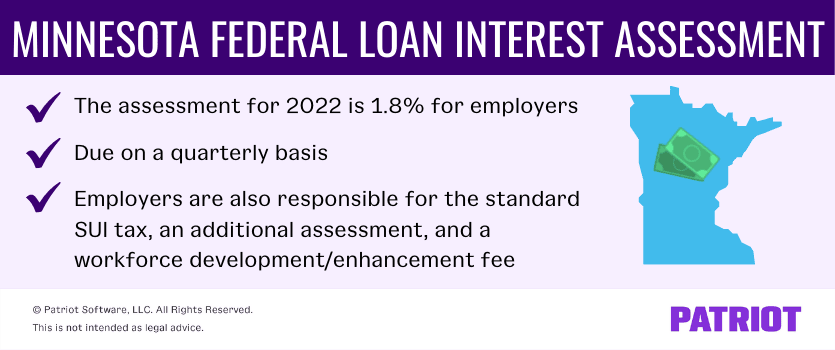

The assessment is equal for all Minnesota employers. In 2021, the assessment was 4%. But for 2022, the assessment decreased to 1.8% for employers.

In addition to the MN Federal Loan Interest Assessment, employers are responsible for the standard state unemployment insurance tax (assigned to each employer), an additional assessment (14% for 2022), and a base tax rate (0.10% for 2022).

Here’s a breakdown of the taxes:

Total Amount Due = Quarterly UI Tax + Additional Assessment + Federal Loan Interest Assessment + Workforce Development/Enhancement Fee

The additional assessments are not included in the employer’s SUTA or SUI rate. Instead, they are separate and apply to the total amount due and not the taxable wages.

To learn more about the assessment and other unemployment insurance (UI) tax rates, check out Minnesota’s website.

When is the assessment due?

Like standard MN state unemployment insurance, the assessment is due on a quarterly basis. Calculate the federal assessment each time you run payroll along with other payroll taxes. When calculating the assessment and other taxes, keep Minnesota’s taxable wage base in mind.

How to calculate the MN federal assessment

When it comes to calculating the federal assessment for Minnesota, do not go based on the employee’s taxable wages. Instead, multiply the assessment rate by the amount you calculate for your state unemployment tax (your business’s rate X gross wages) plus your additional assessment (14%).

For example, you multiply your state unemployment tax rate by your employee’s taxable wages. Then, calculate your additional assessment by multiplying your state unemployment amount by 14%. Add the state unemployment and additional assessment amounts together and multiply the total amount by the 1.8% federal assessment rate to get the MN federal assessment amount.

To calculate the workforce development fee, multiply 0.10% by the employee’s gross wages.

MN Federal Loan Interest Assessment example

Confused about calculating the MN Federal Loan Interest Assessment? You’re not alone. Let’s take a look at an example to walk you through the process.

Say your employee’s gross pay for the period is $875. Your state unemployment tax rate is 2.7%. First, calculate your state unemployment insurance amount by multiplying the employee’s gross pay by your SUTA tax rate.

Minnesota State Unemployment = Gross Pay X SUTA Tax Rate

$875 X 0.027 = $23.63

Next, find your additional assessment amount by multiplying your Minnesota state unemployment amount by 14%.

Additional Assessment = $23.63 X 14%

$23.63 X 0.14 = $3.31

Add together your Minnesota state unemployment and additional assessment. This is the amount you use to help determine your federal assessment.

$23.63 + $3.31 = $26.94

Now, multiply the 1.8% assessment rate by $26.94 to get your MN Federal Loan Interest Assessment for the period.

$26.94 X 0.018 = $0.48

Your MN federal assessment rate for the period for this employee is $0.48. Repeat the process while running payroll for other employees. If you use payroll software, the software will calculate the rates for you.

This is not intended as legal advice; for more information, please click here.