Distributing pay stubs is often an important part of the payroll process. But, do employers have to provide pay stubs? That answer depends on where your business is located. To stay compliant, you need to know the pay stub requirements by state.

What is a pay stub?

A pay stub is like a summary sheet that lists details about an employee’s pay. It includes an employee’s:

- Gross income per pay period

- Taxes and deductions

- Employer contributions

- Net pay

Employers are responsible for knowing how to generate pay stubs for employees. If you use payroll software, the system generates a pay stub each time you run payroll. That way, you can distribute them to employees and easily keep digital or physical copies for your records.

You can think of a pay stub as a receipt for the money you pay employees. Employees can reference their pay stubs if they have any questions about their gross pay, deductions and contributions, or net pay.

Do employers have to provide a pay stub?

You might be wondering, Are pay stubs required? The short answer is: maybe.

Not all employers are required to distribute pay stubs each payroll. To find out your responsibilities, you need to look at federal and state laws.

Are employers required to provide pay stubs? Federal law

There is no federal law that requires that employers provide pay stubs to employees. However, the Fair Labor Standards Act (FLSA) requires that employers keep payroll records.

Under the FLSA, employers need to retain each employee’s hours worked and wages received.

Bottom line: You should generate pay stubs for your records under federal law. But, federal law does not require that you give them to your workers.

Do employers have to give pay stubs? State law

The answer to Are pay stubs required by law? is a little more complicated at the state level. Some states require employers to provide pay stubs and some don’t. If you must distribute them, familiarize yourself with pay stub requirements by state.

Here’s a breakdown of pay stub requirements by state. Some states:

- Require that employers give employees access to pay stubs

- Require that employers give employees printed pay stubs

- Allow employers to give digital pay stubs

- Don’t require employers to give employees pay stubs

Bottom line: Some states have pay stub laws that require you to give employees pay stubs in any format (e.g., digital). Some states also require that you give employees physical copies of them.

Pay stub requirements by state

Most states that require employers to give employees pay stubs have rules saying that the documents must have standard pay stub information.

Generally, this means the pay stubs include the:

- Beginning and end dates of the pay frequency

- Number of regular and overtime hours worked

- Gross wages

- Taxes, deductions, and employer contributions

- Net pay

Here are the pay stub legal requirements by state.

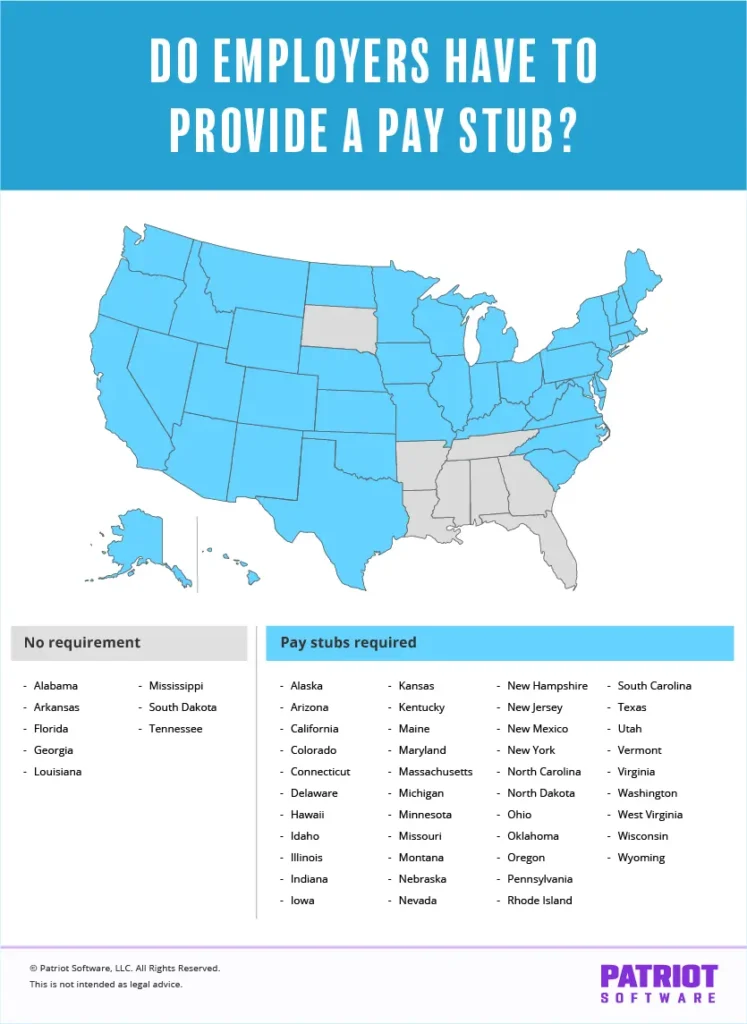

States that do not require pay stubs

The following states do not have pay stubs laws.

- Alabama

- Arkansas

- Florida

- Georgia

- Louisiana

- Mississippi

- South Dakota

- Tennessee

States that require pay stubs

The following states require that employers give employees access to pay stubs.

- Alaska

- Arizona

- California

- Colorado

- Connecticut

- Delaware

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Pay stub legal requirements: Quick-reference chart

| State | Pay Stub Requirements by State |

|---|---|

| Alabama | No requirements. |

| Alaska | Employers must give employees access to written or electronic pay stubs. |

| Arizona | Employers must give employees access to written or electronic pay stubs. |

| Arkansas | No requirements. |

| California | Employers must give employees written or printed pay stubs. |

| Colorado | Employers must give employees written or printed pay stubs. |

| Connecticut | Employers must give employees written or printed pay stubs. |

| Delaware | Employers can give employees electronic pay stubs, but employees can opt-out and ask for paper stubs. |

| Florida | No requirements. |

| Georgia | No requirements. |

| Hawaii | Employers can only give employees electronic pay stubs if they opt into it. |

| Idaho | Employers must give employees access to written or electronic pay stubs. |

| Illinois | Employers must give employees access to written or electronic pay stubs. |

| Indiana | Employers must give employees access to written or electronic pay stubs. |

| Iowa | Employers must give employees written or printed pay stubs. |

| Kansas | Employers must give employees access to written or electronic pay stubs. |

| Kentucky | Employers must give employees access to written or electronic pay stubs. |

| Louisiana | No requirements. |

| Maine | Employers must give employees written or printed pay stubs. |

| Maryland | Employers must give employees access to written or electronic pay stubs. |

| Massachusetts | Employers must give employees written or printed pay stubs. |

| Michigan | Employers must give employees access to written or electronic pay stubs. |

| Minnesota | Employers can give employees electronic pay stubs, but employees can opt-out and ask for paper stubs. |

| Mississippi | No requirements. |

| Missouri | Employers must give employees access to written or electronic pay stubs. |

| Montana | Employers must give employees access to written or electronic pay stubs. |

| Nebraska | Employers must give employees access to written or electronic pay stubs. |

| Nevada | Employers must give employees access to written or electronic pay stubs. |

| New Hampshire | Employers must give employees access to written or electronic pay stubs. |

| New Jersey | Employers must give employees access to written or electronic pay stubs. |

| New Mexico | Employers must give employees written or printed pay stubs. |

| New York | Employers must give employees access to written or electronic pay stubs. |

| North Carolina | Employers must give employees written or printed pay stubs. |

| North Dakota | Employers must give employees access to written or electronic pay stubs. |

| Ohio | Employers must give employees access to written or electronic pay stubs. |

| Oklahoma | Employers must give employees access to written or electronic pay stubs. |

| Oregon | Employers can give employees electronic pay stubs, but employees can opt-out and ask for paper stubs. |

| Pennsylvania | Employers must give employees access to written or electronic pay stubs. |

| Rhode Island | Employers must give employees access to written or electronic pay stubs. |

| South Carolina | Employers must give employees access to written or electronic pay stubs. |

| South Dakota | No requirements. |

| Tennessee | No requirements. |

| Texas | Employers must give employees written or printed pay stubs. |

| Utah | Employers must give employees access to written or electronic pay stubs. |

| Vermont | Employers must give employees written or printed pay stubs. |

| Virginia | Employers must give employees access to written or electronic pay stubs. |

| Washington | Employers must give employees written or printed pay stubs. |

| West Virginia | Employers must give employees access to written or electronic pay stubs. |

| Wisconsin | Employers must give employees access to written or electronic pay stubs. |

| Wyoming | Employers must give employees access to written or electronic pay stubs. |

Why put off until tomorrow what you can do today? Use Patriot’s online payroll to pay your employees and manage pay stubs! Give employees access to their own online portal so they can view digital pay stubs or print and distribute them, depending on your state’s rules. Start your free trial now!

This article has been updated from its original publication date of June 1, 2020.

This is not intended as legal advice; for more information, please click here.