Some businesses prefer paying employees cash instead of other payment methods, like direct deposit or check. If you choose to pay cash wages, you are still responsible for depositing and reporting employment taxes.

Paying employees cash under the table, or off the record, means you fail to pay and report taxes. Learn whether cash under the table is legal and what to do when you pay employees in cash.

Is paying employees cash under the table legal?

When employees are getting paid under the table, taxes aren’t withheld from their wages. Employers paying cash under the table do not fill out quarterly or annual tax forms. And, they do not record employee wages on Forms W-2.

If employees are unrecorded, employers violate their legal responsibilities of obtaining necessary (and often state-mandated) insurances like workers’ compensation or disability insurance.

Because employers who pay cash under the table forego their tax and insurance liabilities, paying employees cash under the table is illegal. Employers who pay employees under the table do not comply with employment laws.

According to the IRS, paying employees cash under the table is one of the top types of employment tax non-compliance.

Why does paying employees cash under the table happen?

Paying employees cash under the table might seem attractive to some business owners, but beware! It may look easier and cheaper than running payroll lawfully, but it will only land you in hot water.

Some employers pay cash under the table to avoid their employer tax obligation. They don’t want to contribute taxes or sign up for workers’ compensation insurance. Another reason employers pay cash under the table is so they can hire workers who are unauthorized to work in the United States. Other employers don’t want to deal with recordkeeping.

Penalty for employees being paid under the table

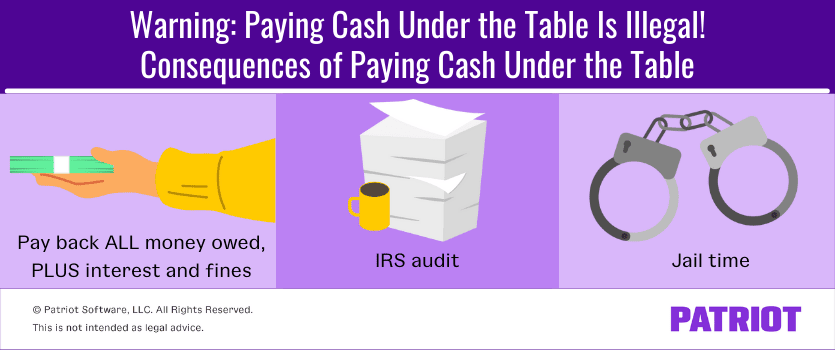

An employer paying cash under the table is subject to severe penalties. And, employees who are getting paid under the table are also penalized.

The IRS can audit your business to learn if you have been skipping out on paying employment taxes. If you don’t have records showing how much you paid employees and withheld, you will be penalized.

Willfully failing to withhold and deposit employment taxes is fraud. Penalties for paying under the table result in criminal convictions. You will be required to pay back all the tax money that should have been deposited plus interest, fines, and/or jail time.

There’s only one way to avoid these high penalties—don’t pay cash under the table.

What to do instead of paying cash under the table

Unlike paying cash under the table, paying employee wages in cash is legal if you comply with employment laws. Keep in mind that if you do pay employees in cash, the IRS will pay closer attention to your records, so you need to make sure to deposit the correct amount of taxes.

Because there is no paper trail when you pay employees in cash, managing payroll can become complex. Instead of cash payments, you might consider paying employees with direct deposit or checks. These options guarantee that you will have a paper trail.

Regardless of how you pay employees, you need to make sure you comply with employment laws. You must obtain a federal employer identification number (FEIN), set up state tax accounts, report new hires, and obtain workers’ compensation insurance.

When you run payroll, withhold taxes and other deductions, like health insurance premiums, from employee wages. And, you will need to contribute employer taxes, including Social Security and Medicare taxes. You also need to know when to deposit and report employment taxes to stay compliant with tax laws.

Your records should be organized. You should provide pay stubs to your employees that show them their wages before and after deductions. And, you should have year-to-date payroll records so you know how much your business has paid your workers.

Looking for an easier way to manage payroll? Patriot’s online payroll software calculates employment taxes for you. And, you can choose between paying employees with checks or our free direct deposit. Give us a try today!

This article has been updated from its original publication date of April 30, 2018.

This is not intended as legal advice; for more information, please click here.