Ah, the joys of employerhood. Having a team of employees to help grow your business can be a beautiful thing. But, getting the hang of payroll—especially payroll taxes—takes time. Not to mention, a multi-state payroll situation can confuse newbie and established employers alike. What’s an employer to do?

Handling multi-state payroll processing starts with understanding multi-state payroll compliance. So, are you ready to get started?

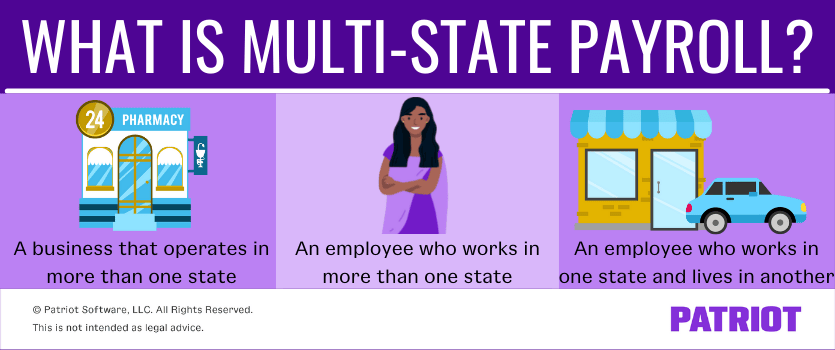

What is multi-state payroll?

Payroll is the process of calculating an employee’s pay, withholding taxes and other deductions, and paying the employee. Multi-state payroll is this same process of calculating, withholding, and paying—but in multiple states.

Multi-state payroll can refer to the following situations:

- A business that operates in more than one state

- An employee who works in more than one state

- An employee who works in one state and lives in another

Regardless of which type of situation your business has, the gist of multi-state payroll processing is the same: taxes can get wonky.

Your multi-state payroll tax guide

Multi-state payroll tax withholding can get pretty confusing, pretty fast. In fact, payroll tax withholding for one state can be overwhelming enough.

First, let’s review the taxes you need to withhold, contribute, or withhold and contribute when running payroll:

| Federal Taxes | State Taxes |

|---|---|

| Federal income tax | State income tax |

| FICA tax (Social Security and Medicare taxes) | State unemployment tax (SUTA or SUI tax) |

| Federal unemployment tax (FUTA tax) | Other state-specific taxes |

Multi-state payroll doesn’t impact federal taxes. So, withhold federal income tax from employees’ wages like normal. Withhold and contribute FICA tax like normal. And, pay federal unemployment tax on the employees’ wages like normal.

It’s the state taxes that can get tricky.

Avoid potential payroll issues for multi-state employers by understanding the additional payroll considerations you need to make:

- State income tax withholding

- State unemployment tax

- Other state-specific taxes

State income tax withholding

State income tax is an employee-only tax, so you must withhold it from your employees’ wages and remit it to the state. The amount you withhold depends on the state and the employee’s state W-4 information, if applicable.

Which state income tax rate applies? Generally speaking, withhold state taxes for the state where the employee performs work.

Say you have an employee who works in another state from your business location. You likely need to withhold income tax for that state because of your business presence (aka “nexus”).

Let’s say an employee lives in one state and works in another. Typically, you just need to withhold state income tax for the state they perform work, and the employee pays tax for their state with their tax return. However, check to see if there’s a reciprocal agreement between the states. If there is, withhold only for the state the employee lives in. If there’s no reciprocal agreement, you may decide to withhold for both the state they perform work and the state they reside (i.e., a courtesy withholding).

Say you have an employee who works in multiple states throughout the year. Because you withhold and remit state taxes for the state where the employee works, you may need to handle state income tax for multiple states, depending on how long the employee works in each state. Check each state’s rules for specifics.

State unemployment tax

In most states, state unemployment tax is an employer-only tax. That means you do not withhold it from employees’ wages (exception: Alaska, New Jersey, and Pennsylvania).

So the question is: If you have a multi-state payroll situation, where do you send your SUTA tax deposits?

Do not pay SUTA tax to more than one state for a multi-state employee. Instead, follow unemployment tax rules for multi-state employees so you know which SUTA tax fund to pay into.

Use the Department of Labor’s Localization of Work Provisions tests to determine which state an employee is covered by for unemployment (in the following sequence):

- Localization of service: Is the employee’s service localized in one state? If so, this is the state for SUTA tax.

- Base of operations: If the employee’s work is not localized in a state, do they perform some service in the state where their base of operations is located?

- Direction and control: If the employee does not perform service in the state where their base of operations is located, do they perform service in the state where the work is controlled and directed?

- Residence: If the employee does not perform work from the state where their services are directed and controlled, do they perform service in the state where they live?

Other state-specific taxes

State income and unemployment taxes aren’t the only things you need to worry about when it comes to multi-state payroll.

States have a wide range of additional payroll taxes you should be familiar with, such as:

- Paid family leave contributions

- State disability insurance tax

- Other state-specific taxes (e.g., Oregon Multnomah County Preschool for All Tax)

And that’s not the end of the line for state considerations. You may also need to follow paid sick leave laws by state, state overtime and double-time laws, and state rest and meal break rules.

Consult your state for more information.

Payroll tax multiple states: What to do

Yes, multi-state payroll can get confusing and overwhelming. But don’t panic. Here’s a quick look at your responsibilities:

- Register your business in each state, if applicable

- Withhold and remit state taxes

- Understand further business implications (e.g., sales tax nexus)

Want to make payroll taxes easier? Sign up for payroll software that can handle filing in multiple states. Keep in mind that many full-service payroll providers charge an additional fee for each additional state.

This is not intended as legal advice; for more information, please click here.