This article applies to employers who took out a Paycheck Protection Program loan in 2020. For information about PPP 2.0 under the Consolidated Appropriations Act, check out the last section of this article.

If the complex PPP loan forgiveness process has been weighing oflver your head, here’s some good news: you don’t have to apply right away. In fact, a lot of small businesses aren’t.

The Small Business Administration and Treasury continue releasing guidelines. And, there’s plenty of time for Congress to release more COVID-19 legislation. So, it’s no surprise that many business owners are waiting for the dust to settle before filling out their application. What should your PPP loan forgiveness strategy be?

PPP loan forgiveness strategy: The waiting game

You might be eager to see how much—if any—of your loan you have to pay back. But before rushing through the application and turning it into your lender, weigh your options.

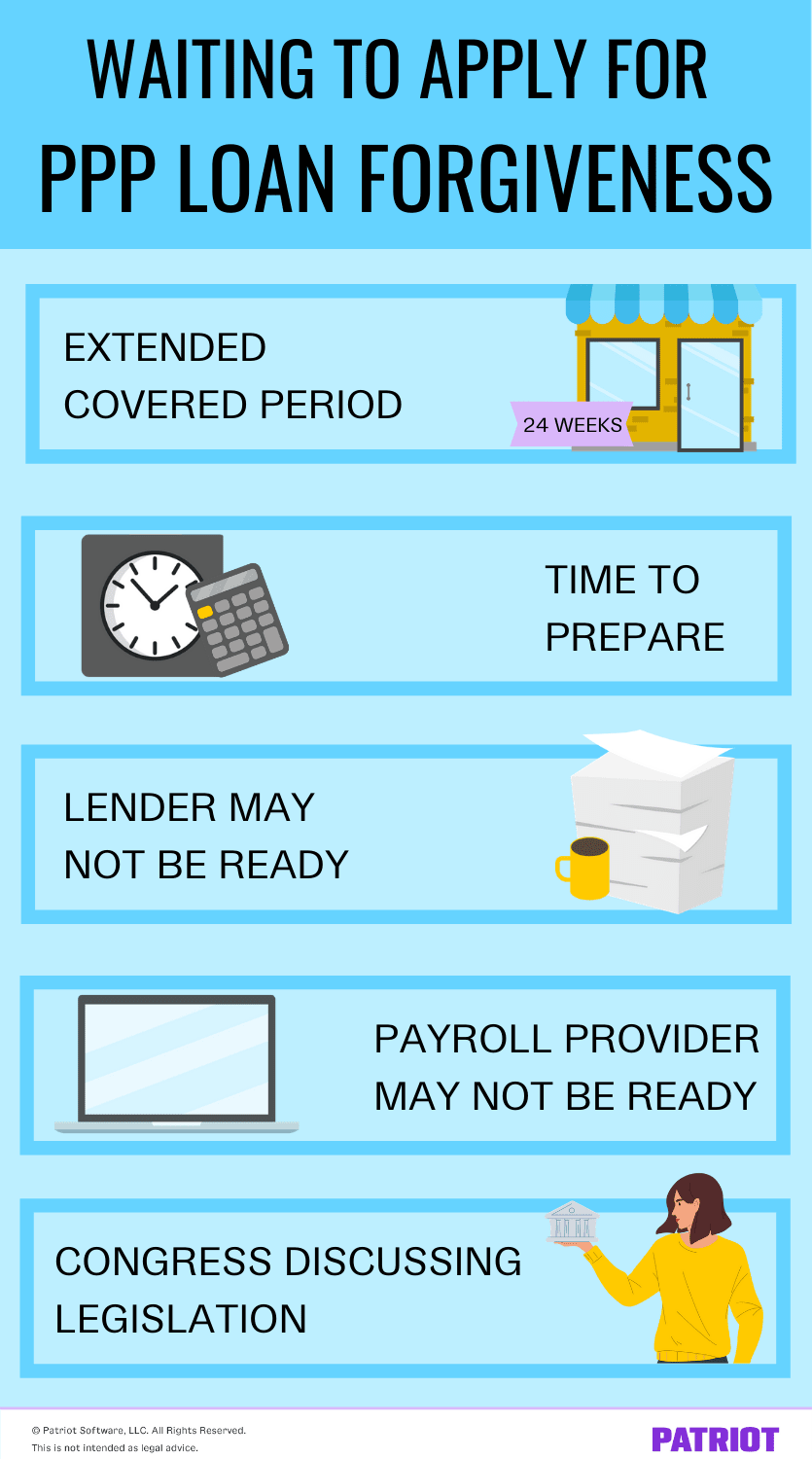

Here are some reasons why you might consider waiting to complete your PPP loan forgiveness application.

1. You can take advantage of the extended covered period

Originally, the Paycheck Protection Program covered period was eight weeks. That meant borrowers had eight weeks to make eligible payments with their loans.

But, the PPP Flexibility Act (which was signed into law on June 5, 2020) tripled the covered period’s time from eight weeks to 24 weeks. This means you have 24 weeks from your first PPP loan disbursement to use the loan for qualifying payroll costs and mortgage interest, rent, and utility payments.

So, why rush it?

If you received your loan prior to June 5, you can elect to use the original eight-week covered period. Or, you can take advantage of the extended covered period to make sure you’re using your PPP loan proceeds toward eligible expenses.

2. You have time to thoroughly prepare

There currently isn’t a hard PPP forgiveness application deadline. But, you might be worried that waiting to apply for PPP forgiveness means you may have to start repaying the loan.

However, the loan repayment deferral period says that you have until one of the following (whichever is earlier) to start paying back the loan:

- The date the SBA remits loan forgiveness to the borrower

- 10 months after the end of the covered period (if the borrower doesn’t apply for forgiveness)

Unless the SBA and Treasury release a set application deadline, you have 10 months before you have to start repaying the loan. Likewise, this may mean you have 10 months after the end of your loan’s covered period to apply … which gives you ample time to prepare.

Use this time to gather all your documents and perfect your calculations. Taking your time can help prevent errors on the application and ensure you have all the supplemental documents ready to go.

3. Your lender might not be ready

Some lenders are accepting PPP application forms. Some, like Chase and PNC, are not. Your lender might be working to incorporate the SBA’s newest guidelines into the application process.

If your lender isn’t ready to accept your application, you might want to hold off on filling one out. That way, you (like your lender) can follow the most current SBA and Treasury guidance to give your application the best shot of forgiveness.

Not to mention, many banks aren’t accepting paper forms. Instead, they’re only accepting digital applications through an online portal.

Check with your lender to find out if they’re ready to accept PPP loan forgiveness applications. If they aren’t, you might be able to sign up for alerts to let you know when they start accepting documents.

4. Your payroll provider might not be ready

Do you use payroll software? If so, a lot of the information you need (e.g., payroll costs) for your forgiveness application is right there, in your account.

To make things even easier and more accessible, a number of payroll providers are working on Paycheck Protection Program packets. These packets are filled with payroll reports that give borrowers the data they need to accurately fill out their PPP forgiveness application.

Many payroll providers are waiting to put out these packets to ensure they have the most recent guidance from the SBA and Treasury.

Consult your payroll provider to determine what is available and when it will be available.

5. Congress is still discussing legislation

There are a number of PPP-related bills that Congress has proposed in the hopes of easing small business owners’ burden.

As a result, Nishank Khanna, CFO at Clarify Capital, advises borrowers not to be in a hurry to apply, saying:

It might be better for businesses to wait to apply for forgiveness because the federal government is working to make the process easier. The lengthy application process could be reduced to requiring just a signature to receive funding, saving small business owners a great deal of time and energy. With new legislation expected so soon, there are very few situations that could make a strong case for urgency.”

Here are some of the ideas that Congress has tossed around:

- Automatic forgiveness of PPP loans that are less than $150,000

- Expanded forgivable expenses

- Tax deductions for expenses paid with PPP loans

The purpose of the Paycheck Protection Small Business Forgiveness Act proposal is to save certain borrowers from the rigorous forgiveness application process. Under the proposal, borrowers who took out loans less than $150,000 would receive automatic forgiveness by submitting a one-page form.

Jim Pendergast, Senior VP of altLINE, cited the potential automatic forgiveness as his top reason for recommending businesses hold off on the application:

By far, the best reason to hold off on applying for PPP loan forgiveness is the possibility that loans below a specific limit may be automatically forgiven. This is convenient for the borrower, but whether skipping the paperwork is a good idea or not for the lenders, we’ll have to wait and see.”

Another proposal, the Heroes Act, aims to expand forgivable expenses, which would give borrowers more freedom when it comes to using their PPP loans. This proposal wants to expand forgivable expenses to include personal protective equipment and other health- and safety-related equipment and supplies.

How will a forgiven PPP loan impact your taxes? Although it’s a tax-free loan, you’re using it to cover expenses that you might normally deduct come tax time. If this is the case, you might be hit with a larger-than-normal tax bill. In response, Congress released the Small Business Expense Protection Act of 2020. This proposal intends to let small business owners take tax deductions for expenses paid with PPP loans.

Keep in mind that these proposals have not passed.

But because Congress continues going back and forth on further COVID-19 legislation relating to the PPP, waiting might be a smart decision.

Alert! PPP 2.0 has arrived

After months of back and forth, the Consolidated Appropriations Act was signed into law on December 27, 2020. This legislation provides new funding for the Paycheck Protection Program, as well as made the following changes to the PPP:

- Expanded eligibility for nonprofits (includes set-asides for very small businesses and community-based lenders)

- Second-time loans for eligible businesses with fewer than 300 employees and at least a 25% drop in gross receipts in a 2020 quarter compared to the same 2019 quarter

- Businesses can claim the Employee Retention Credit (ERC) in addition to a PPP loan (before, businesses were only allowed to opt into one or the other)

- Expenses you can spend your PPP loan on that qualify for forgiveness now also include operating expenses, covered property damage, supplier costs, and worker protection expenditures

- A simplified forgiveness application process for loans up to $150,000

- Businesses can deduct expenses paid with forgiven PPP loans from taxes

And, the Paycheck Protection Program Extension Act of 2021 was signed into law on March 30, 2021, extending the PPP deadline to May 31, 2021.

This is not intended as legal advice; for more information, please click here.