Pay frequency, or how often you pay your team, is one of the first decisions you must make when you hire your first employee.

If you haven’t thought about payroll frequency, now’s the time to start. Employee satisfaction, legal compliance, and cash flow may depend on it.

Skip Ahead

- What is pay frequency?

- What is the best pay frequency?

- What is the most common pay frequency?

- How much would an employee earn each pay period? Example

- How to choose a payment frequency

What is pay frequency?

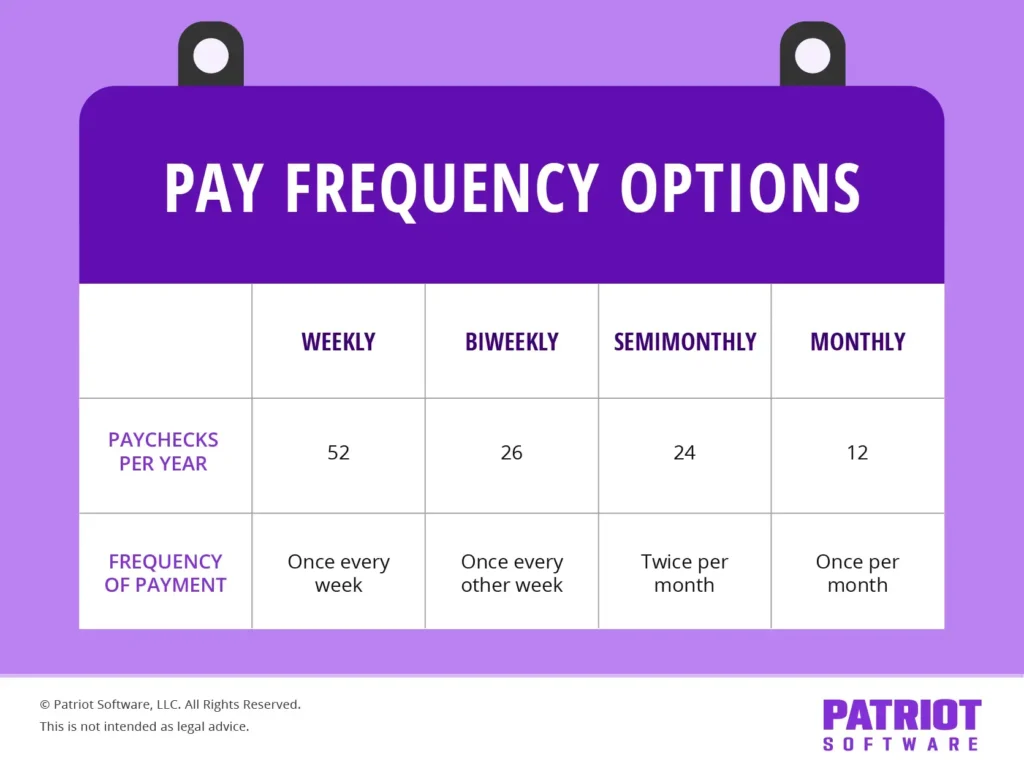

Pay frequency, or payroll frequency, is how often you pay employees (aka the number of pay periods in a year). Your pay frequency also determines how often you must run payroll.

There are four popular pay frequencies to choose from: Weekly, biweekly, semimonthly, and monthly. Your frequency determines the number of paychecks an employee receives in a year.

Pay frequency influences each paycheck’s wage and tax amounts. However, it doesn’t impact an employee’s annual tax liability or net pay (over time, it all equals out).

Pay frequency option #1: Weekly

Under a weekly pay frequency, employees receive their wages each week. An employee paid weekly receives 52 paychecks per year.

Each paycheck is less money and more frequent than other frequency options. You must run payroll more often than with any of the other frequencies.

Pay frequency option #2: Biweekly

With a biweekly pay frequency, you pay employees every other week. Employees who get biweekly wages receive 26 paychecks per year.

Employees receive their wages the same day of the week each pay period, like on a Friday. Typically, employees receive two paychecks each month. However, there are two months in the year when employees receive three paychecks instead of two (so plan your budget accordingly!).

Pay frequency option #3: Semimonthly

Under semimonthly pay, employees receive 24 paychecks per year.

It can be easy to confuse semimonthly pay with biweekly schedules. Under both frequencies, employees typically receive wages twice per month. But, there are a few key differences between biweekly vs. semimonthly pay.

With a semimonthly frequency, you pay employees on specific dates, but the days might differ. For example, you can pay an employee on the 15th and 30th of each month. These dates can fall on any day of the week.

A semimonthly pay frequency can be difficult for employers and employees to track. Employees can receive their wages on a Tuesday or a Friday, all depending on the day the date falls.

Pay frequency option #4: Monthly

If you pay employees monthly, they receive one paycheck per month. An employee paid monthly receives 12 paychecks per year.

Monthly paychecks are for larger amounts of money but are less frequent than other frequencies. Monthly paychecks can make financial planning difficult for some employees.

What is the best pay frequency?

There isn’t a “best” and “worst” frequency. But how often you pay employees does impact your:

- Time commitment: Running payroll by hand takes time. The more frequently you pay employees, the more time you spend running payroll.

- Money: Want to save time running payroll by using software? Great! But, some payroll software companies charge you based on the number of payrolls you run each month.

- Payroll cutoff: Your frequency determines your payroll cutoff, which is the date and time you must run payroll for it to process by payday.

What is the most common pay frequency?

Every business is different. The pay frequency that works best for your industry, business size, and employee type (i.e., hourly vs. salary) may not work for the company next door.

With that being said, some frequencies are more popular than others.

According to the U.S. Bureau of Labor Statistics, biweekly payroll is the most common pay frequency, followed by weekly payroll.

Here’s the breakdown of how many businesses use each pay period in the United States:

| Pay Period | How Many Businesses Use It? |

|---|---|

| Weekly | 27% |

| Biweekly | 43% |

| Semimonthly | 19.8% |

| Monthly | 10.3% |

How much would an employee earn each pay period? Example

Let’s say an employee earns $60,000 annually. Take a look at how much their gross wages would be by pay period:

- Weekly: $1,153.85 ($60,000 / 52)

- Biweekly: $2,307.69 ($60,000 / 26)

- Semimonthly: $2,500 ($60,000 / 24)

- Monthly: $5,000 ($60,000 / 12)

How to choose a payment frequency

Every business is different. Before you create a pay frequency schedule, consider the following four factors:

- Pay frequency laws

- Your employees

- Your industry

- How you run payroll

1. Pay frequency laws

Are there pay frequency laws you have to follow?

There is no federal law that says what frequency you must choose. However, you must keep a consistent frequency. You cannot change up an employee’s frequency when you feel like it.

Pay frequency requirements by state determine what pay frequencies you can and can’t use. Most states set a minimum frequency you must follow. For example, Arizona requires that employers pay employees two or more days per month, not more than 16 days apart.

Before deciding on frequency, check with your state laws.

2. Your employees

How many employees do you have? Are your employees salaried or hourly? These employee-related factors may impact the frequency you go with.

Number of employees: According to the BLS, employer size can determine pay frequency. For example, 66.6% of businesses with 1,000+ employees use biweekly, compared to 39% for businesses with one to nine employees.

Hourly vs. salary: The type of workers you employ can also affect your business’s payroll frequency. You can establish different pay periods for salary vs. hourly employees (although this might get confusing if you run payroll by hand).

3. Your industry

What industry is your business in? For some companies, industry determines your frequency. Certain industries tend to pay weekly, while others tend to pay monthly.

According to the BLS, 65.4% of construction employers pay employees using a weekly schedule. But, only 14% of employers in the financial activities industry run weekly payroll.

4. How you run payroll

How do you run payroll? By hand? Using software?

If you run payroll by hand, shorter pay frequencies (i.e., weekly) require more payroll runs, which takes up more time and energy.

Payroll software can significantly cut back the time you spend running payroll. But again, some companies have additional fees and charge per payroll run. You could end up paying more to run weekly payrolls than running biweekly, semimonthly, or monthly payrolls.

Need a way to keep your payroll under control? With Patriot’s online payroll, you pay per employee, not per paycheck. So go ahead and run unlimited payrolls—we won’t charge more! Get your free trial today.

This article has been updated from its original publication date of October 30, 2014.

This is not intended as legal advice; for more information, please click here.