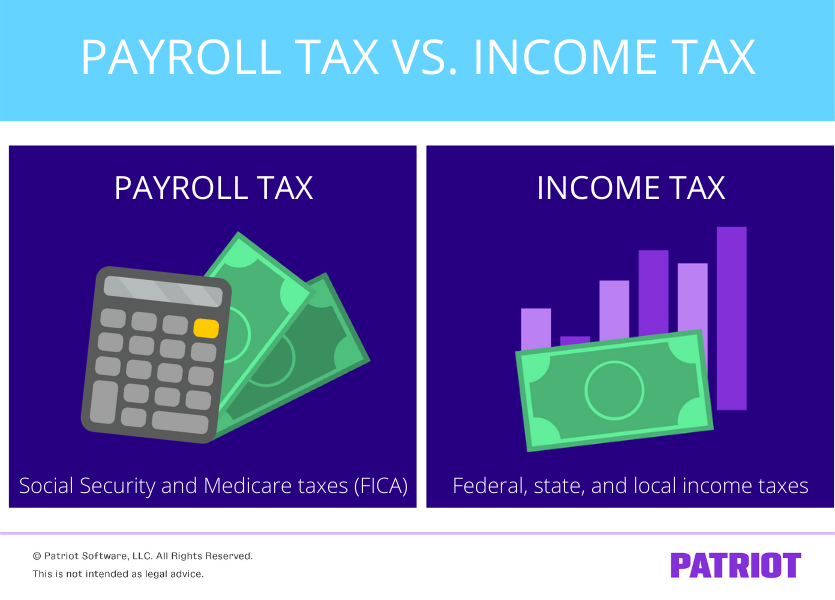

Tax withholding comes with the territory of being an employer. Employment taxes can be broken down into payroll taxes and income taxes. Most people use the terms interchangeably. But when you hear about a payroll tax deferral, you probably want to know the exact difference between payroll tax vs. income tax.

Income tax vs. payroll tax at a glance

Payroll tax and income tax are technically separate groups, but you need to know both to withhold employment taxes.

There are a number of reasons why it’s important to understand the difference between the two groups. You may need to know the difference to:

- Understand what a payroll tax deferral means

- Know what tax to withhold from fringe benefits (e.g., educational assistance)

- Fill out IRS payroll forms

- Learn how the government uses the funds

So, how are payroll taxes different from personal income taxes?

Payroll tax consists of Social Security and Medicare taxes, otherwise known as Federal Insurance Contributions Act (FICA) tax. FICA tax is an employer-employee tax, meaning both you and your employees contribute to it. Payroll tax is a percentage of an employee’s pay.

Income tax is made up of federal, state, and local income taxes. Unless exempt, every employee pays federal income tax. Most states have an additional state income tax. Some localities also have a local income tax. Income tax amounts are based on a number of factors, such as an employee’s Form W-4 and filing status.

The difference between payroll tax and income tax also comes down to what the taxes fund. Whereas income taxes go to a general government fund, payroll taxes specifically go to Social Security and Medicare funds.

Now, let’s take a look at where payroll and income taxes are similar. To start, you have to withhold both from an employee’s wages before you can give them their take-home pay. And after withholding both taxes, you must deposit and report them to the IRS. Your depositing schedule is the same for both payroll and income taxes. You also report both taxes on the same form (Form 941 or Form 944). But, federal income taxes and payroll taxes have separate lines on the reporting form.

A more in-depth look at payroll tax vs. income tax

After reading the basic differences between the two taxes, you may have some new questions. Read on to learn what is payroll tax vs. income tax.

What is payroll tax?

Payroll tax uses a flat tax rate, meaning it is a percentage that you withhold from employee wages. Withhold 7.65% of each employee’s gross wages from their pay. And, contribute a matching 7.65%.

So, if an employee earns $500 per paycheck, you would withhold $38.25 ($500 X .0765) from their paycheck. You also need to contribute $38.25 for the employer portion.

Let’s break down the percentage by Social Security and Medicare.

Social Security tax is 6.2%. There is a Social Security wage base limit, so you only need to withhold up to a certain amount.

Medicare tax is 1.45%. Unlike Social Security tax, there is no Medicare wage base limit. Instead, there is an additional Medicare tax. After an employee earns above the additional Medicare tax threshold, withhold an additional 0.9% of their wages. That means you will withhold 2.35% for Medicare with the additional tax (0.9% + 1.45%). However, you only contribute 1.45%.

You’re probably wondering: what is the purpose of payroll taxes exactly? Again, payroll taxes fund Social Security and Medicare programs. This includes retirement, disability, health care, hospice care, and survivor of deceased worker benefits.

What is income tax?

Income tax refers to federal, state, and local income taxes. Unlike payroll tax, federal income tax is not one flat rate. Instead, it uses a progressive tax rate.

Federal income tax depends on your employee’s Form W-4 information (e.g., filing status, dependents, and additional withholding requests). When you hire an employee, they need to fill out Form W-4, Employee’s Withholding Certificate. An employee’s wages and pay frequency also impact their federal income tax amount.

To determine how much to withhold for federal income tax, use IRS Publication 15-T. There are two tax withholding table methods—percentage and wage bracket. Use the information on the employee’s Form W-4 as well as their wages and frequency to figure out their federal income tax deduction.

State income tax works similarly to federal income tax. If there is state income tax, you will give your employee a state income tax withholding form. State income tax can either be a flat or progressive rate.

Localities may assign a flat rate, dollar amount, or progressive rate. Consult your locality for more information on local income taxes.

Income taxes fund public services like defense, education, and transportation.

Things to keep in mind

Again, you need to withhold both payroll and income taxes from your employees’ paychecks.

Doing payroll by hand is an option for deducting payroll and income taxes, but this can be time consuming and lead to mistakes. The distinction between payroll vs. income tax is even more important when you get into fringe benefits and taxation. Some types of fringe benefits are exempt from federal income tax but not payroll tax.

If you need help calculating how much to withhold from an employee’s wages for taxes (and when to withhold it), consider using payroll software.

So, the next time someone asks you, Is payroll tax the same as income tax?, you can dazzle them with the key differences between the two.

Make payroll easier on yourself. Patriot’s online payroll calculates taxes on employee wages. And, our Full Service payroll services option will deposit and file taxes for you. Try either for free today!

This article has been updated from its original publication date of September 6, 2017.

This is not intended as legal advice; for more information, please click here.